Meat

Markets

Looking at livestock prices for 2014

ERNST JANOVSKY, HEAD: AGRIBUSINESS, ABSA

The livestock feed industry is a major consumer of grain and oilseeds.

Without a profit expectation for this industry, the consumption of

livestock feed will decline and that will be negative for grain and oilseeds

producers.

Profit is derived from the product prices as well as the cost of production.

Let us investigate the expectations of the major livestock enterprises.

Beef

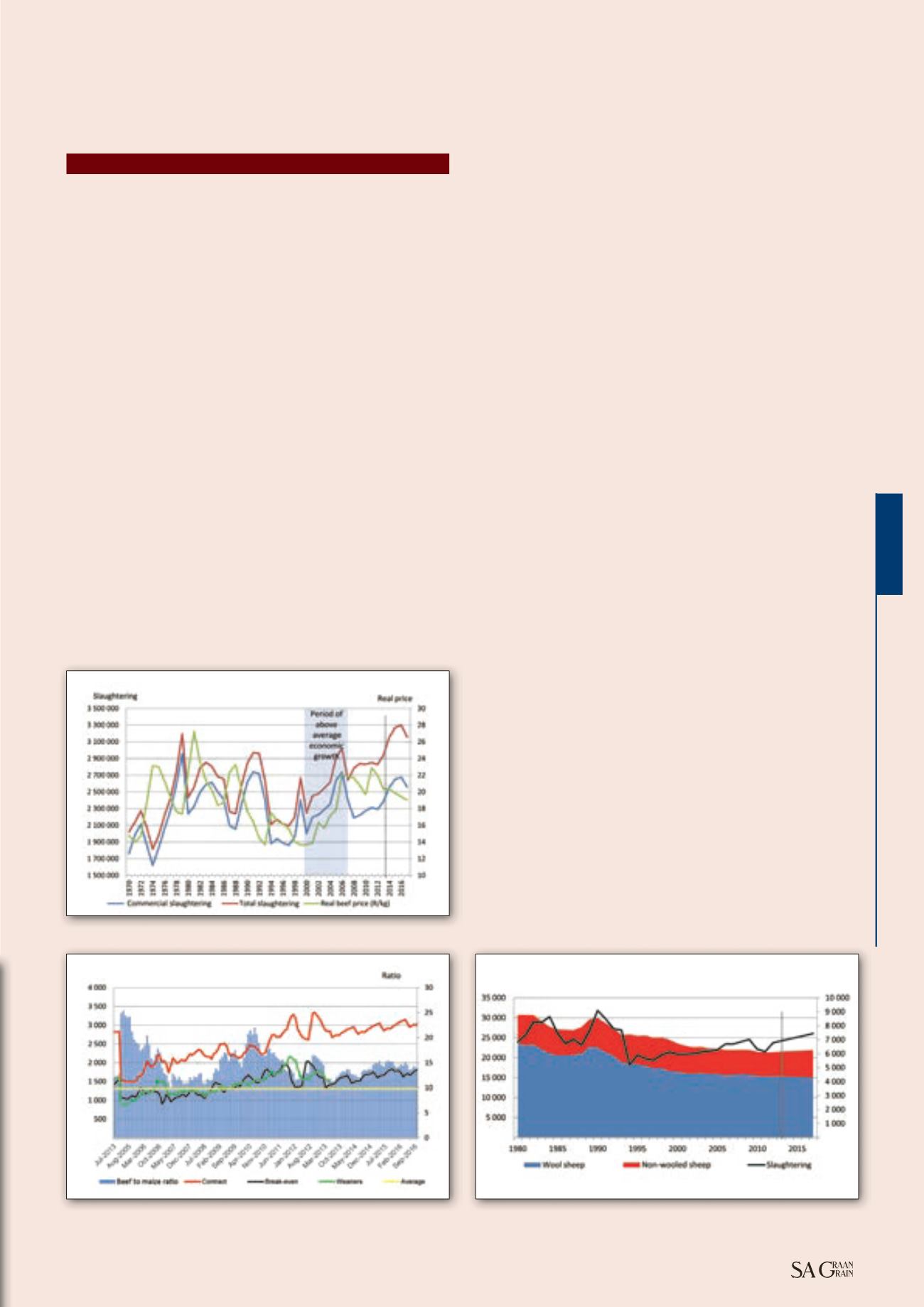

The good old times where real beef prices increased in spite of an

increase in slaughtering, is something of the past and we are once again

back to normal. There has always been a strong correlation between beef

slaughtering and real beef prices – as slaughtering increased, real beef

prices declined. However, during the period of 2000 to 2006, as a result

of good international economic growth as well as domestic economic

growth, real beef prices increased in spite of an increase in slaughtering.

Since then, we experienced the world financial crisis and in South Africa

a slowdown in economic growth which implies that consumers are taking

strain. The net effect is that as spending continued to increase, real beef

prices continued to decline.

The future however does not look as rosy, as far above average

production conditions over the past five years created some leeway in a

sense that producers did not need to slaughter their cattle as there was

enough fodder available to carry stock over. All of this however changed

dramatically during the past season given the first indicative drought in

the western areas of the country, this combined with a severe dry year in

Namibia and one of the biggest herds we have ever had in South Africa,

has led to a sharp increase in slaughtering.

An above average rain season can bring some relief, but given the long-

term prediction, it is expected that we are moving into a dryer rainfall

cycle. We therefore expect slaughtering to increase as producers start to

cut back on production and we also expect that the national beef herd will

be under pressure and start to shrink.

As communal areas’ contribution to total slaughtering has increased

substantially over the past years, it is expected that given the level

of fodder management, communal producers would be much more

vulnerable to the effects of a drought than commercial producers as they

do not have any reserves whether financial or in the form of fodder.

Lower world commodity prices for coarse grains lead to a lowering of

feed prices, unfortunately this was to some extend set off by a weaker

rand/dollar exchange rate. Intensive livestock industries, such as feedlots,

therefore continue to take some strain.

Beef outlook

Slaughtering is expected to continue to increase over the next few years

placing downward pressure on producer prices as demand is expected

to remain fairly flat. Class A2 beef prices are expected to decline from the

anticipated R31/kg in December, to just below R27/kg in May 2014.

Weaner calf prices are expected to show some recovery, but will struggle

to exceed R18,50/kg in live weight in 2014.

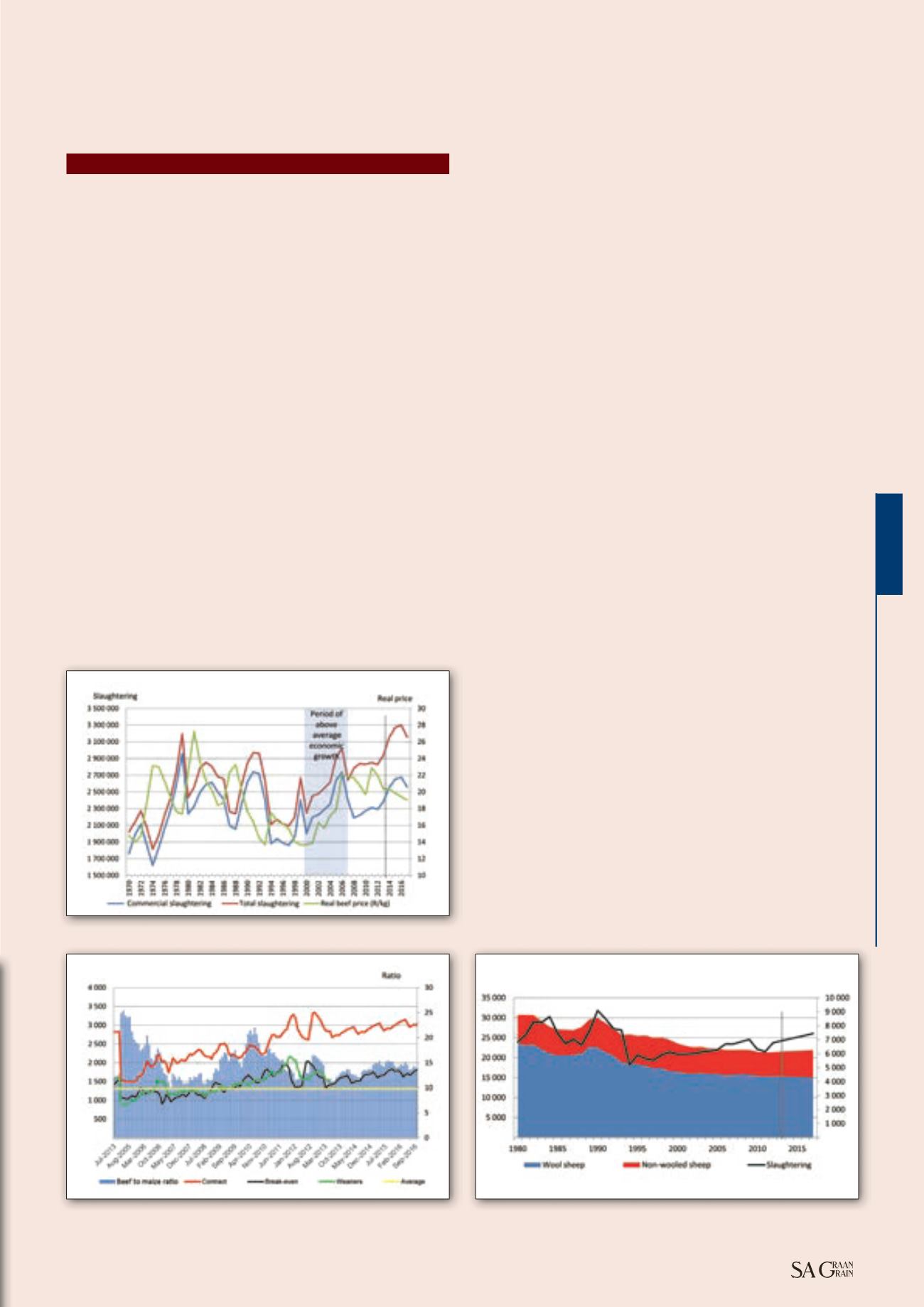

Mutton

World sheep numbers continue to decline; this is mainly due to the dry

production conditions in Australia triggering herd liquidation, with a

resulting decline in world mutton production.

On the domestic front the national sheep is showing some recovery

nationally after reaching a low during 2010 which coinside with the

outbreak of Rift Valley fever which led to a decline of almost 30% in

mutton production. Due to the decline in production, prices peaked at a

new all-time record of R54,55/kg for Class A2 in August 2011.

Production recovered to pre-2011 prices during the 2012 season, with

the bulk of the producers now inoculating against Rift Valley fever. Herd

numbers have also shown some recovery as producers muster the art of

keeping their flocks safe from vermin and stock theft.

41

December 2013

Graph 1: Relation between beef slaughtering and real beef prices (2008 = base).

Graph 2: Relation between maize and weaner calf prices (c/kg).

Graph 3: South African sheep herd and slaughtering (‘000).

Continued on page 42