winsgewendheid daarvan evalueer. Hulle moet besluit of

die Safex-prys voldoende is, en daarvoor stel Graan SA

gedetailleerde ondernemingsbegrotings vir die homogene

produksiestreke van Suid-Afrika op.

2015/2016-produksieseisoen

Die afgelope seisoen (2014/2015) se droogtetoestande

het graan- en oliesaadproduksie in die grootste dele

van Suid-Afrika onder hewige druk geplaas. Met die

nuwe seisoen om die draai, lyk die situasie heelwat

beter weens besonder lae voorraadvlakke, wat plaas-

like pryse ondersteun. Dié styging van produsentepryse

by die meeste somergewasse, maar spesifiek mielies,

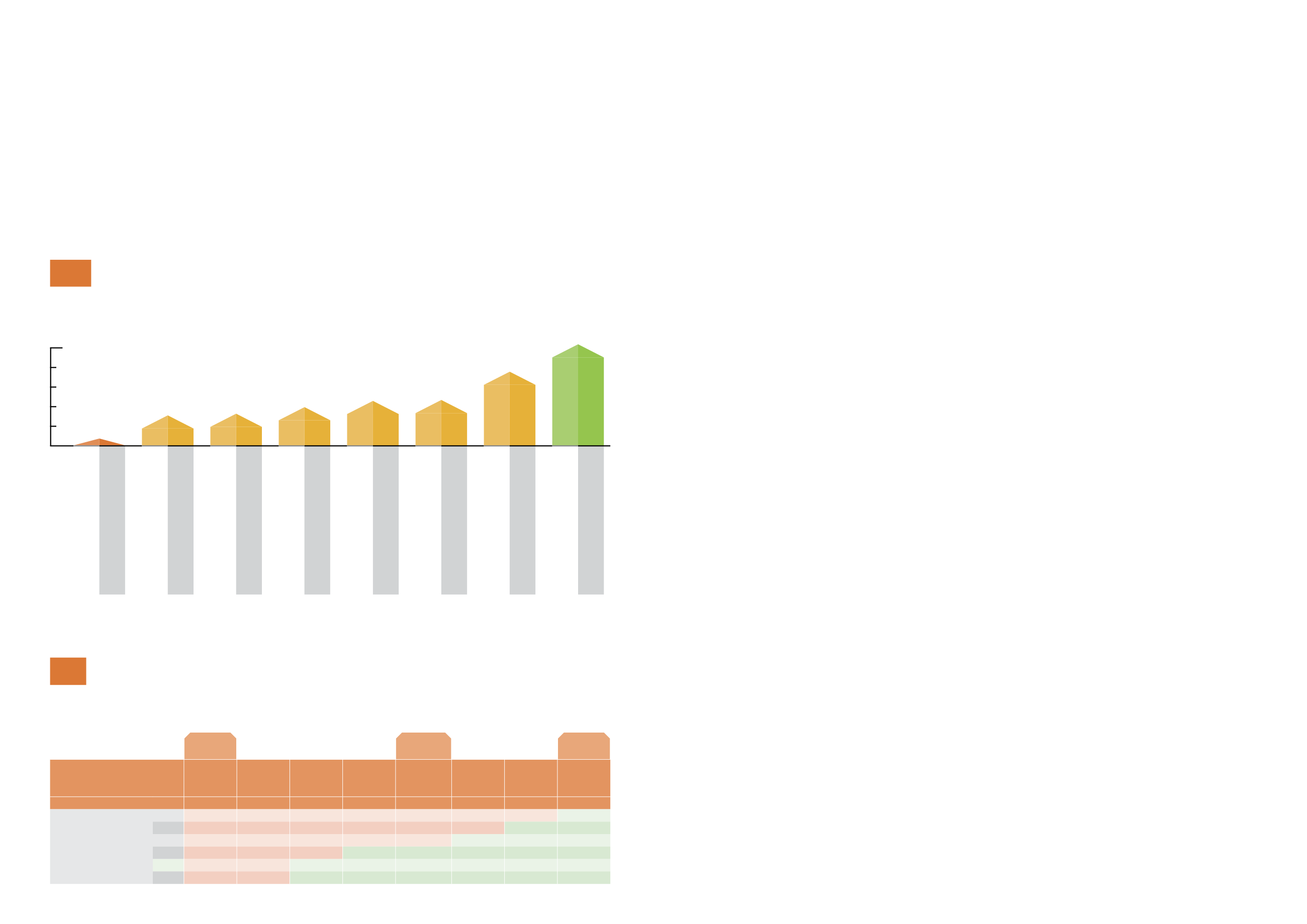

The projected sensitivity analyses (break-even yield and price) for the above-average yield maize

dryland scenario for the 2015/2016 production season in the north-western Free State

Die geprojekteerde sensitiwiteitsontledings (gelykbreekopbrengs en -prys) vir die bogemiddelde

droëlandopbrengsscenario vir mielies vir die 2015/2016-produksieseisoen in die Noordwes-Vrystaat

Export

Uitvoer

July 2016

julie 2016

import

invoer

Safex price July 2016

Safex-prys Julie 2016

(R/ton)

1 700

1 900

2 100

2 300

2 450

2 650

2 850

3 400

1 428

1 628

1 828

2 028

2 178

2 378

2 578

3 128

Yield (t/ha)

Opbrengs (t/ha)

3,5

-1 438

-1 238

-1 038

-838

-688

-488

-288

262

4,0

-1 080

-880

-680

-480

-330

-130

70

620

4,5

-801

-601

-401

-201

-51

149

349

899

5,0

-578

-378

-178

22

172

372

572

1 122

5,5

-396

-196

4

204

354

554

754

1 304

6,0

-244

-44

156

356

506

706

906

1 456

4

Table

Tabel

and assess their profitability. They must decide whether the

Safex price is adequate, and Grain SA compiles detailed

business budgets for the homogenous production regions of

South Africa for this purpose.

2015/2016 production season

The drought conditions of the past season (2014/2015)

placed profitable grain and oilseed production in most

parts of South Africa under major pressure. With the new

season around the corner, the situation looks considerably

better as a result of stock levels that are particularly low

and that support local prices. This increase in producer

prices for most summer crops, but specifically for maize,

die afgelope jaar beteken dat produsente se voor-

uitsigte ten opsigte van winsgewendheid beter is.

Die winsgewendheid (bruto marge per hektaar en per

ton) van verskillende mielie-opbrengsscenario’s asook

ander graan- en oliesadegewasse wat in die Noordwes-

Vrystaat geplant word, word in

Grafiek 18

getoon vir die

2015/2016-produksieseisoen. Die opbrengsscenario’s is

gegrond op aannames van produksietoestande en kan

dus tussen produsente verskil.

Let wel:

Hoewel die inligting

slegs vir die Noordwes-Vrystaat-produksiegebied getoon

word, is dit ook vir die ander streke beskikbaar. Die

vergelykende analise (

Grafiek 18

) wys dat grondbone die

beste bruto marge vir die komende produksieseisoen toon.

Sensitiwiteitsontledings

Die geprojekteerde sensitiwiteitsontledings (gelykbreek-

opbrengs en -prys) vir die bogemiddelde-opbrengs droë-

landscenario vir mielies vir die 2015/2016-produksieseisoen

in die Noordwes-Vrystaat word in

Tabel 4

getoon.

Met die opstel van die begroting was die Julie 2016

Safex-mielieprys gemiddeld R2 450/ton, wat ongeveer

R2 178/ton in die produsent se sak is nadat die liggings-

differensiaal, hanteringskoste en bemarkingskommissie

in ag geneem is. Die geraamde produksiekoste vir ‘n op-

brengs van 4,5 t/ha is gebruik. Die totale veranderlike koste

om ‘n hektaar mielies vir dié opbrengs te plant, is ongeveer

R7 831/ha. ‘n Berekende vastekoste-komponent (salarisse,

huur, lewenskoste, elektrisiteit, ensovoorts) van R2 200/ha

moet by ‘n totale produksiekoste van R10 031/ha

gevoeg word.

Indien die Safex-prys teen die geraamde begrote insetkoste

(vaste plus veranderlike koste) realiseer, moet ‘n produsent ten

minste 4,5 t/ha oes stroop om gelyk te breek. Indien slegs die

veranderlike koste in ag geneem word, moet ‘n produsent se

opbrengs meer as 3,5 t/ha wees as hy wil gelykbreek. Hierdie

tabel beklemtoon dat produsente se winsgewendheidsituasie

beter as verlede jaar lyk, hoofsaaklik weens hoër mieliepryse

na die onlangse droogte.

Insetnavorsing en

-ontwikkeling

INLEIDING

Die

rand/dollar-wisselkoers en die prys van ruolie speel

‘n belangrike rol in die vorming van plaaslike insetpryse.

Vanaf Oktober 2014 tot Oktober 2015 het die waarde van

die rand met 21% teen die VSA-dollar verswak. Die prys

van Brent-ruolie het oor dieselfde tydperk van $88 tot

$41 per vat (43%) gedaal.

Die groothandelprys van diesel in Gauteng het met 12%

gedaal. Mielie-, sonneblom-, sojaboon-, en graansorghum-

saadpryse het gemiddeld onderskeidelik met 5,6%, 6,6%, 5,6%

en 10,2% gestyg, vergeleke met die vorige seisoen. Die prys

van KAN, MAP en kaliumchloried het onderskeidelik met 5%,

13% en 6% gestyg en die prys van ureum het met 2% gedaal.

Die pryse van feitlik alle internasionale landbouchemiese

middels het op ‘n jaargrondslag gedaal. Omdat die

wisselkoers so skerp verswak het, is hierdie dalings nie

noodwendig in plaaslike markte gesien nie. Op ‘n

jaargrondslag het die pryse van landboumasjinerie

en -toerusting met gemiddeld 4,5% gestyg.

over the past year has led to better profitability prospects

for producers.

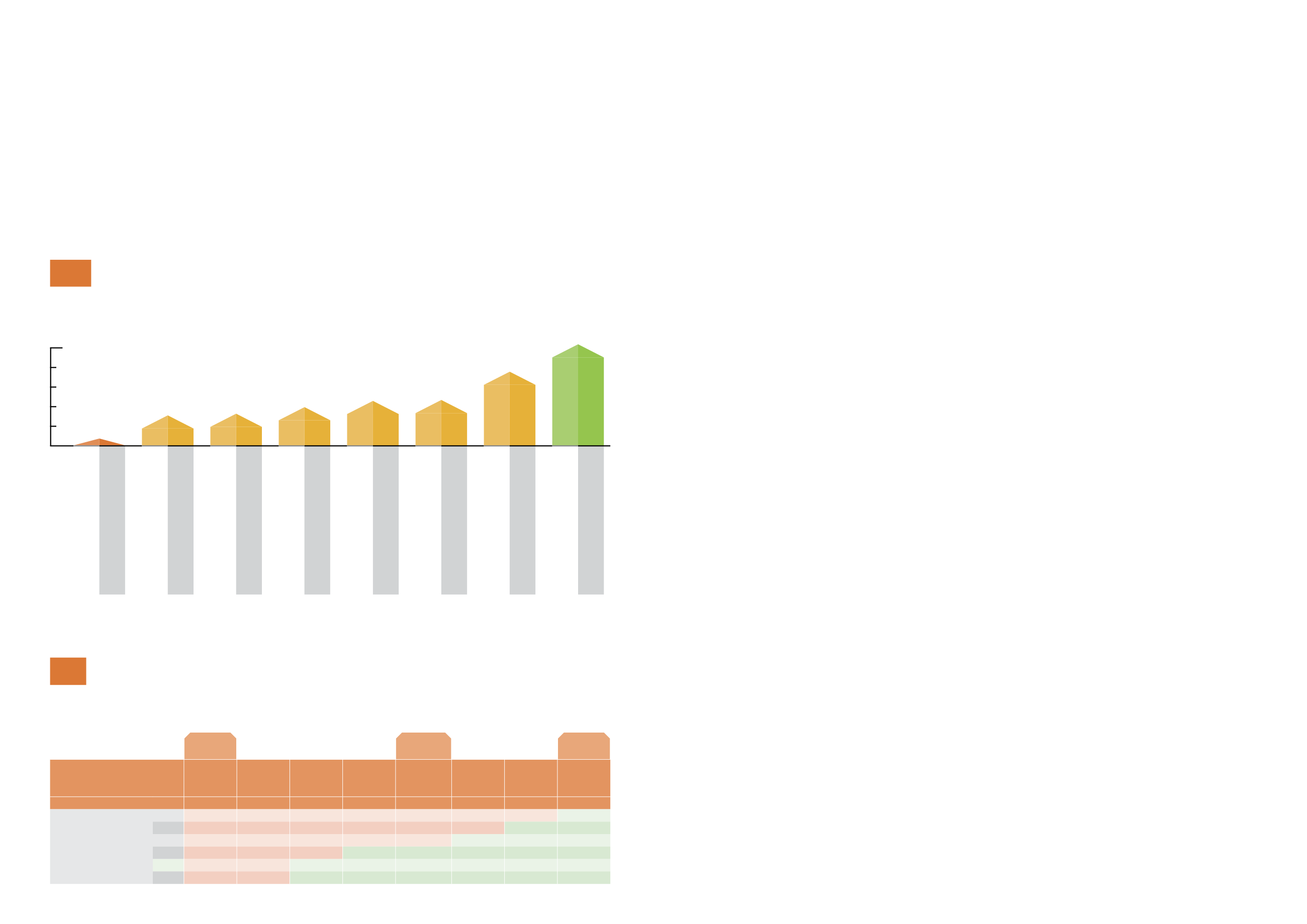

The profitability (gross margin per hectare and per ton) of

different maize yield scenarios as well as other grain and

oilseed crops planted in the north-western Free State is indica-

ted in

Graph 18

, as applicable to the 2015/2016 production

season. The yield scenarios are based on assumptions of

production conditions and may therefore differ between

producers.

Note:

although the information in the next section

is shown only for the north-western Free State production area,

it is available for the other regions as well. The comparative

analysis (

Graph 18

) demonstrates that groundnuts display the

best gross margin for the coming production season.

Sensitivity analyses

The projected sensitivity analyses (break-even yield and price)

for the above-average yield maize dryland scenario for the

2015/2016 production season in the north-western Free State is

shown in

Table 4

.

During the drafting of the budget the July 2016 Safex

maize price was on average R2 450/ton, which is

approximately R2 178/ton in the producer’s pocket after

considering the location differential, handling costs and

marketing commission. The estimated production cost of

a 4,5 t/ha yield was used during compilation. The total

variable cost to plant a hectare of maize for this yield is

about R7 831/ha. A calculated fixed-cost component

(salaries, rent, cost of living, electricity, etc.) of R2 200/ha

must be added to a total production cost of R10 031/ha.

If the Safex price should realise at the estimated

budgeted input cost (fixed plus variable costs), a

producer should harvest at least 4,5 t/ha to break

even. By taking into account only the variable costs, a

producer must yield more than 3,5 t/ha to break even.

This table highlights that producers’ profitability situation

looks better than last year, mainly due to the higher

maize prices after the recent drought.

Input research and

development

INTRODUCTION

The

rand/dollar exchange rate and crude oil prices play

an important role in determining local input prices. From

October 2014 to October 2015 the value of the rand

dropped by 21% against the US dollar. The price of Brent

crude oil declined from $88 per barrel to $41 per barrel

(43%) over the same period.

The domestic wholesale price of diesel in Gauteng

decreased by 12%. Maize, sunflower, soybean and grain

sorghum seed prices increased by an average of 5,6%,

6,6%, 5,6% and 10,2% respectively compared with the

previous season. The price of LAN, MAP and potassium

chloride increased by 5%, 13% and 6% respectively, and

the price of urea dropped by 2%. The prices of almost all

international agrochemical substances dropped on an

annual basis. Because the exchange rate weakened

so drastically, these decreases where not necessarily

seen in local markets. On an annual basis the prices of

agricultural machinery equipment were on average

4,5% higher.

Industry Services division

Afdeling bedryfsdienste

Input research and development

Insetnavorsing en -ontwikkeling

Produksiekoste (vervolg)

PRODUCTION costs (continued)

26

27

Maize/

Mielies

Lower yield/

Laer opbrengs

Sunflower/

Sonneblom

Average yield/

Gemiddelde opbrengs

Maize/

Mielies

Average yield/

Gemiddelde opbrengs

Soybeans/

Sojabone

Average yield/

Gemiddelde opbrengs

grain Sorghum/

Graansorghum

Average yield/

Gemiddelde opbrengs

Maize/

Mielies

Average yield/

Gemiddelde opbrengs

(

less till/

verminderde bewerking)

Maize/

Mielies

Higher potential/

Hoër potensiaal

Groundnuts/

Grondbone

Average yield/

Gemiddelde opbrengs

The profitability (gross margin) of grain and oilseeds in R/ha for different yield scenarios

in the north-western Free State area (2015/2016 production season)

Die winsgewendheid (bruto marge) van graan en oliesade in R/ha vir verskillende opbrengsscenario’s

in die Noordwes-Vrystaat-omgewing (2015/2016-produksieseisoen)

18

Graph

Grafiek

Gross margin/

Bruto marge

7 500 R/ha

* The Safex futures used in this scenario calculation were/

Die Safex-termynkontrakte wat in hierdie scenarioberekening gebruik is:

• Maize for delivery in July 2016/

Mielies vir lewering in Julie 2016

= R2 450/t

• Sorghum for delivery in July 2016/

Sorghum vir lewering in Julie 2016

= R3 500/t

• Soybeans for delivery in May 2016/

Sojabone vir lewering in Mei 2016

= R4 900/t

• Sunflower or delivery in May 2016/

Sonneblom vir lewering Mei 2016

= R4 900/t

• Groundnuts for delivery/

Grondbone vir lewering

= R11 000/t (choice/

keur

)/R7 500/t (diverse/

divers

)/R4 500/t (press/

pers

)

6 000

4 500

3 000

1 500

0

3,5 t/ha

1,8 t/ha

4,5 t/ha

1,8 t/ha

3,0 t/ha

4,5 t/ha

7,3 t/ha

1,5 t/ha