Market overview

Markets

A look at the grain and oilseeds

market, with an overview of the

sunflower industry

WANDILE SIHLOBO AND FUNZANI SUNDANI, BOTH ECONOMISTS AT INDUSTRY

SERVICES, GRAIN SA

The recent USDA report has significantly affected grain and oilseed

prices. The report supported soybean and corn prices, but wheat prices

experienced pressure. This article will take a look at the domestic and

international markets for grain and oilseeds, the exchange rate as well as

a brief overview of the South African sunflower seed market.

International markets

Corn

According to the recent WASDE (World Agricultural Supply and Demand

Estimates) report, the US production of corn is lower than expected

at 355,3 million tons. It is still 30% well above last year’s 273,8 million

tons. The expected large crop in the Ukraine and the favourable weather

conditions during harvest in the US add to price pressure. However,

increases in feed usage as well as increases in exports led to price

support for corn. South Korea, Japan, China and Mexico are countries

that have shown an increase in the demand for US corn.

It is important to note that the corn price fundamentals are not strong

enough to sustain corn price levels. The relatively high soybean price

needs to be respected by traders in order to ensure sufficient corn

plantings, thus the higher corn prices.

Soybeans

Although South America is expecting a large crop, increased demand for

soybeans helped to underpin prices. China, Egypt and Thailand showed

an increase in demand. There are expectations that China’s soybean

imports may reach a record of 69 million tons as compared to 59,5 million

tons the previous year. Keep in mind that the excellent export price for

soybeans and low expected carry-out, underpins feed grain prices.

The critical months for soybean production in Argentina are during

January and February and therefore uncertainty about future crop

conditions is outstanding.

Wheat

Wheat prices have been trading down with expectations of a larger crop

from the world market. Decreases in exports compared to corn and

soybeans exports, lead to lower prices. It is expected that milling quality

wheat will only recover in the second quarter of 2014.

Sunflower

Sunflower harvests have been slower than usual in some of the key

producing areas in the US. However, Russia’s 2013 sunflower harvest

yielded 7,8 million tons compared to 7,2 million tons the previous year.

There has been some increased demand for sunflower oil, mainly from

Egypt. Favourable weather conditions in Argentina helped in aiding their

2013/2014 sunflower seed plantings, with the planting pace reported to

be higher than the previous year while the weather conditions for planting

started out dry.

Vegetable oil prices are supported by an increase in palm oil prices and

the damage by weather events in South East Asia. The higher soy-oil and

oilcake prices also lend support.

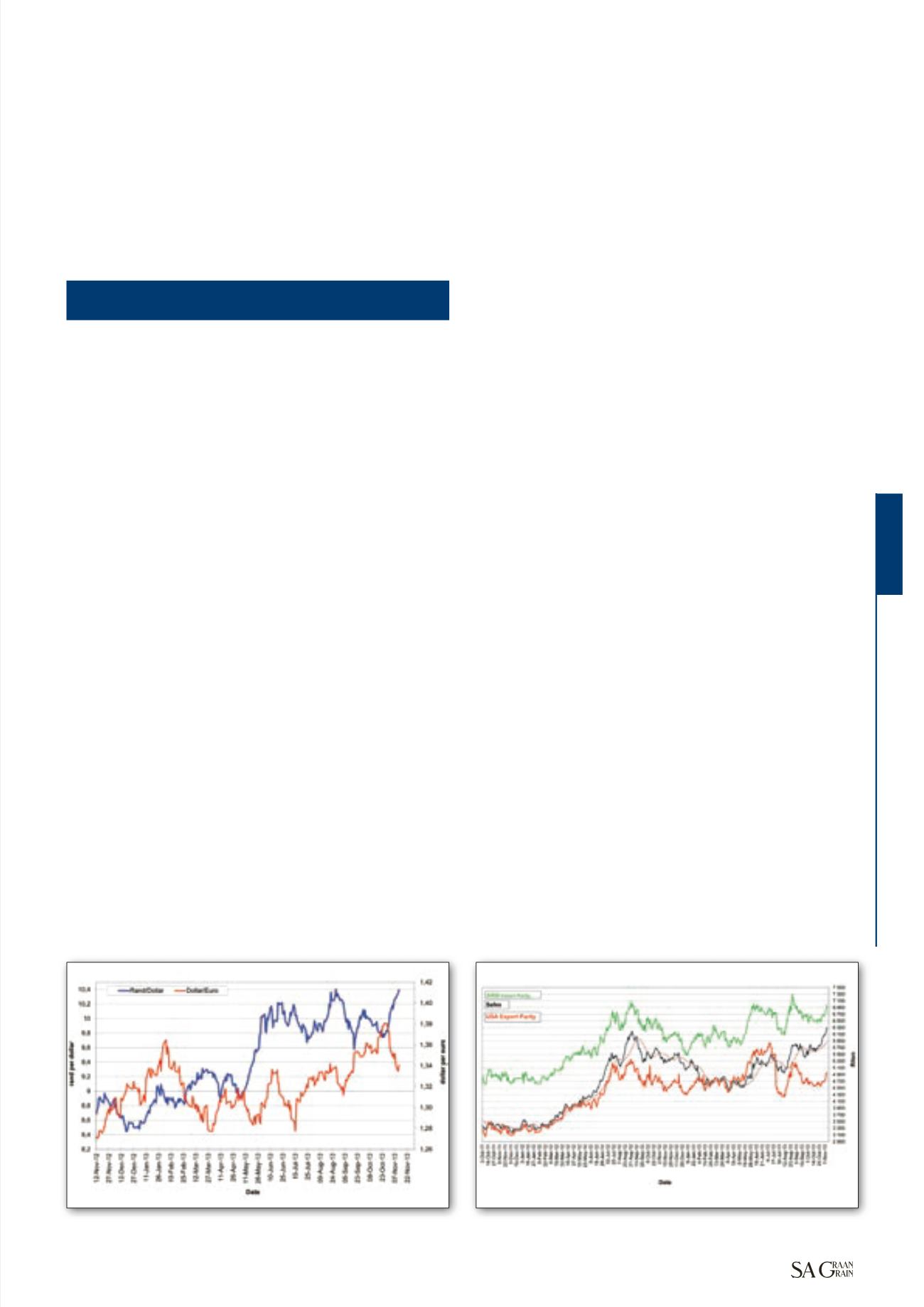

Exchange rate movements

Since last year, the rand has been very volatile, recently reaching high

levels of R10,42 against the dollar. It is expected that the rand will weaken

further until the second quarter of 2014.

The recent pressure on the rand and other emerging market currencies,

is mainly due to the expectations that the United States Federal Reserve

(US Fed) might start tapering its $85 billion a month stimulus earlier than

expected. The recent report by the United States Commerce Department

that the US economy grew at a higher rate of 2,8% in the third quarter

of 2013, compared to 2,5% in the second quarter, coupled with better

employment data, raised concerns that the US Fed might start tapering

in December 2013, instead of March 2014, as previously expected.

Consequently, the dollar strengthened as investors renew their trust in

the US economy (

Graph 1

).

Domestic markets

Maize exports

Recently, South African maize exports have mainly been going to the

BLNS countries as well Zimbabwe. Zimbabwe is expected to import about

39

December 2013

– 13 November 2013

Graph 1: Exchange rate movement.

Source: Grain SA (2013)

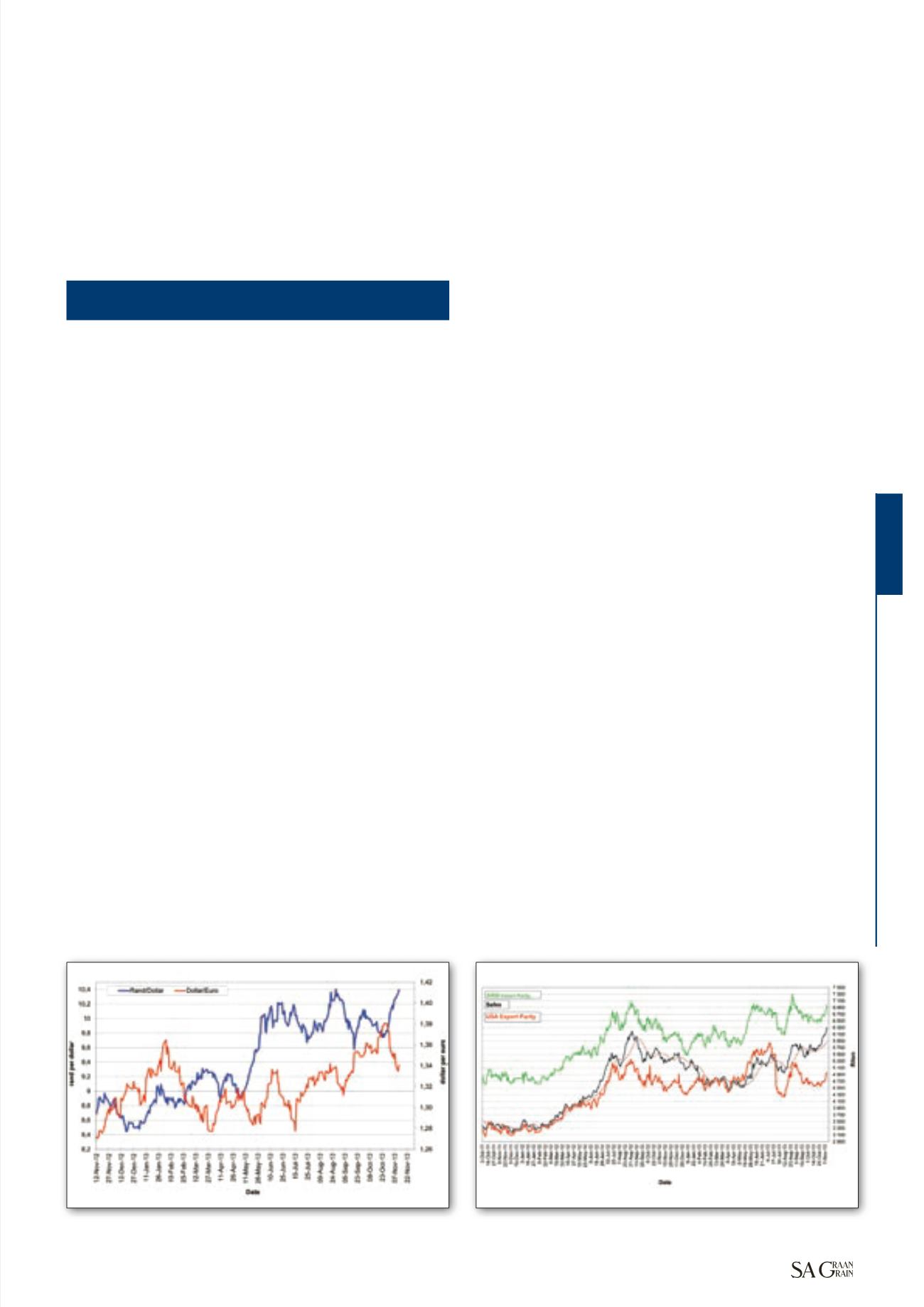

Graph 2: Prices of soybean delivered in Randfontein.

Source: Grain SA (2013)

Continued on page 40