Die goudprys en die prys van Brent-ruolie het onderskeidelik

met 6% en 43% gedaal.

Die VSA-dollar versterk steeds weens verwagte rentekoers-

verhogings vroeg in 2016. Dit het tot die verswakking van

geldeenhede in ontluikende markte gelei. In Oktober 2015

het die rand met 20% jaar-tot-jaar teen die dollar verswak.

‘n Swakker rand ondersteun plaaslike kommoditeitspryse,

maar verhoog inflasionêre druk op ingevoerde

insetprodukte.

Sedert Oktober 2014 het CBOT-mielie-, -sojaboon- en

-koringpryse onderskeidelik met 4%, 11% en 25% gedaal.

Die vooruitsigte vir kommoditeitspryse wêreldwyd bly

laag, aangesien Suid-Amerika, die Verenigde State en die

Swartsee-lande groot voorrade het en relatief groot oeste

in 2015/2016 verwag.

Somergraan

Die droogte het tot ‘n beduidende afname in

sorghumproduksie gelei met ‘n 24%-verhoging in Safex-

pryse (ongeveer R3 040 per ton in Oktober 2015). Die

opwaartse druk vanaf die mieliemark het sorghumpryse

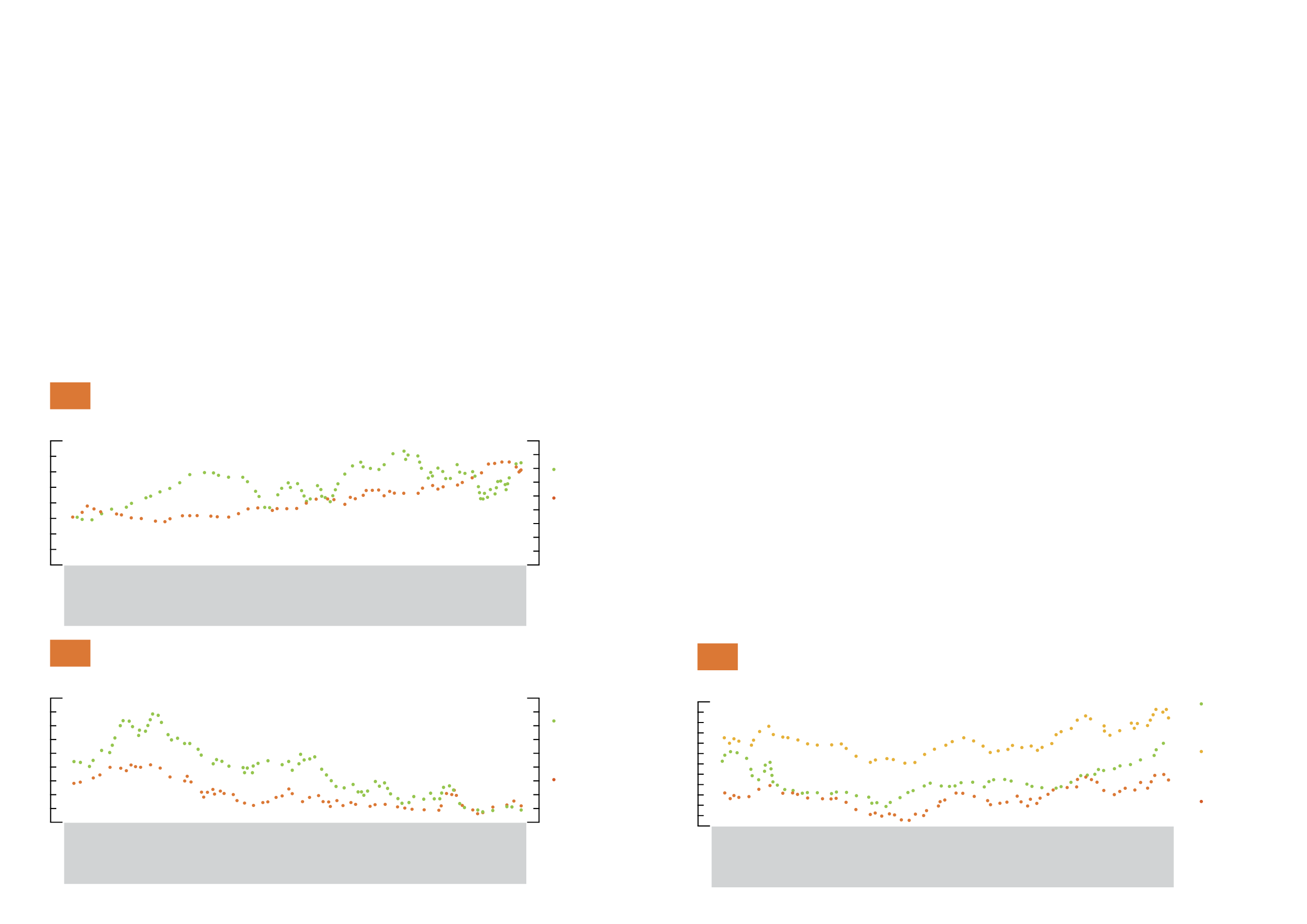

The JSE overall share index and R/$ exchange rate

Die JSE algehele indeks en die R/$-wisselkoers

2

02/01/2014

16/01/2014

30/01/2014

13/02/2014

27/02/2014

13/03/2014

27/03/2014

10/04/2014

24/04/2014

08/05/2014

22/05/2014

05/06/2014

19/06/2014

03/07/2014

17/07/2014

31/07/2014

14/08/2014

28/08/2014

11/09/2014

25/09/2014

09/10/2014

23/10/2014

06/11/2014

20/11/2014

04/12/2014

19/12/2014

02/01/2015

16/01/2015

30/01/2015

13/02/2015

27/02/2015

17/03/2015

31/03/2015

14/04/2015

28/04/2015

12/05/2015

26/05/2015

09/06/2015

23/06/2015

07/07/2015

21/07/2015

04/08/2015

18/08/2015

10/09/2015

15/09/2015

29/09/2015

13/10/2015

JSE Index

JSE Indeks

R/$

Graph

Grafiek

JSE Index/

JSE Indeks

56 000

Rand/$

$15,00

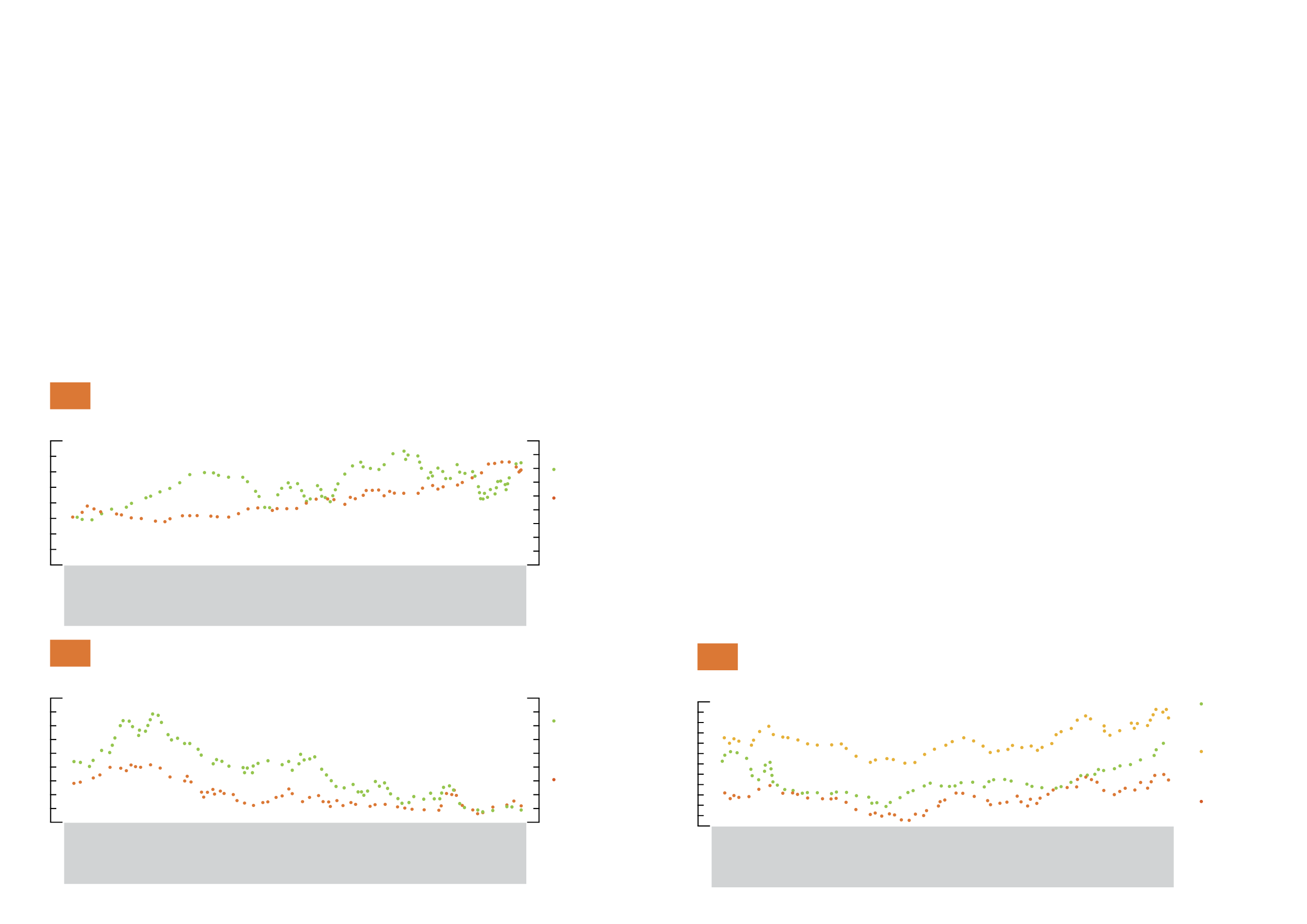

The F.O.B. price of USA maize and wheat

Die VAB-prys van VSA-mielies en -koring

3

02/01/2014

16/01/2014

30/01/2014

13/02/2014

27/02/2014

13/03/2014

27/03/2014

10/04/2014

24/04/2014

08/05/2014

22/05/2014

05/06/2014

19/06/2014

03/07/2014

17/07/2014

31/07/2014

14/08/2014

28/08/2014

11/09/2014

25/09/2014

09/10/2014

23/10/2014

06/11/2014

20/11/2014

04/12/2014

19/12/2014

02/01/2015

16/01/2015

30/01/2015

13/02/2015

27/02/2015

17/03/2015

31/03/2015

14/04/2015

28/04/2015

12/05/2015

26/05/2015

09/06/2015

23/06/2015

07/07/2015

21/07/2015

04/08/2015

18/08/2015

10/09/2015

15/09/2015

29/09/2015

13/10/2015

USA HRW

wheat

VSA HRW-

koring

USA Maize

VSA-mielies

Graph

Grafiek

Wheat price/

Koringprys ($/ton)

380

Maize price/

Mielieprys ($/ton)

330

Brent crude oil price decreased by 6% and 43%

respectively.

The US dollar continues to strengthen due to expected

interest rate hikes in early 2016. This has led to the weaken-

ing of emerging market currencies. In October 2015, the

rand weakened by 20% year-on-year against the dollar.

A weaker rand is supportive of domestic commodity

prices, but adds inflationary pressures to imported

input products.

Since October 2014, CBOT maize, soybean and wheat

prices decreased by 4%, 11% and 25% respectively. The

outlook for global commodity prices remains bearish, as

South America, the United States and the Black Sea

countries have large supplies and expect relatively

large crops in 2015/2016.

Summer grain

The drought has led to a significant decrease in sorghum

production, with a 24% increase in Safex-prices (around

R3 040 per ton in October 2015). The upwards pressure from

the maize market supported sorghum prices. No imports are

54 00

52 000

50 000

48 000

46 000

44 000

42 000

40 000

360

340

320

300

280

260

240

220

200

14,40

13,60

12,80

12,00

11,20

10,40

9,60

8,80

8,00

310

290

270

250

230

210

190

170

150

ondersteun. Aangesien groot voorrade beskikbaar is, word

geen invoere verwag nie. Die Internasionale Graanraad

het die 2015/2016 wêreld-sorghumproduksie op 69,9 miljoen

ton geskat. Dit is die hoogste die afgelope vier seisoene.

Die 2014/2015-droogte het tot ‘n 30% jaar-tot-jaarafname

in die mielie-oes gelei. Dit het tot hoë mieliepryse gelei,

met witmielies se prys wat 61% hoër was (ongeveer

R3 121 per ton). Geelmielies het teen R2 790 per ton

verhandel (43% hoër as ‘n jaar gelede).

In Oktober 2015 was die nuwe gewastermynkontrakpryse

vir lewering in Julie 2016 48% hoër vir witmielies en 35%

hoër vir geelmielies as ‘n jaar gelede weens onsekerheid

oor weervooruitsigte (

Grafiek 3

). In Oktober 2015 was

die Suid-Afrikaanse oordragvoorraadsyfer vir wit- en

geelmielies 1 454 000 ton, vergeleke met 2 074 000 in die

vorige bemarkingsjaar. Die geprojekteerde totale surplus

was 251 000 ton, vergeleke met 839 000 ton die vorige

jaar met die gevolg van 758 000 ton geprojekteerde

mielie-invoere vir 2015/2016. Uitvoere, meestal na

streekmarkte, word op 630 000 ton geskat.

Oliesade

Suid-Afrika se sojaboonproduksie was 1 041 600 ton, ‘n

12%-verhoging op die 2014/2015-oes. Die oppervlakte

onder sojabone het met 36% gegroei, maar die droogte

het ‘n oesverhoging gekortwiek. ‘n Groter vraag deur die

nuwe perskapasiteit en kleiner voorrade weens die droogte

ondersteun plaaslike pryse vir oliesade.

In Oktober 2015 het sojabone teen R5 397 per ton verhandel

(5% hoër as ‘n jaar gelede). Suid-Afrika se sojabooninvoere

kan in 2015/2016 op 140 000 ton stabiliseer indien die gepro-

jekteerde hoeveelheid sojabone wat vir olie en oliekoek

gepers word 880 000 ton, en volvet-sojaboonverbruik

142 000 ton bly.

Sonneblom het in Oktober 2015 teen ongeveer R6 605 per ton

verhandel (38% hoër as ‘n jaar gelede) (

Grafiek 4

). Plaaslike

produksie het vanaf 832 000 ton in 2014/2015 tot 660 900 ton

in 2015/2016 gedaal (‘n jaar-tot-jaardaling van 26%).

Die oordragvoorraadsyfer vir sonneblom kan aan die einde

van 2015/2016 120 600 ton haal, maar die toenemende

vraag van die persaanleg sal pryse waarskynlik ondersteun.

Ongeveer 146 690 ton sonneblomolie is in 2014 ingevoer,

The price of sunflower delivered in Randfontein

Die prys van sonneblom gelewer in Randfontein

4

02/01/2014

16/01/2014

30/01/2014

13/02/2014

27/02/2014

13/03/2014

27/03/2014

10/04/2014

24/04/2014

08/05/2014

22/05/2014

05/06/2014

19/06/2014

03/07/2014

17/07/2014

31/07/2014

14/08/2014

28/08/2014

11/09/2014

25/09/2014

09/10/2014

23/10/2014

06/11/2014

20/11/2014

04/12/2014

19/12/2014

02/01/2015

16/01/2015

30/01/2015

13/02/2015

27/02/2015

17/03/2015

31/03/2015

14/04/2015

28/04/2015

12/05/2015

26/05/2015

09/06/2015

23/06/2015

07/07/2015

21/07/2015

04/08/2015

18/08/2015

10/09/2015

15/09/2015

29/09/2015

13/10/2015

Safex

sunflower

Safex

sonneblom

EU import

parity

EU-invoer-

pariteit

EU export

parity

EU-uitvoer-

pariteit

Graph

Grafiek

R/ton

8 100

Markinligting (vervolg)

expected as large supplies are available. The International

Grains Council estimated the 2015/2016 global sorghum

production at 69,9 million tons. This is the highest for the

past four seasons.

The 2014/2015 drought resulted in a 30% year-on-year

decrease in the maize crop. This led to high maize

prices, with white maize prices going up by 61% (around

R3 121 per ton). Yellow maize traded at R2 790 per ton

(43% higher than a year ago).

In October 2015 the new crop futures prices for delivery in

July 2016 were 48% higher for white maize and 35% higher for

yellow maize compared to a year ago due to uncertainty

about weather prospects (

Graph 3

). In October 2015, the

total South African carry-over figure for white and yellow

maize was 1 454 000 tons, compared to 2 074 000 tons in the

previous marketing year. The projected total surplus was

251 000 tons, compared to 839 000 tons the previous year,

so that 758 000 tons of maize imports are projected for

2015/2016. Exports, mostly destined for regional markets,

were projected at 630 000 tons.

Oilseeds

South Africa’s soybean production reached 1 041 600 tons,

a 12% increase from the 2014/2015 crop. The area planted

with soybeans increased by 36%, but a crop increase

was curbed by the drought. A greater demand from the

new crushing capacity and smaller stocks because of the

drought support local prices for oilseeds.

In October 2015 soybeans traded at R5 397 per ton (5% higher

than a year ago). South African soybean imports may stabilise

at 140 000 tons in 2015/2016 should the projected soybean to

be crushed for oil and oilcake remain at 880 000 tons, and full

fat soybean consumption at 142 000 tons.

Sunflower seeds traded at around R6 605 per ton in

October 2015 (38% higher than a year ago) (

Graph 4

).

Domestic production decreased from 832 000 tons in

2014/2015 to 660 900 tons in 2015/2016 (a year-on-year

decrease of 26%).

The carry-over figure for sunflower seeds may reach

120 600 tons at the end of 2015/2016, but prices are likely

to remain supported due to the increasing demand from

the crushing plant. Approximately 146 690 tons of sunflower

Market information (continued)

7 700

7 300

6 900

6 500

6 100

5 700

5 300

4 900

4 500

4 100

3 700

3 300

Industry Services division

Afdeling bedryfsdienste

Market overview for grain and oilseeds

Markoorsig vir graan en oliesade

38

39