Industry Services

Bedryfsdienste

34

35

Market overview for grain and oilseeds

Markoorsig vir graan en oliesade

dat die differensiaalkwessie ‘n simptoom van ‘n gebrek aan

deursigtigheid van kontantmarkpryse is.

Die ontwikkeling van die kontantmark en deursigtigheidmoet die

fokus wees in toekomstige doelwitte om die belangrikheid van

die liggingsdifferensiaal in kontantmarktransaksies te verminder.

Mieliebemarkingsjaar

Die bemarkingsinligtingjaar vir verslagdoening oor vraag en

aanbod vir alle wintergraan strek van Oktober tot September.

Die bemarkingsjaar vir somergraan, mielies uitgesluit, strek van

Maart tot Februarie. Graan SA het aan die bedryf voorgestel

dat die bemarkingsjaar vir mielies ook van Maart tot Februarie

moet strek, wat die onsekerheid van vroeë lewerings heeltemal

kan uitskakel. Graan SA se vraag- en aanbodinligting sal hierdie

bemarkingstydperk weerspieël.

Handelaarstoewydingsverslag

Van der Vyfer enMeyer (2014) se verslag,

Positioning reportingby

category in agricultural derivatives markets: Should South Africa

follow international best practices?

meld dat dit op die oog af

lyk asof Suid-Afrika met internasionale praktyke ooreenstem.

Volgens hierdie navorsing, wat deur Graan SA geïnisieer is, is die

kategorisering van posisies geneem (verskansing of spekulasie)

op die JSE se mark vir afgeleide kommoditeite (JSE CDM)

onvermydelik, veral as die CDM met internasionale praktyke wil

ooreenstem.

Internasionale handel

Die langdurige ekonomiese vennootskapsooreenkoms (EPA)

onderhandelinge tussen ‘n groep SAOG-lande en die Europese

Unie is uiteindelik op 15 Julie 2014 afgehandel. Graan SA het

dit reggekry om ‘n beperkte tariefkwota van 300 000 ton op

ingevoerde koring te beding.

Graderingsregulasies

Gradering van sojabone

Die vinnige uitbreiding van sojaboonproduksie plaas byko-

mende druk op die silobedryf. Graan SA werk met die

silobedryf en die DLBV saam om ‘n bevredigende oplossing vir

die uitvoering van die sojaboongraderingsregulasies te vind.

Produsente moet seker maak dat hulle produkte in ooreen-

stemming met die Wet op Landbouprodukstandaarde

gegradeer word. Dit is van toepassing op alle graan- en olie-

saadkommoditeite.

Gradering van sorghum

Die sorghumbedryf het toenemend kultivars nodig wat nie

noodwendig aan die moutvereistes voldoen nie. Ons het

voorgestel dat veranderinge aan die regulasie aanvaar word

om tussen tannienvrye (0<,2%) en tannienbevattende kultivars

te onderskei. Die voorstel moet nog aanvaar word.

Gradering van koring

Die gekwalifiseerde verslapping van die graderingsregulasies

en kultivarvrystellingskriteria vir koring kan tot ‘n regverdiger

graderingstelsel in die mark lei. Graan SA het veranderinge

aan die graderingsregulasies voorgestel en gesels aktief met

waardekettinglede om dringend strategiese oplossings te kry.

the differential issue is a symptom of a lack of transparency of

cash market prices.

The development of the cash market and transparency should

be the focus in future objectives to reduce the importance of

the location differential in cash market transactions.

Maize marketing year

The marketing information year on supply and demand

reporting for all winter grains is from October to September

each year. The marketing year for summer grains, except for

maize, is from March to February. Grain SA proposed to the

industry that the marketing year for maize should also be from

March to February, as this would completely eliminate the

uncertainty of early deliveries. Grain SA’s supply and demand

information will reflect this marketing period.

Commitment of traders report

In their report,

Positioning reporting by category in agricultural

derivatives markets: Should South Africa follow international

best practices?

, Van der Vyfer and Meyer (2014) report

that on the surface it appears that South Africa is in line with

international practices.

According to this research, initiated by Grain SA, the cat-

egorising of positions taken (hedging or speculating) on the

JSE Commodity Derivatives Market (JSE CDM) is inevitable,

especially if the CDM wishes to be in line with international

practices.

International trade

The long-running economic partnership agreement (EPA)

negotiations between a group of SADC countries and the

European Union were finally concluded on 15 July 2014.

Grain SA managed to negotiate a limited tariff quota of

300 000 tons on imported wheat.

Grading regulations

Grading of soybeans

The rapid expansion in soybean production places additional

pressure on the silo industry. Grain SA collaborates with the

silo industry and DAFF to find a satisfactory solution for the

execution of the soybean grading regulations.

Producers should ensure that their products are graded in

accordance with the Agricultural Product Standards Act. This

applies to all grain and oilseed commodities.

Grading of sorghum

The sorghum industry increasingly requires cultivars that do

not necessarily meet malting requirements. We proposed that

changes to the regulation be accepted in order to differentiate

between tannin-free (0<,2%) and tannin-containing cultivars.

The proposal still needs to be accepted.

Grading of wheat

The qualified relaxing of the grading regulations and cultivar

release criteria for wheat could lead to a more just grading

system in the market. Grain SA proposed changes to the

grading regulations and is actively engaging with supply chain

members to reach strategic solutions as a matter of urgency.

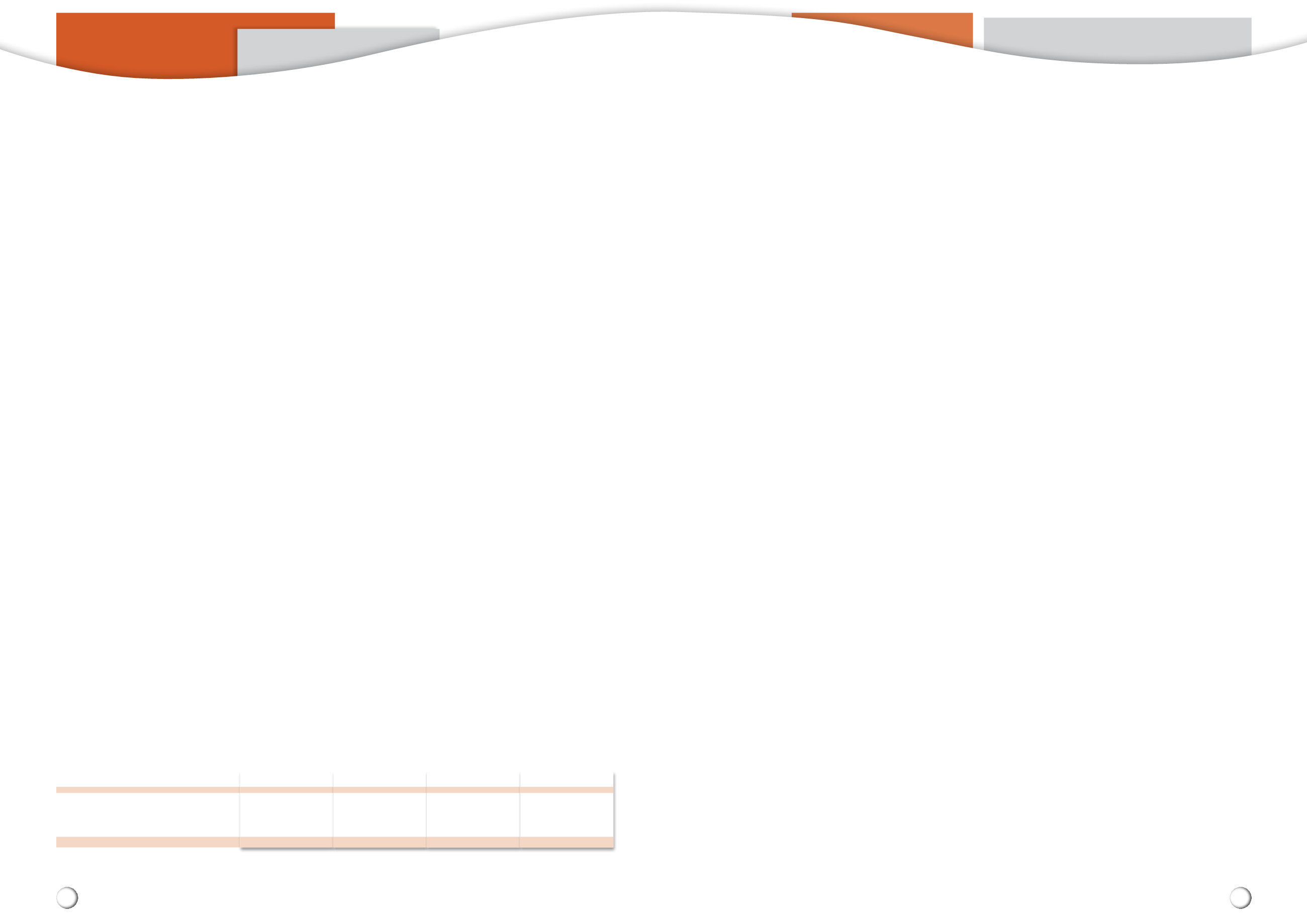

2011

2012

2013/2014

2014/2015*

Sunflower/Sonneblom

676 300

648 300

662 600

804 000

Soybean/Sojaboon

247 300

412 300

561 600

720 000

Subtotal/Subtotaal

923 600

1 060 600

1 224 200

1 524 000

Canola/Kanola

56 600

74 700

95 000

105 000

Total/Totaal

980 200

1 135 300

1 319 200

1 629 000

Table 1: The increase in the crushing of oilseeds.

Tabel 1: Die toename in die pers van oliesade.

* Projected

* Geprojekteer

persaanlegte: Oliesade

Volgens die Proteïennavorsingstigting (PNS) was die totale

sojaboonperskapasiteit in Suid-Afrika in 2012 slegs 600 000 ton

met vyf persaanlegte. Teen 2013/2014 het vyf nuwe maatskap-

pye die kapasiteit tot 1,5 miljoen ton verhoog. Die totale doelwit

is 2 102 000 ton in 2014. Die totale volvet-produksiekapasiteit se

doelwit is 580 000 ton. Die huidige sojameelvraag is 1,3 miljoen

ton wat gelyk is aan 1,63 miljoen ton sojabone. Die 2015-vraag

kan tot 1,6 miljoen ton (bykans 2 miljoen ton sojabone) wees.

In 2020 kan die vraag na sojameel meer as 1,82 miljoen ton

(2,3 miljoen ton sojabone) wees.

Die groter perskapasiteit sal na verwagting die groeiende

invoer van oliekoek en plantolie stuit en die produksie van

sojabone, sonneblom en kanola verhoog.

Tabel 1

toon die

verhoogde persing van oliesade.

Handel en handelsbeleidomgewing

Koringinvoertarief

ITAC het Graan SA se aansoek om ‘n nuwe verwysingsprysvlak

van $294/ton goedgekeur. ‘n Koringtarief is vasgestel toe die

FOB Golf HRW Nr. 2-koringprys vir drie opeenvolgende weke in

September tot ‘n vlak van $284/ton gedaal het. Die tarief van

R156/ton skep ‘n meer stabiele omgewing en sekerheid met die

potensiaal om koringproduksie te verhoog.

Liggingsdifferensiale

Talle insette is voor en sedert 2008 gemaak oor die funksionering

van die termynmark en die liggingsdifferensiaal. Die JSE het ‘n

besigheidsbesluit geneem om die differensiaalstelsel te behou.

Graan SA ondersteun nie die JSE se liggingsdifferensiaalstelsel

nie en gaan voort omdie billike berekening van die differensiaal

te moniteer.

Die mieliedifferensiaal het in Maart 2014 gemiddeld met 9,8%

gestyg na die oorspronklike voorgestelde styging van 12,9%. Hier-

deur het Graan SA meer as R100 miljoen vir produsente gespaar.

Graan SA het vir die JSE aangedui dat die differensiaal by

Wesselsbron verkeerd gepubliseer is. Die regstelling daarvan

beteken ‘n potensiële besparing van ongeveer R4,125 miljoen vir

produsente wat mielies by die Wesselsbronsilo lewer.

Kontantmarkdeursigtigheid en

basisverhandeling

Prof Mathew Roberts, wat deur die NLBR aangestel om die

funksionering van die termynmark te ondersoek, het aangedui

Crushing plants: oilseeds

According to the Protein Research Foundation (PRF) the total

soybean crushing capacity in South Africa in 2012 was only

600 000 tons, as represented by five crushing plants. By 2013/2014

five new companies had increased the capacity to 1,5 million

tons. The total objective is 2 102 000 tons in 2014. The total full fat

production capacity aims at 580 000 tons. The current soybean

meal demand is 1,3 million tons, which is equal to 1,63 million tons

of soybeans. The 2015 soybean meal demand may increase to

1,6 million tons (almost 2 million tons of soybeans). By 2020 the

soybean meal demand may exceed 1,82 million tons (2,3 million

tons of soybeans).

The greater crushing capacity is expected to stop the growing

imports of oilcake and vegetable oil and to increase the

production of soybeans, sunflower and canola.

Table 1

shows

the increased crushing of oilseeds.

Trade and trade policy environment

Wheat import tariff

ITAC approved the application by Grain SA for a new reference

price level of $294/ton. A wheat tariff was set when the

FOB Gulf HRW no. 2 wheat price decreased to a level of less

than $284/ton for three consecutive weeks in September.

The tariff of R156/ton creates a more stable environment and

certainty, with the potential of increasing wheat production.

Location differentials

Numerous inputs were made since 2008 and before on the

functioning of the futures market and the location differential. The

JSE made a business decision to retain the differential system.

Grain SA does not support the JSE’s location differential system

and continues to monitor the fair calculation of the differential.

The maize differential increased on average by 9,8%

during March 2014 after the original proposed increase

of 12,9%. Grain SA thus saved more than R100 million

for producers.

Grain SA indicated to the JSE that the differential at Wesselsbron

had been published incorrectly. The correction of this means

a potential saving of roughly R4,125 million for producers

delivering maize to the Wesselsbron silo.

Cash market transparency and basis trading

Prof Mathew Roberts, who was commissioned by the NAMC to

investigate the functioning of the futures market, indicated that

Markoorsig (vervolg)

Market overview (continued)