3% meer as die vorige jaar. Sedert Oktober ‘n jaar gelede

het die prys van sonneblom uit die Europese Unie-lande

met 9% toegeneem weens droë weersomstandighede in

talle produksiegebiede. Die jaar-tot-jaar styging van 38%

van Suid-Afrikaanse sonneblompryse was die gevolg van

groeiende binnelandse vraag en lae produksie.

Die oordragvoorraad vir grondbone het weens ‘n

31%-afname in produksie tot 18 000 ton gedaal. Die

2015/2016-produksie word op 56 675 ton geskat. Invoere

kan tot 7 000 ton afneem. Graan SA verwag dat uitvoere

met 34% sal daal vanaf 12 100 ton in 2014/2015 tot 8 000 ton

in 2015/2016. Die kommersiële lewering van kanola sal na

verwagting in 2015/2016 met 13% of 105 400 ton styg. Die

kommersiële aanbod daal met 1% weens ‘n 18%-afname

in die oppervlakte geplant (vanaf 95 000 hektaar tot

78 050 hektaar). Die oordragvoorraad vir 2015/2016

kan tot 43 500 ton afneem.

Wintergraan

Koring het in die tweede week van Oktober 2015 teen

R4 110 per ton verhandel, ‘n 14%-verhoging jaar-tot-jaar.

Koringpryse het momentum gekry weens ‘n styging in

vraag en vrese vir laer produksie in die Swartsee-lande en

Australië. Om in die plaaslike vraag van 3 468 000 ton te

voorsien, moet Suid-Afrika dalk bykans 1,8 miljoen ton koring

in 2015/2016 invoer.

‘n Enkele garskoper bepaal die prys van moutgars en

dit word aan die Safex-koringprys gekoppel. Invoere sal

na verwagting met 20% daal tot 60 000 ton in 2015/2016

aangesien die verwagte kommersiële produksie van

347 000 ton in die vraag sal voorsien. Die toename kom van

‘n 10%-verhoging in die oppervlakte aangeplant, vanaf

85 125 hektaar in 2014 tot 93 730 hektaar in 2015.

UITVOERBEVORDERING

Ontwikkeling van nuwe markte

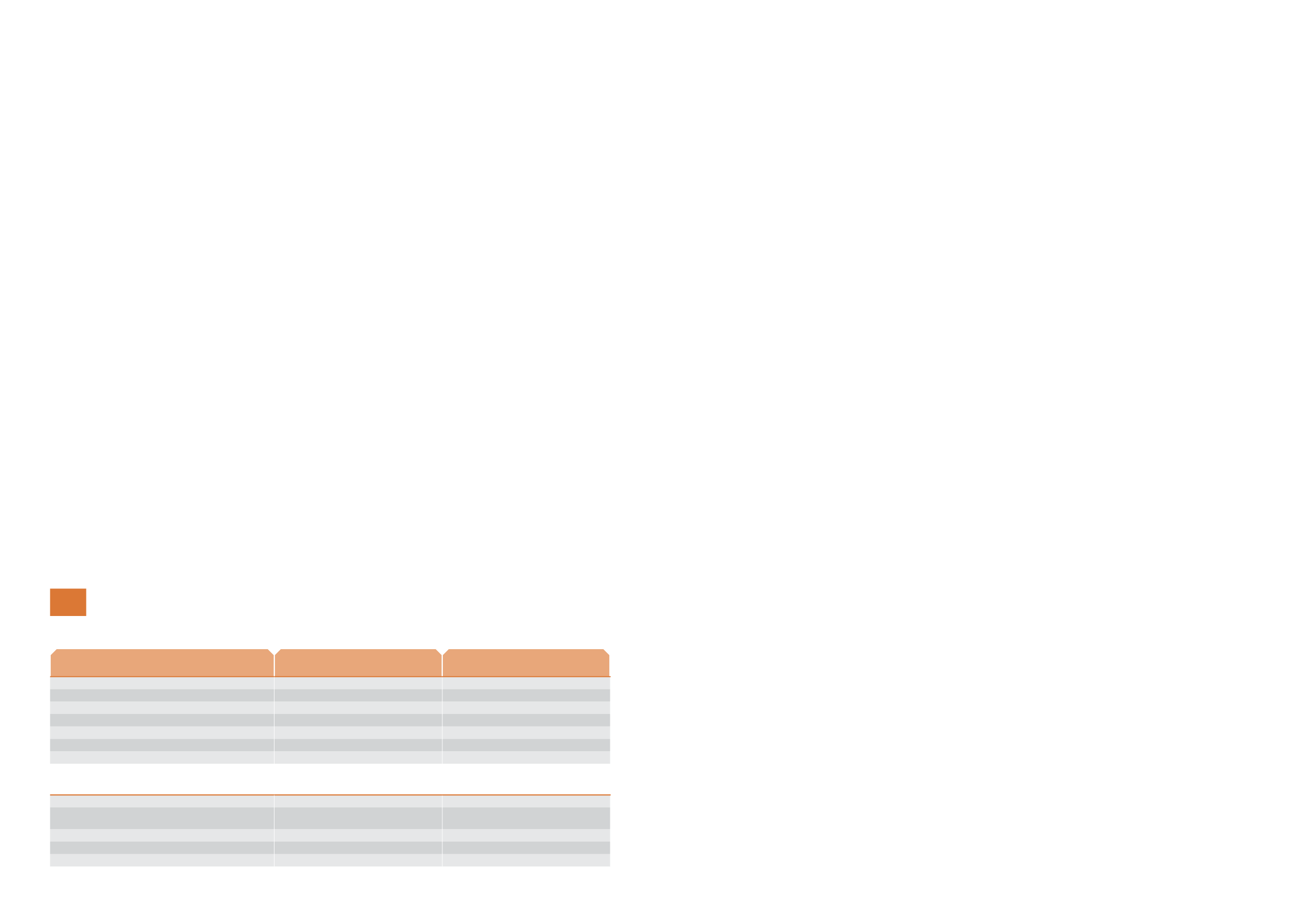

Tabel 1

lys die geïdentifiseerde sleutelmarkte vir mielie-

uitvoere. Suid-Afrika het reeds sy markaandeel in talle

Key export markets for the South African maize industry

Sleuteluitvoermarkte vir die Suid-Afrikaanse mieliebedryf

1

Prioritise development in the short to medium term

Prioritiseer ontwikkeling oor die kort tot medium termyn

Counrty

Land

Status

Restriction

Beperking

Japan

Present/

Teenwoordig

n/a/

n.v.t.

Mexico/

Mexiko

Present/

Teenwoordig

n/a/

n.v.t.

Taiwan/Chinese Taipei

Present/

Teenwoordig

n/a/

n.v.t.

Zimbabwe

Present/

Teenwoordig

n/a/

n.v.t.

United Arab Emirates/

Verenigde Arabiese Emirate

No presence/

Geen teenwoordigheid

n/a/

n.v.t.

China

Present/

Teenwoordig

n/a/

n.v.t.

Thailand

Present/

Teenwoordig

n/a/

n.v.t.

Prioritise development in the medium to long term

Prioritiseer ontwikkeling oor die medium tot lang termyn

Saudi Arabia/

Saoedi-Arabië

Present/

Teenwoordig

n/a/

n.v.t.

Egypt/

Egipte

No presence/

Geen teenwoordigheid

Existing GMO restrictions/

Bestaande

GMO-beperkings

Indonesia/

Indonesië

No presence/

Geen teenwoordigheid

n/a/

n.v.t.

Vietnam/

Viëtnam

No presence/

Geen teenwoordigheid

n/a/

n.v.t.

Iran

No presence/

Geen teenwoordigheid

n/a/

n.v.t.

Table

Tabel

seed oil were imported in 2014, which is 3% higher than in

the previous year. Since October a year ago the price of

sunflower from the European Union countries increased by 9%

due to dry weather conditions across many production areas.

The 38% year-on-year price increase in South African sunflower

prices was on the back of increasing domestic demand and

low production.

The carry-over stock for groundnuts decreased to

18 000 tons due to a 31% decrease in production. The

2015/2016 production is estimated at 56 675 tons. Imports

can decline to 7 000 tons. Grain SA expects exports to de-

crease by 34%, from 12 100 tons in 2014/2015 to 8 000 tons in

2015/2016. The commercial delivery of canola is expected to

increase by 31% or 105 000 tons in 2015/2016. The commercial

supply decreased by 1% due to an 18% decrease in the area

planted (from 95 000 hectares to 78 050 hectares). The carry-

over stock for 2015/2016 might decrease to 43 500 tons.

Winter grains

Wheat traded at R4 110 per ton during the second week

of October 2015 – a 14% year-on-year increase. Wheat

prices gained momentum owing to an increase in de-

mand as well as fears of lower production in the Black Sea

countries and Australia. To meet the domestic demand

of 3 468 000 tons, South Africa may need to import

almost 1,8 million tons of wheat in 2015/2016.

The price of malting barley is determined by a single barley

buyer and is linked to the Safex wheat price. Imports are

expected to decrease by 20% to 60 000 tons in 2015/2016

as the expected commercial production of 347 000 tons

will satisfy the demand. This increase is due to a 10%

increase in the area planted, from 85 125 hectares

in 2014 to 93 730 hectares in 2015.

EXPORT PROMOTION

Development of new markets

Table 1

lists the identified key markets for maize exports.

South Africa has already established its market share in

van hierdie lande gevestig. Dit moet in stand gehou word

om langtermyngroei moontlik te maak. Graan SA poog

deurlopend om toegang tot ander markte soos Egipte,

Indonesië, Viëtnam en Iran te verkry.

Graan SA het ook uitvoermarkte vir sorghum geïdentifiseer

nadat die vraag uit Botswana begin daal het. Japan

en Europa is aantreklike markte, maar Afrika bied ook

moontlike markte soos Soedan en Ethiopië.

INVOERVERVANGING EN

BEDRYFSONTWIKKELING

Biobrandstofregulasies

Die Departement van Energie het ‘n biobrandstofimple-

menteringskomitee aangestel. Graan SA ondersteun die

Departemente van Landbou, Bosbou en Visserye (DLBV)

en van Energie (DvE) om regulasies vir grondstofproduksie

daar te stel. Die biobrandstofregulasies moet nog aan die

kabinet voorgelê en dan in die

Staatskoerant

gepubliseer

word vir implementering.

Persaanlegte: Oliesade

Suid-Afrika se sojaboonperskapasiteit van 600 000 ton in

2012 het intussen tot ongeveer 2,3 miljoen ton toegeneem.

Ongeveer 1,3 miljoen ton hiervan kan ook vir die pers van

sonneblom gebruik word. In Oktober 2015 was sommige

van die persaanlegte nog nie op volle kapasiteit nie.

Volgens die Proteïennavorsingstigting was Suid-Afrika se

sojaboonoliekoekvereistes in 2015/2016 1,5 miljoen ton

waarvan 55% ingevoer moet word. Die nuwe perskapasiteit

kan die groeiende invoer van oliekoek en plantolie stuit en

die produksie van sojabone, sonneblom en kanola verhoog.

HANDEL EN HANDELSBELEIDSOMGEWING

Koringinvoertarief

Die Internasionale Handelsadministrasiekommissie het ‘n

nuwe verwysingsprysvlak van $294 in 2013 goedgekeur. In

Oktober 2015 was die koringtarief R911,20 per ton na ‘n daling

van die internasionale koringprys tot minder as die basisprys.

Die tarief verseker ‘n meer stabiele omgewing.

Mielie-invoertarief

Graan SA het aansoek gedoen om die hersiening

van ‘n mielietarief vanaf ‘n verwysingsprys van $110

tot $233,39 per ton. Die styging in die verwysingsprys

bevoordeel langtermyn-nasionale voedselsekerheid.

Liggingsdifferensiale

Graan SA ondersteun nie die JSE se liggingsdifferensiaal-

stelsel nie en het in 2013 en 2014 op die afskaffing daarvan

gefokus. Na teenvoorstelle om die differensiale in plek te

laat, probeer Graan SA om dit so laag as moontlik te hou

en moniteer die berekening daarvan.

Kontantmarkdeursigtigheid en basisverhandeling

Prof Mathew Roberts, wat die funksionering van die termyn-

mark vir die Nasionale Landboubemarkingsraad (NLBR)

ondersoek, meen die differensiaalkwessie is ‘n simptoom

van ‘n gebrek aan deursigtige kontantmarkpryse.

Deursigtigheid is noodsaaklik vir ‘n akkurate kontantmark

wat fundamentele vraag- en aanbodelemente weerspieël.

many of these countries. These will need to be maintained

to make long-term growth possible. Grain SA makes

continuous efforts to access other markets such as Egypt,

Indonesia, Vietnam and Iran.

Grain SA has also identified export markets for sorghum

after the demand from Botswana started to decline. Japan

and Europe are attractive markets, but Africa also offers

possible markets like Sudan and Ethiopia.

IMPORT REPLACEMENT AND

INDUSTRY DEVELOPMENT

Biofuel regulations

The Department of Energy established a biofuels

implementation committee. Grain SA supports the

Department of Agriculture, Forestry and Fisheries (DAFF)

and Energy (DoE) in issuing regulations for raw-material

production. The biofuel regulations are yet to be submitted

to cabinet and then published in the

Government Gazette

for implementation.

Crushing plants: oilseeds

South Africa’s soybean crushing capacity of 600 000 tons

in 2012 has in the meantime increased to approximately

2,3 million tons. About 1,3 million tons of this can also be

used for crushing sunflower seed. In October 2015 some of

the crushing plants were not yet functioning at full capacity.

According to the Protein Research Foundation, South Africa’s

soybean oilcake requirements in 2015/2016 will be 1,5 million

tons, 55% of which would have to be imported. The new

crushing capacity can stop the growing imports of oilcake

and vegetable oil and increase the production of soybeans,

sunflower and canola.

TRADE AND TRADE POLICY ENVIRONMENT

Wheat import tariff

The International Trade Administration Commission

approved a new reference price level of $294/ton in 2013.

In October 2015, the wheat tariff was R911,20 per ton after

the international wheat price declined to less than the base

price. This tariff ensures a more stable environment.

Maize import tariff

Grain SA applied for the review of a maize tariff from a

reference price of $110 to $233,39 per ton. The increase in

the reference price benefits long-term national food security.

Location differentials

Grain SA does not support the JSE’s location differential

system and focused on abolishing it in 2013 and 2014.

After counter proposals to leave the differentials in place,

Grain SA has been trying to keep them as low as possible

and monitors their calculation.

Cash market transparency and basis trading

Prof Mathew Roberts, who is investigating the functioning

of the futures market for the National Agricultural Marketing

Council (NAMC), maintains that the differentials issue is a

symptom of a lack of transparent cash market prices.

Transparency is essential for an accurate cash market

that reflects supply and demand fundamentals.

Industry Services division

Afdeling bedryfsdienste

Markinligting (vervolg)

Market information (continued)

Market overview for grain and oilseeds

Markoorsig vir graan en oliesade

40

41

* Present – South Africa already exports maize to this specific country/

Teenwoordig – Suid-Afrika voer reeds mielies uit na hierdie land

* No presence * n/a – there is no GMO restriction/

Geen teenwoordigheid nie * n.v.t. – daar is geen GMO-beperking nie