Industry Services

Bedryfsdienste

22

23

Input research and development

Insetnavorsing en -ontwikkeling

Die saadbedryf

Graan SA het vergaderings met verskillende saadmaatskap-

pye gereël om die verhoging in saadpryse in verhouding tot die

mielieprys te bespreek.

SAADPRYSE

Saadmaatskappye het die pryse vir die 2014/2015-produksie-

seisoen in Mei 2014 vrygestel. Gemiddelde prysstygings

was 5,5% vir mieliesaad, 5,6% vir sonneblomsaad,18% vir

graansorghumsaad en 5,5% vir sojaboonsaad. Sedert die

2001/2002-produksieseisoen het die mielieprysindeks (

Gra-

fiek 1

) vergeleke met die mieliesaadprysindeks beduidend

verswak. Met die voortgesette styging in mieliesaadpryse en 'n

geraamde gemiddelde produsenteprys van R1 697 per ton vir

die komende seisoen (2014/2015) verswak dit steeds.

SAADMARK

Volgens die Oesskattingskomitee is 2 688 200 hektaar mielies

in die 2013/2014-produksieseisoen aangeplant. Dit is 3,3%

minder as in die 2012/2013-seisoen. Die waarde van die

mieliesaad wat in die 2012/2013-produksieseisoen geplant is,

was R2,688 miljard. Na raming was die waarde van saad wat

in die 2013/2014-produksieseisoen geplant is R2,742 miljard.

Hoewel die oppervlakte onder mielies dus afgeneem het,

het die waarde van die plaaslike saadverkope gestyg.

SAADGEHALTE

Die amptelike saadtoetsstasie van Suid-Afrika monitor saad-

gehalte. Vanaf Augustus 2013 tot September 2014 is 760 mon-

sters geneem, waarvan 16 nie aan die minimumvereistes

voldoen het nie. Gedurende die 2013/2014-produksieseisoen

is verskeie probleme met saadkwaliteit aangemeld. Graan SA

het sy lede met dispute bygestaan.

TERUGHOUDING VAN SAAD EN

KONSEPTANTIÈMEMODEL

‘n Komitee is in die lewe geroep om te kyk hoe saad-

maatskappye vergoed kan word vir die negatiewe impak

van die terughouding van saad op die bedryf. Die model wat

tans op die tafel is, is gebaseer op die manier waarmee die

Wintergraantrust fondse vir navorsing insamel. Die voordeel van

só ‘n stelsel is dat almal betaal omdat dit ‘n statutêre maatreël is

en dat die fondse slegs vir saadterughoudings gehou kan word.

BESKIKBAARHEID VAN SAAD

Die saadbedryf (SANSOR) het Graan SA verseker dat voldoende

hoeveelheid graan- en oliesade-saad vir die 2014/2015-

The seed industry

Grain SA arranged meetings with various seed companies in

order to address the increase of seed prices in relation to the

maize price.

SEED PRICES

Seed companies released the prices for the 2014/2015

production season in May 2014. Average price increases

were 5,5% for maize seed, 5,6% for sunflower seed, 18% for

grain sorghum seed and 5,5% for soybean seed. Since the

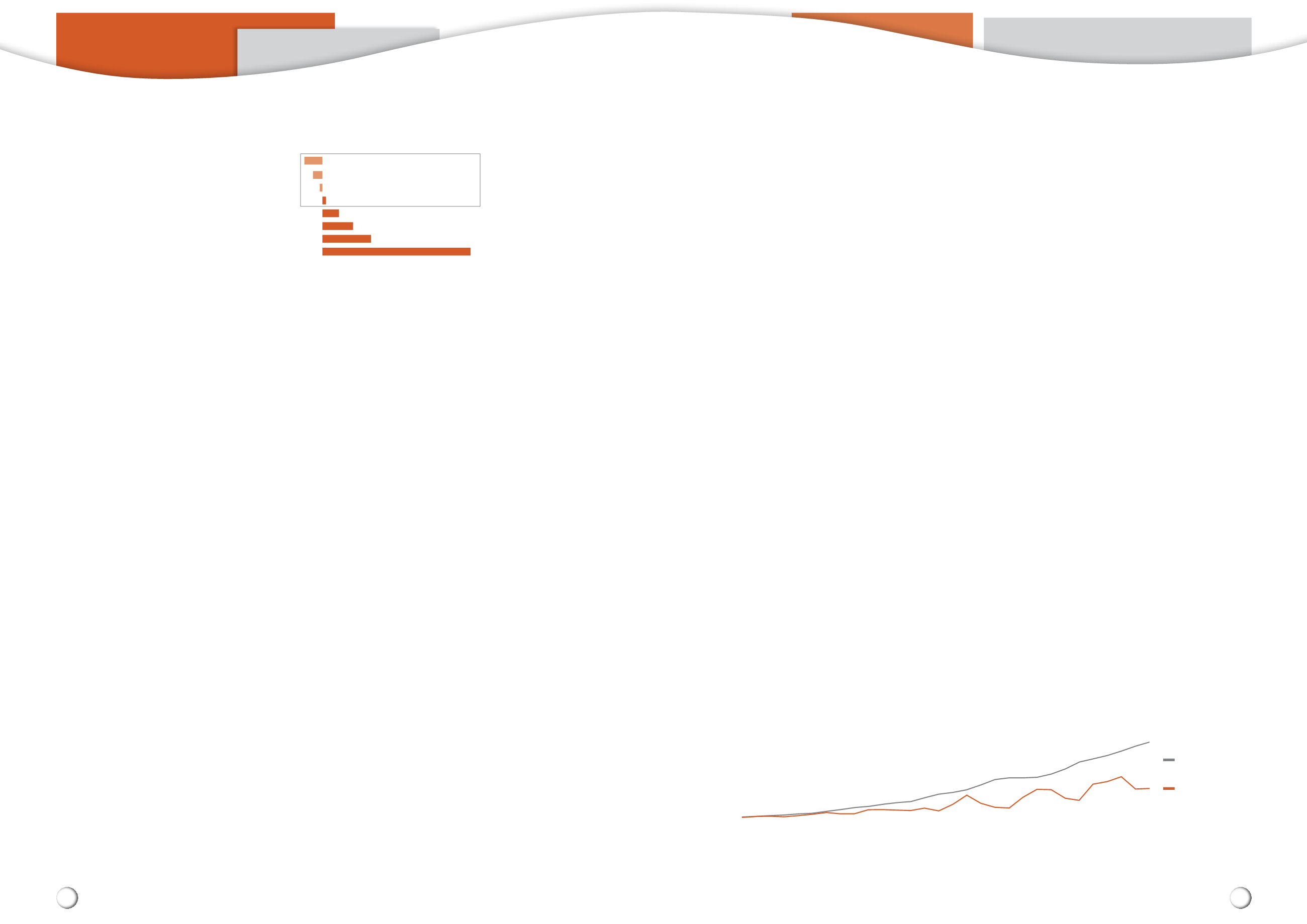

2001/2002 production season the maize price index (

Graph 1

)

weakened significantly compared to the maize seed price

index. With the continued increase in maize seed prices and

with an estimated average producer price of R1 697 per ton

for the coming season (2014/2015), the maize price index

continues to weaken.

SEED MARKET

According to the Crop Estimates Committee, 2 688 200 hectares

of maize were planted during the 2013/2014 production season.

This was 3,3% less than in the 2012/2013 season. The value of

the maize seed planted during the 2012/2013 production

season was R2,688 billion. The value of the seed planted

during the 2013/2014 production season was estimated to be

R2,742 billion. Although the area under maize therefore

decreased, the value of the local sales of seed increased.

SEED QUALITY

The official seed testing station of South Africa monitors seed

quality. From August 2013 to September 2014, 760 samples

were taken, of which 16 samples did not comply with the

minimum requirements. During the 2013/2014 production

season several problems with seed quality were reported.

Grain SA assisted its members with disputes.

Retention OF SEED AND DRAFT ROYALTIES MODEL

A committee was established to investigate how seed

companies can be compensated for the negative impact of

the retention of seed on the industry. The model currently on

the table is based on the way in which the Winter Cereal Trust

raises funds for research. The advantage of such a system is

that everybody pays, as it is a statutory measure and the funds

can be kept only for seed that is held back.

SEED AVAILABILITY

The seed industry (SANSOR) assured Grain SA that a sufficient

quantity of grain and oilseed seeds will be available for the

2 000

1 800

1 600

1 400

1 200

1 000

800

600

400

200

0

Index/

Indeks

Graph 1: Indices of the price of maize seed and the producer price of maize

Grafiek 1: Indekse van die prys van mieliesaad en die produsenteprys van mielies

1985/1986

1986/1987

1987/1988

1988/1989

1989/1990

1990/1991

1991/1992

1992/1993

1993/1994

1994/1995

1995/1996

1996/1997

1997/1998

1998/1999

1999/2000

2000/2001

2001/2002

2002/2003

2003/2004

2004/2005

2005/2006

2006/2007

2007/2008

2008/2009

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014*

2014/2015*

Source/

Bron

: Grain SA/

Graan SA

* Preliminary/

Voorlopig

Maize seed index

Mieliesaadindeks

Maize price index

Mielieprysindeks

Insetnavorsing en -ontwikkeling

Inleiding

D

ie rand/dollar-wisselkoers en prys van ru-olie speel ‘n

belangrike rol in die bepaling van plaaslike insetpryse. Oor

die twaalf maande vanaf Oktober 2013 tot Oktober 2014,

het die waarde van die rand met 11% teen die dollar gedaal,

terwyl die prys van Brent-ruolie vanaf $109,30 per vat tot $91,93

per vat gedaal het.

Mielie-, sojaboon-, sonneblom- en graansorghumsaadpryse het

gemiddeld met tussen 5,5% en 18,0% gestyg, vergeleke met

die vorige seisoen. As ‘n mens na die plaaslike kunsmispryse

kyk, het die prys van KAN, ureum, MAP en kaliumchloried

onderskeidelik met 11%, 9%, 14% en 6% gestyg. Onkruiddoder-

en insekdoderpryse het op ‘n jaar-tot-jaar-grondslag gestyg.

Die plaaslike groot-handelprys van diesel in Gauteng het

met 1,08% gedaal. Op ‘n jaargrondslag het die pryse van

landboumasjinerie-toerusting met 11,9% gestyg.

BTW-NULKOERSE IN DIE WEEGSKAAL

Die BTW-wet laat sedert 1991 toe dat primêre produsente wat vir

BTW geregistreer is, sekere landbou-insette teen ‘n BTW-nulkoers

aankoop. Dit bied ‘n bewese kontantvloeiverligting. Tesourie en

die Suid-Afrikaanse Inkomstediens (SAID) het egter bewyse dat

grootskaalse bedrog in hierdie insetbelastingstelsel plaasvind. Dit

het hulle genoop om die nulkoersstelsel te hersien. Hulle voorstel

is dat die nulkoerskonsessie vervang word met BTW op insette

teen standaardkoerse.

Produsente sal dus die insette BTW-draend moet aankoop,

dit wil sê 14% meer daarvoor betaal. Produsente kan die

BTW terugeis, maar die ekstra rente- en/of geleentheidskoste

vir die tydperk totdat die BTW weer van die SAID ontvang

word, gaan vir die produsent se rekening wees. Produsente

sal ook 14% meer finansiering op produksielenings nodig hê.

Die wegdoening van BTW-nulkoerse op spesifieke insette is

op 17 Julie 2014 in ‘n Konsep Belastingswysigingswetsontwerp

gepubliseer vir publieke kommentaar.

Rolspelers in georganiseerde landbou het kommentaar ingedien

vir die behoud van hierdie voordeel. In September is nóg ‘n

vergadering met die SAID en Tesourie gehou waar veral maniere

om bedrog te bekamp, bespreek is. In Oktober 2014 het Tesourie

die afskaffing van die BTW-nulkoerse met minstens 12 maande

uitgestel hangende ondersoeke na alternatiewe voorstelle.

Input research and development

Introduction

T

he rand/dollar exchange rate and crude oil prices play

an important role in determining local input prices. Over

the 12-month period from October 2013 to October 2014,

the value of the rand depreciated by 11% against the dollar,

while the Brent crude oil price decreased from $109,30 per

barrel to $91,93 per barrel.

Maize, soybean, sunflower and grain sorghum seed prices

increased by an average of between 5,5% and 18,0%

compared to the previous season. Looking at local fertiliser

prices, the prices of LAN, urea, MAP and potassium chloride

increased by 11%, 9%, 14% and 6% respectively. Herbicide

and insecticide prices increased on a year-on-year basis. The

domestic wholesale price of diesel in Gauteng decreased

by 1,08%. On an annual basis the prices of agricultural

machinery equipment were 11,9% higher.

VAT ZERO RATES AT RISK

Since 1991 the VAT Act has permitted primary producers who

are registered for VAT to purchase certain agricultural inputs

at a zero VAT rate. This provides proven cash-flow relief.

However, the Treasury and South African Revenue Services

(SARS) have proof of large-scale fraud in this input tax system.

This has forced them to review the zero-rate system. Their

proposal is that the zero-rate concession be replaced by VAT

on inputs at standard rates.

Producers will therefore have to purchase the inputs VAT

inclusive, i.e. pay 14% more. Producers can claim back the

VAT, but the additional interest and/or opportunity cost for

the period until the VAT is received back from SARS will be for

the producer’s account. Producers will also require 14% more

financing on production loans. The scrapping of VAT zero

rates on specific inputs was published for public comment on

17 July 2014 in a Draft Tax Amendment Bill.

Role-players in organised agriculture submitted comments

for the retention of this benefit. Another meeting with SARS

and the Treasury was held in September, at which ways of

combating fraud were discussed in particular. In October 2014

the Treasury postponed the scrapping of the VAT zero rates

by at least 12 months pending the investigation of alternative

proposals.

* – The Safex futures contracts used in this scenario calculation for maize delivery in July 2015 was R2 000/ton

– Estimated variable and fixed costs were taken into consideration.

* –

Die Safex-termynkontrakte wat in hierdie scenarioberekening vir mielielewering in Julie 2015 gebruik is, was R2 000/ton

– Beraamde veranderlike en vaste koste is in ag geneem.

Graph 8: The profitability (gross margin) of grain and oilseeds in R/ton for different yield scenarios

in the North-West Free State environment (2014/2015 production season)

Grafiek 8: Die winsgewendheid (bruto marge) van graan en oliesade in R/ton vir verskillende

opbrengsscenario’s in die Noordwes-Vrystaat-omgewing (2014/2015-produksieseisoen)

-500

500

1 500

2 500

3 500

4 500

5 500

Gross margin (R/ton)/

Bruto marge (R/ton)

Maize – lower yield/

Mielies – laer opbrengs

Maize – average yield/

Mielies – gemiddelde opbrengs

Maize – average yield (minimum tillage)/

Mielies – gemiddelde opbrengs (minimum bewerking)

Maize – higher yield/

Mielies – hoër opbrengs

Grain sorghum – average yield/

Graansorghuim – gemiddelde opbrengs

Sunflower – average yield/

Sonneblom – gemiddelde opbrengs

Soybeans – average yield/

Sojabone – gemiddelde oprengs

Groundnuts – average yield/

Grondbone – gemiddelde opbrengs

-779

-318

-84

101

522

970

1 555

4 761

Maize scenarios/

Mielie-scenario's