The FAO (2013) projects food insecurity to rise in Zimbabwe. About

2,2 million people will be without food between January and

March of 2014. In Lesotho, production has recovered, but the majority of

the population is still facing constrained food access.

With opportunities opening up for South African producers, there

are however some great challenges in doing business in the region;

infrastructure is noted to be among those (FAO, 2013). Civil wars in some

countries, such as the Democratic Republic of the Congo, Mali, Nigeria,

the Central African Republic, South Sudan etc are still seen as a barrier in

doing business in the region.

Domestic markets

Exchange rate

The rand has been extremely volatile, reaching levels of R10,40 against

the dollar; before gaining some strength and now trading around R9,91.

According to the Nedbank Group Economic Unit (2013), the significant

weakening of the rand value was pressurised by the announcement by

the US Federal Reserve to taper the bond purchases. However, the rand

took another turn (strengthened) when the US Fed decided not to taper

the stimulus. The rand value was also helped by the news that the strikes

in Anglo American Platinum had ended.

However, the Nedbank Group Economic Unit (2013) noted that at some

point the US Fed will start tapering the stimulus, probably before the end

of the year and that could again put pressure on the emerging markets.

The rand is still expected to weaken, owing to the large current account

and fiscal deficits, low economic growth, infrastructure constraints, high

unemployment and elevated inflation. Currently, the rand is 12% weaker

compared to a year ago and supports the domestic commodity prices.

Crude oil prices increased by 5% and contributed to the domestic costs

of dryland maize production to increase by 7% (Table 1).

South African summer grain and

oilseeds trends

Since 2010, commodity prices have been very unstable. White maize and

yellow maize prices have been volatile, but currently white maize prices

are trading at a premium above yellow maize; largely supported by the

increasing demand from neighbouring countries, such as Zimbabwe.

Sorghum prices are supported by the sorghum imports needed.

Sunflower and soybean prices have also been showing an increasing

price trend. The recently established soybean crushing plants increased

the demand for soybean. At the same time, the domestic production

and crushing of sunflower seed does not meet the domestic demand for

sunflower oil. In 2012, South Africa imported a record of 187 000 tons of

sunflower oil.

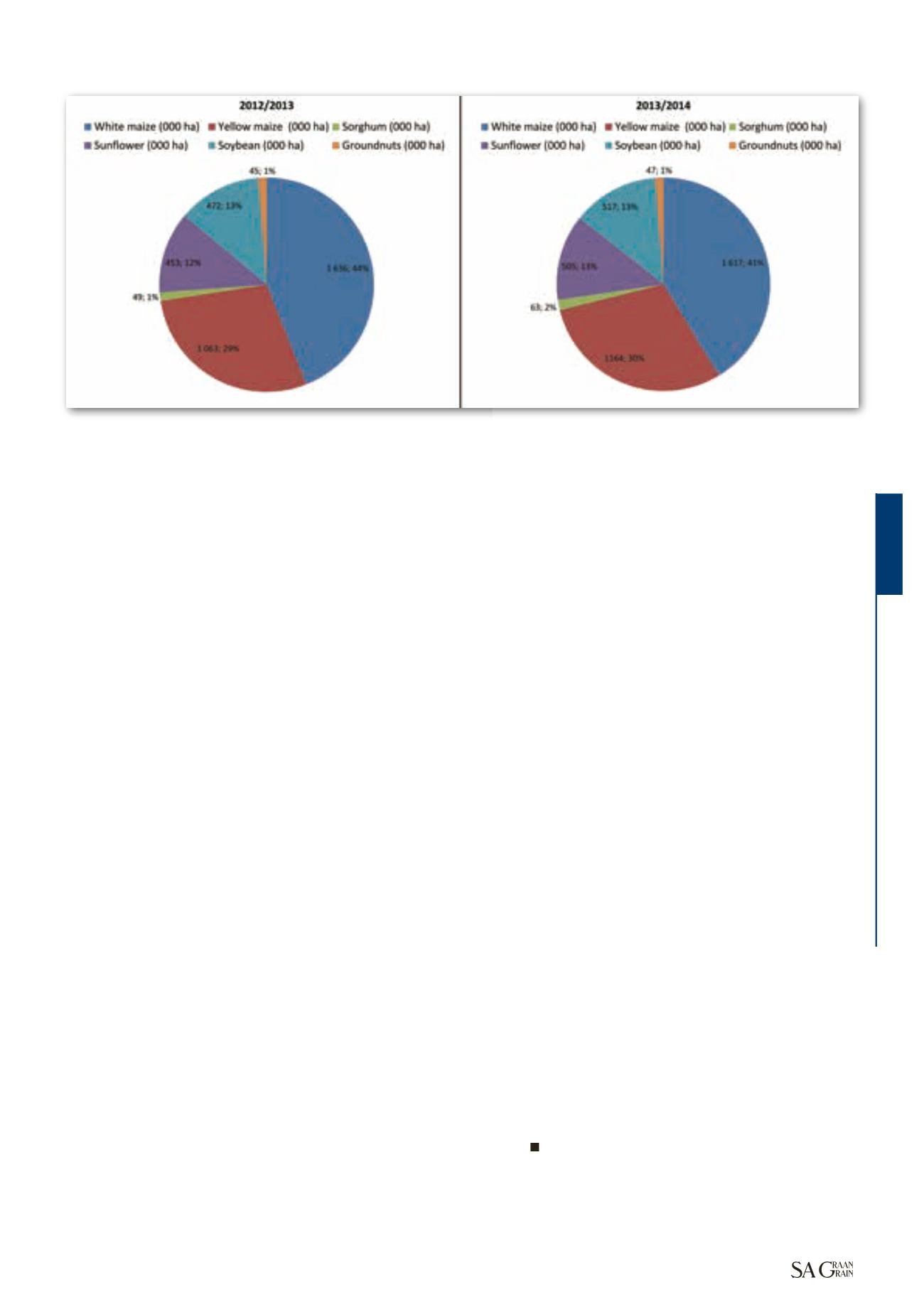

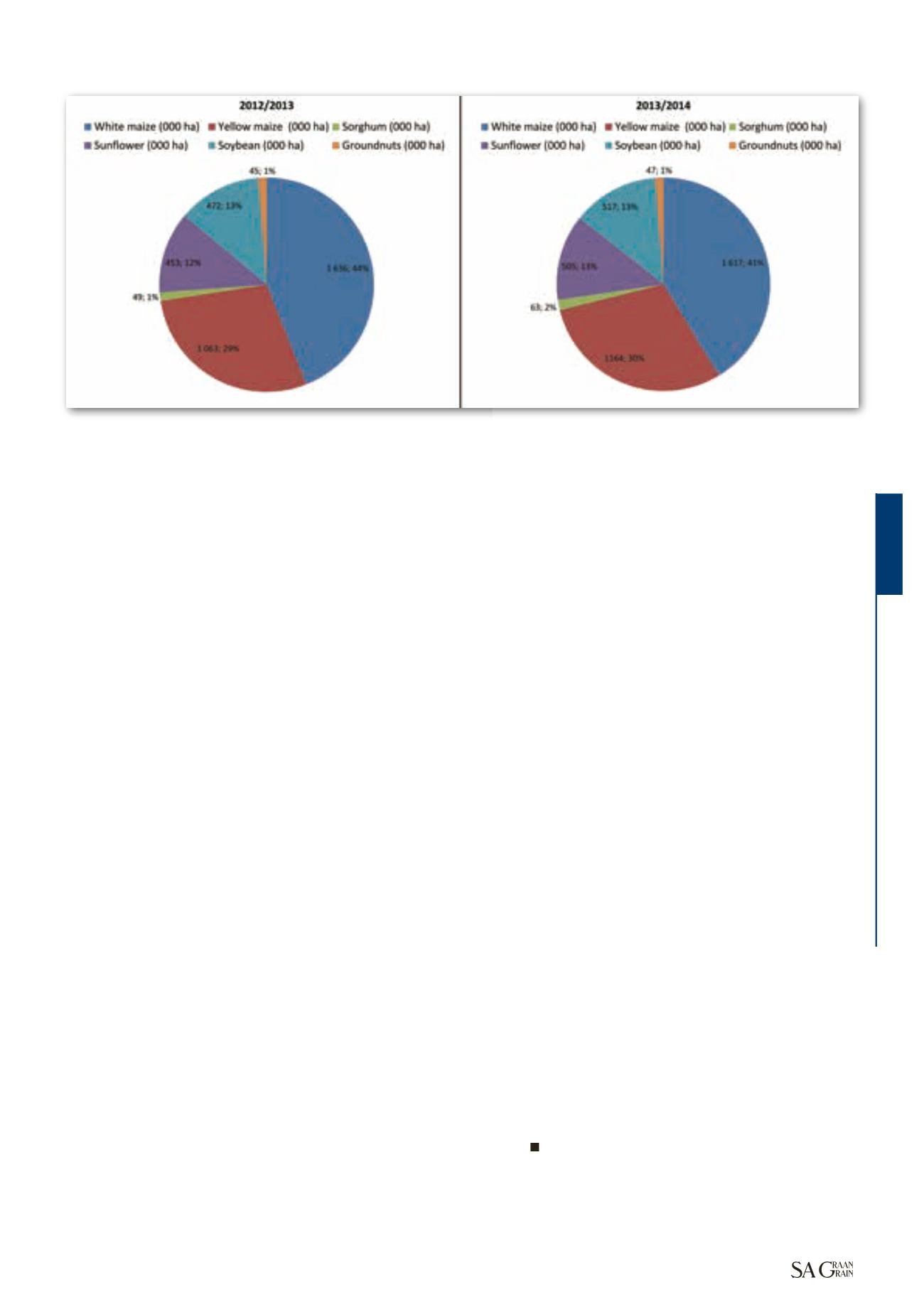

Hectares planted to summer grain oilseeds

In Southern Africa, the 2013 winter wheat harvest is expected to start in

October. Planting preparations for summer grain plantings have started

in South Africa. Trends show that South African producers expect that

white maize production may decrease; while soybean production is

expected to increase (

Graph 3

). Producers hope for sufficient rainfall as

dry weather conditions affects soil preparations.

The figures in Graph 3 show the changes in the area planted. Between

2012/2013 to the current planting season (2013/2014), the area planted to

white maize has been shrinking, from 44% to 41%. At the same time, the

area planted to yellow maize has been increasing, from 29% to 30%; with

the current planting season expected to have about 1 164 000 hectares

planted.

The area planted to sorghum has also shown a slight increase; for

2013/2014 it’s expected to increase slightly from 4 900 hectares to

63 000 hectares (Graph 3).

The area planted to sunflower is expected to increase from 12% to 13%; it

is currently expected to be 505 000 hectares for 2013/2014. For soybean,

the area planted is expected to increase from 472 000 hectares to

517 000 hectares for 2013/2014, largely supported by the increase in the

domestic demand from the crushing plants (Graph 3).

The area planted for groundnuts has declined over the years and is

expected to be around 45 000 hectares for 2013/2014 (Graph 3).

The domestic grain and oilseeds prices follow the domestic factors

of supply and demand, irrespective of the year-on-year decline in

international prices. It is expected that the factors, such as hectares

planted, expected rainfall and new demand for commodities such as

soybeans, may dominate the level of domestic prices compared to the

global factors of demand.

Keep price risk management strategies and the planting of alternative

crops in mind as export parity does not support the current price levels

for maize.

Further reading

FAO, 2013. Crop prospects and food situation, Rome: FAO.

GSA, 2013. Summergrains import and export parity prices, Pretoria: Grain SA.

IGC, 2013. Grain market report, Antwerp: International Grains Council.

Nedbank Group Economics Unit, 2013. Guide to the Economy, Johannesburg: Nedbank.

Graph 3: RSA hectares planted on summer grains and oilseeds.

Source: Grain SA, 2013

Market overview

Markets

85

November 2013

An overview of summer grains and oilseeds

Continued from page 82