DIE SAADBEDRYF

Saad maak ongeveer 12% van ‘n mielieprodusent se

veranderlike produksiekosterekening uit. Graan SA moniteer

saadpryse om deursigtigheid en mededingendheid te

verhoog. Daar word ook deurlopend met rolspelers gesprekke

gevoer oor produsente se behoeftes en bekommernisse.

SAADPRYSE

Die pryse vir die 2015/2016-produksieseisoen is in Mei 2015

bekendgestel. Gemiddelde prysstygings vir mieliesaad

was 5,6%, vir sonneblomsaad was dit 6,6%, graansorghum-

saadpryse het met 10,2% en sojaboonsaadpryse met 5,6%

gestyg. Die Produsenteprysindeksstyging (PPI) vir Mei 2015

was gemiddeld 3,6%.

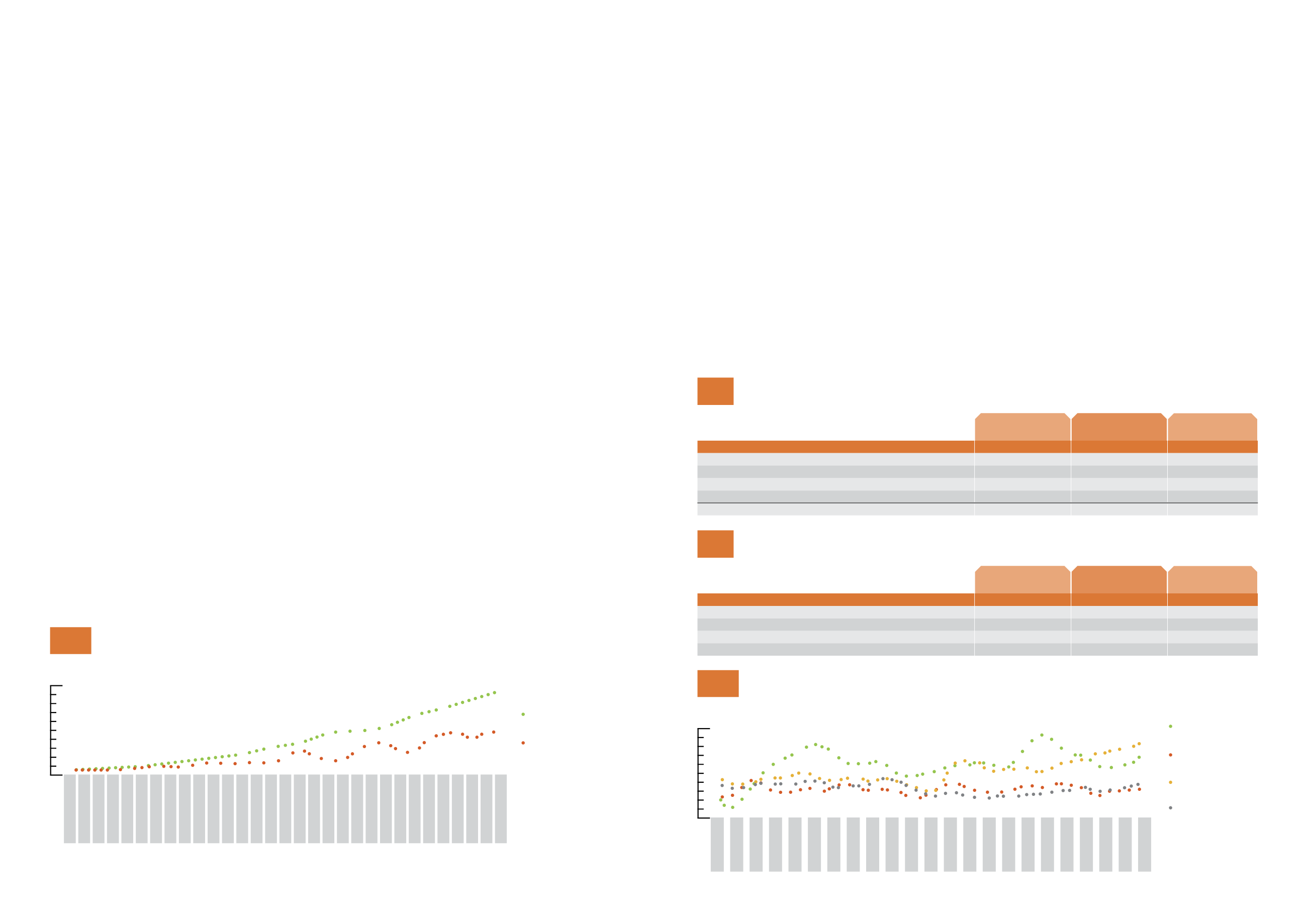

Sedert die 2001/2002-produksieseisoen het die mielieprysin-

deks (

Grafiek 1

) beduidend verswak teenoor die mieliesaad-

prysindeks. Met die voortgesette styging in mieliesaadpryse

en ‘n geraamde gemiddelde produsenteprys

1

van

R2 169 per ton vir die 2015/2016, verswak dit steeds.

SAADMARK

Volgens die NOK is 2 652 850 hektaar mielies in die

2014/2015-produksieseisoen geplant. Dit is 1,3% minder

as in die 2013/2014-seisoen. Indien produsente in 2014/

2015 dieselfde hoe-veelheid saad per hektaar geplant

het, word geraam dat die totale waarde van saad van

R2,742 miljard tot R2,855 miljard, toegeneem het. Volgens

SANSOR was die waarde van die totale saadmark in die

graan- en oliesadebedryf nagenoeg R3,927 miljard vir

die 2014/2015-produksieseisoen.

SAADGEHALTE

Verskeie probleme met saadkwaliteit is aangemeld.

Graan SA-lede is met dispute bygestaan.

TERUGHOUDING VAN SAAD EN KONSEP-TANTIeMEMODEL

Volgens saadmaatskappye word terughousaad jaarliks

vir ongeveer 80% van soja-aanplantings en 70% van

koringaanplantings gebruik.

1

Average producer price = Safex, July 2016 price - average differential cost - handling costs

1

Gemiddelde produsenteprys = Safex, Julie 2016-prys - gemiddelde differensiaalkoste - hanteringskoste

THE SEED INDUSTRY

Seed constitutes about 12% of a maize producer’s

variable production costs. Grain SA monitors seed

prices to increase transparency and competitiveness.

Consultations with role-players on the needs and

concerns of producers are also ongoing.

SEED PRICES

The prices for the 2015/2016 production season were

released in May 2015. Maize seed prices for the 2014/2015

production season rose by 5,6% on average, sunflower

seed prices by 6,6%, grain sorghum seed prices by 10,2%

and soybean seed prices by 5,6%. The average producer

price index (PPI) increase for May 2015 was 3,6%.

Since the 2001/2002 production season the maize price index

(

Graph 1

) weakened significantly compared to the maize

seed price index. With the continued increase in maize seed

prices and with an estimated average producer price

1

of

R2 169 per ton for 2015/2016, the index continues to weaken.

SEED MARKET

According to the CEC, 2 652 850 hectares of maize

were planted in the 2014/2015 production season.

This was 1,3% less than in the 2013/2014 season. Had

producers planted the same quantity of seed per

hectare in 2014/2015, the total value of seed would

have increased from R2,742 billion to R2,855 billion.

According to SANSOR, the value of the total seed

market in the grain and oilseed industry was roughly

R3,927 billion for the 2014/2015 production season.

SEED QUALITY

Several problems with seed quality were reported.

Grain SA assisted its members in disputes.

Farm saved SEED AND DRAFT ROYALTIES MODEL

According to seed companies, roughly 80% of soy

plantings and 70% of wheat plantings are annually

done with farm saved seed.

Graan SA, die saadbedryf (SANSOR), Agbiz Grain, DLBV

en die onderskeie forums het ‘n komitee in die lewe geroep

om na verskillende modelle te kyk om saadmaatskappye te

vergoed vir die negatiewe impak van terughousaad.

Daar is ook gekyk na modelle wat in ander lande gebruik

word om kultivarontwikkeling te finansier, byvoorbeeld

met navorsingsheffings. Daar is besluit om ‘n “eindpunt

tantiemesisteem” te gebruik en die verteenwoordigende

bedryfskomitee maak goeie vordering.

BESKIKBAARHEID VAN SAAD

SANSOR het Graan SA verseker dat voldoende hoeveel-

hede saad vir die 2015/2016-produksieseisoen beskikbaar

sal wees. Saad van sekere gewilde groottes en variëteite

kan dalk beperk wees.

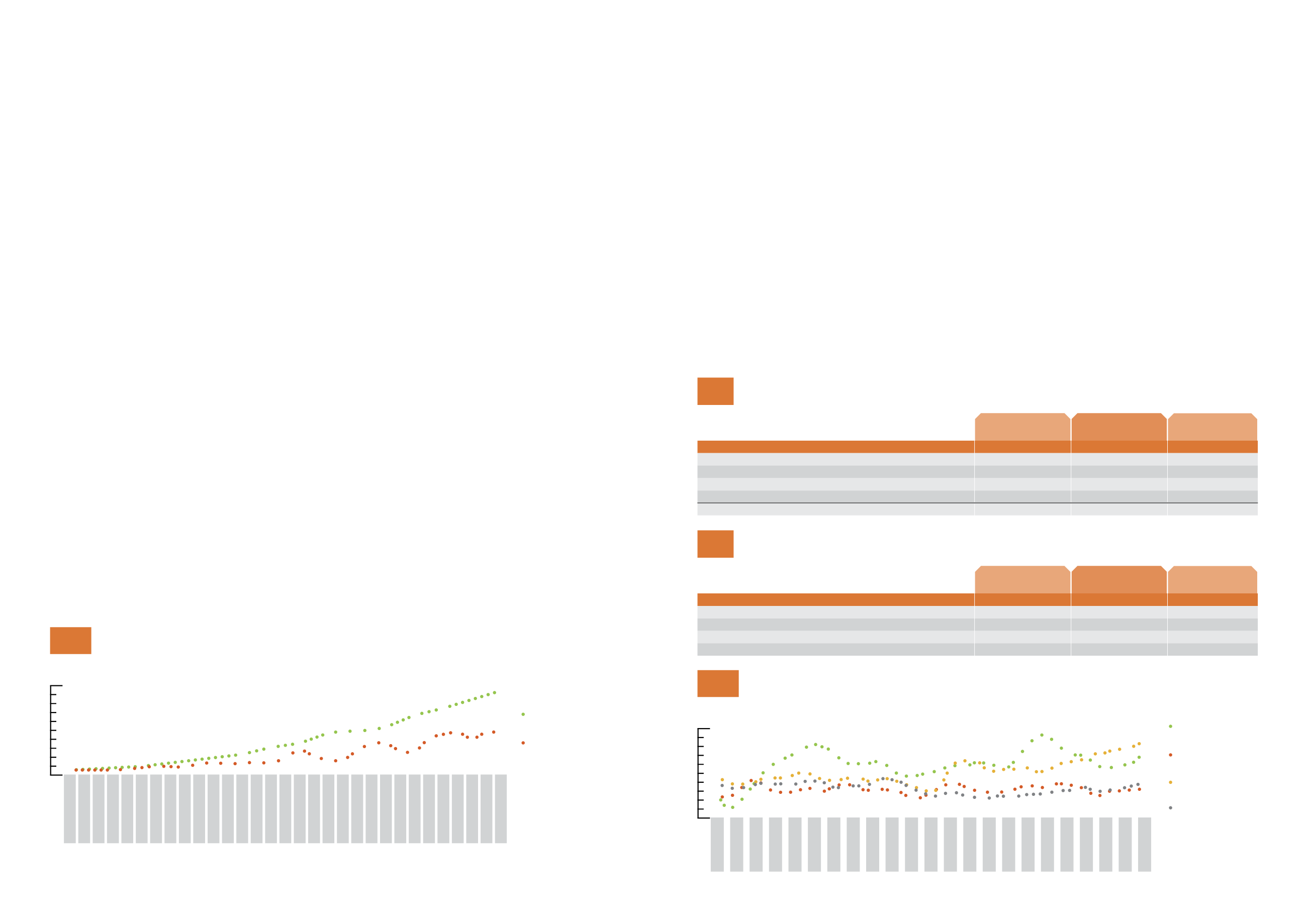

DIE KUNSMISBEDRYF

Suid-Afrika is ‘n netto invoerder van kunsmis. Al die kalium,

asook 60% - 70% van die stikstofbenodighede, word ingevoer.

Suid-Afrika het ook al meer fosfate begin invoer weens

probleme met voorsiening by Foskor. Plaaslike pryse word

International fertiliser prices ($/ton)

Internasionale kunsmispryse ($/ton)

1

Fertiliser

Kunsmis

September 2014 September 2015

% change

% verandering

$/ton

$/ton

Ammonia/

Ammoniak

554

410

-26

Urea/

Ureum

350

258

-26

DAP

436

459

+5

MOP (Potash/

Kalium

)

300

288

-4

Rand/dollar

10,99

13,67

+24

Table

Tabel

International fertiliser prices (R/ton)

Internasionale kunsmispryse (R/ton)

2

Fertiliser

Kunsmis

September 2014 September 2015

% change

% verandering

R/ton

R/ton

Ammonia/

Ammoniak

6 093

5 605

-8

Urea/

Ureum

3 848

3 527

-8

DAP

4 792

6 275

+31

MOP (Potash/

Kalium

)

3 303

3 937

+19

Table

Tabel

Grain SA, the seed industry (SANSOR), Agbiz Grain, the DAFF

and the various forums established a committee to look at

different models for compensating seed companies for the

negative impact of farm saved seed.

They also looked at models used in other countries to

fund cultivar development, for instance with research

levies. It was decided to use an end-point royalty system,

and the representative industry committee is making

good progress.

SEED AVAILABILITY

SANSOR assured Grain SA that a sufficient quantity of

seeds will be available for the 2015/2016 production

season. However, seed of certain popular sizes and

varieties may be limited.

THE FERTILISER INDUSTRY

South Africa is a net importer of fertilisers. All our potassium,

as well as 60% - 70% of our nitrogen requirements, is imported.

South Africa has also started to import increasing quantities

of phosphates because of supply problems at Foskor. Local

Industry Services division

Afdeling bedryfsdienste

Input research and development

Insetnavorsing en -ontwikkeling

28

29

Indices of the price of maize seed and the production price of maize

Indekse van die prys van mieliesaad en die produsenteprys van mielies

1

1985/1986

1986/1987

1987/1988

1988/1989

1989/1990

1990/1991

1991/1992

1992/1993

1993/1994

1994/1995

1995/1996

1996/1997

1997/1998

1998/1999

1999/2000

2000/2001

2001/2002

2002/2003

2003/2004

2004/2005

2005/2006

2006/2007

2007/2008

2008/2009

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014

2014/2015*

2015/2016*

Indices/

Indekse

: 1985/1986 = 100

* Preliminary/

Voorlopig

Maize seed index

Mieliesaadindeks

Maize price index

Mielieprysindeks

Graph

Grafiek

Index/

Indeks

2 000

1 800

1 600

1 400

1 200

1 000

800

600

400

200

0

International fertiliser prices in rand terms

Internasionale kunsmispryse in randterme

2

01/2012

03/2012

05/2012

07/2012

09/2012

11/2012

01/2013

03/2013

05/2013

07/2013

09/2013

11/2013

01/2014

03/2014

05/2014

07/2014

09/2014

11/2014

01/2015

03/2015

05/2015

07/2015

09/2015

Source/

Bron

: FMB Ltd/

FMB Beperk

Ammonia

Ammoniak

DAP

Urea

Ureum

MOP

(Potash/

Kalium

)

Graph

Grafiek

R/t

7 000

6 500

6 000

5 500

5 000

4 500

4 000

3 500

3 000

2 500

2 000