11

10

Corporate social responsibility report

Sosiale maatskaplike

verantwoordelikheidsverslag

G

rain SA’s strategic goals are not only aimed

towards establishing profitable and sustainable

grain production for commercial and developing

producers, but also towards the fulfilment of our social

responsibility.

The organisation’s production and income cost figures, as well

as market information, are used by numerous role-players in

the grain value chain to make informed decisions in their own

businesses, whether it is to increase their investments in the

grain industry or to give support to producers.

These role-players include:

●

Researchers and research institutions

It is pivotal for researchers to include economic analyses

in their studies. Grain SA is thus frequently contacted by

different researchers and research institutions, specifically

universities, for grain data.

●

Input suppliers

Various input suppliers, such as seed, fertiliser or

agrochemical companies utilise Grain SA’s income and

cost analyses to compare the profitability of the different

grains and oilseeds crops produced in South Africa.

●

Financial institutions

Financial institutions use Grain SA’s market information on

an annual basis, in the process of considering agricultural

financing to producers.

●

Department of Agriculture, Forestry and Fisheries (DAFF)

It has been noted that numerous personnel of the DAFF

in the different provinces do not compile their own

production costs for grain. The personnel thus make use

of Grain SA’s figures.

●

Agribusinesses

Grain SA works in partnership with different agribusinesses

when the actual production cost figures are gathered.

●

Insurance companies and grain traders

Insurance companies and grain traders use our figures to

manage risks, while Grain SA and organised agriculture also

need production cost figures at various occasions to liaise

with policymakers.

In order for the free market in South Africa to operate efficiently

and for producers to make well-informed farming decisions,

unbiased information with a high level of integrity is essential.

Therefore Grain SA also distributes international and local grain

market information on a regular basis.

Processed sources for supply and demand information about

grain may be readily available in the world market, but similar

information about the African and South African market

is incomplete. There is no other formal source available

of market assimilated information than that supplied by

G

raan SA se strategiese doelwitte is nie net daarop gemik

om winsgewende en volhoubare graanproduksie vir

kommersiële en ontwikkelende produsente te bewerk-

stellig nie, maar ook op die vervulling van ons maatskaplike

verantwoordelikheid.

Die organisasie se produksie- en inkomstekostesyfers en mark-

inligting word deur verskeie rolspelers in die graanwaardeketting

gebruik om ingeligte besluite in hul eie besighede te neem, hetsy

dit is om hul belegging in die graanbedryf te verhoog of om

ondersteuning aan produsente te verleen.

Hierdie rolspelers sluit in:

●

Navorsers en navorsingsinstansies

Dit is noodsaaklik vir navorsers om ekonomiese ontledings

in hul navorsingstudies in te sluit. Graan SA word dus dikwels

deur verskillende navorsers en navorsingsinstansies, spesifiek

universiteite, vir ons graandata gekontak.

●

Insetverskaffers

Verskeie insetverskaffers, soos saad-, kunsmis- of landbouche-

miese maatskappye maak van Graan SA se inkomste- en

koste-ontledings gebruik om die winsgewendheid van

verskillende grane en oliesadegewasse wat in Suid-Afrika

geproduseer word, te vergelyk.

●

Finansiële instellings

Finansiële instellings maak op ‘n jaarlikse basis van

Graan SA se markinligting gebruik wanneer die toestaan

van landboufinansiering aan produsente oorweeg word.

●

Departement van Landbou, Bosbou en Visserye (DLBV)

Daar word kennis geneem dat talle personeellede van die

DLBV in verskillende provinsies nie hul eie produksiekoste vir

graan saamstel nie. Die personeel maak dus van Graan SA se

data gebruik.

●

Agri-besighede

Graan SA werk in vennootskap saam met verskillende

agri-besighede wanneer die werklike produksiekostesyfers

versamel word.

●

Versekeringsmaatskappye en graanhandelaars

Versekeringsmaatskappye en graanhandelaars maak van

ons syfers gebruik om risiko’s te bestuur, terwyl Graan SA en

georganiseerde landbou op verskeie geleenthede ook pro-

duksiekostesyfers benodig om met beleidmakers te skakel.

Objektiewe inligting is noodsaaklik vir die effektiewe funksione-

ring van die vrye mark in Suid-Afrika en vir produsente om

goed ingeligte besigheidsbesluite te neem. Daarom versprei

Graan SA ook internasionale en plaaslike graanmarkinligting

op ‘n gereelde basis.

Verwerkte bronne van vraag en aanbod-inligting vir graan

is geredelik beskikbaar in die wêreldmark, maar soortgelyke

verwerkte inligting vir die Afrika- en die Suid-Afrikaanse mark

is onvolledig. Daar is geen ander formele bron van verwerkte

inligting anders as dit wat deur Graan SA voorsien word nie. Dit

behels die insameling, volgehoue navorsing en vertolking van

inligting vir die plaaslike bedryf.

Die markinligting wat gratis deur Graan SA beskikbaar gestel

word, word deur plaaslike en internasionale maatskappye en

organisasies erken.

Die volgende rolspelers het tydens 2013/2014 voordeel daaruit

getrek en van Graan SA se markinligting gebruik gemaak:

●

Finansiële instellings.

●

Openbare belanghebbendes.

●

Handel- en graanlogistieke verwante belanghebbendes.

●

Produksie- en insetverwante belanghebbendes.

●

Media.

●

Verbruikers van graan.

●

Produsente.

●

Konsultante.

●

Internasionale belanghebbendes.

●

Politici en politieke analiste.

●

Voedselsekerheidsverwante belanghebbendes.

Grain SA. This entails the collection, continual research and

interpretation of information for the local industry.

The public and free availability of market information supplied

by Grain SA are recognised by local and international

companies and organisations.

The following role-players benefited in 2013/2014 and utilised

Grain SA’s marketing information:

●

Financial institutions.

●

Public stakeholders.

●

Trade and grain logistics related stakeholders.

●

Production and input related stakeholders.

●

Media.

●

Consumers of grain.

●

Producers.

●

Consultants.

●

International stakeholders.

●

Politicians and political analysts.

●

Food security related stakeholders.

MADEPOSSIBLEBY

THEMAIZETRUST

GRAIN MARKETING

Producers are encouraged

to consistently communicate

with Grain SA Industry

Service team on advice

about market conditions as

the season unfolds.

A

griculture is generally an uncertain/

risky business. Farmers face multiple

challenges, from inputs, weather

and crop yield, to harvesting and selling of

produce at fair prices. South Africa produces

a number of commodities, but this article will

focus on maize, specically the fundamental

factors behind maize price movements.

This topic has recently generated interest,

especially after maize prices reached

high levels between November 2013 and

February 2014.

There are a number of factors that inuence

maize price movements, but the fundamental

factors are domestic weather conditions, supply

and demand, exchange rate (that is, the value

of South African Rand to the US Dollar), and

ChicagoBoardofTrade (CBOT)prices.General-

ly, these factorsdrivemaizepricesonday today

basis. However, their impact is not always the

same.Amorepracticalexample is that;between

October and February annually, domestic maize

price movements are to a large extent generally

inuenced by domesticweather conditions.

Putting the aforementioned into context,

in the beginning of 2014 South African maize

prices were at their highest levels due to in-

creased buying appetite from countries such

as Mexico, Zimbabwe, Taiwan and Japan.

Additionally, there was an unexpected appetite

from Zimbabwe, which totalled South Africa’s

exports to Zimbabwe at around 240 000 tons.

It is important to note that, at that time cli-

matic weather conditions were expected to

be the main driver of maize prices, but were

outweighedbyunexpectedbuyingappetiteand

low old season stocks.

However, around May 2014, maize prices

softened to the lowest levels due to increased

harvest pressure. Additionally, 2014/15 mar-

keting year had a big crop, estimated at

14,3 million tons, which further pressured the

maize prices. Moreover, South Africa also

experienced soft demand from traditional ex-

port markets, hence pushing down the maize

prices. These factors are hoped to have briey

highlighted the dynamics of themaizemarkets.

Looking forward to 2015, the Crop Esti-

mate Committee expects South Africa’s total

maize area plantings to slightly decrease by

3,3% year-on-year, to 2,6 million hectares.

Moreover, throughout November 2014, there

have been generally favourable climatic con-

ditions across the country. If these favour-

able climatic conditions persist, the country

might stand a good chance of receiving a good

crop. Nevertheless, it is important to note that

in Mpumalanga Province, the maize crop will

be behind schedule due to delayed plantings

which were caused by dry weather condition

around October 2014. Assuming that condi-

tions remain favourable, South African maize

prices are expected to remain at soft levels,

with additional pressure coming from soft

prices in the CBOT at the back record United

States crop.

Hereafter, producers are encouraged to

consistently communicatewithGrainSA Indus-

tryService team on advice aboutmarket condi-

tions as the season unfolds. Grain SA Industry

service also sends out SMS’s to the producers

showing daily grain and oilseed price move-

ments, as well as the morning and afternoon

market commentary.

Article submittedbyWandileSihlobo,

GrainSAEconomist.Formore information,

sendanemail

.

A brief overview

on local maize prices

8

Pula Imvula_Februarie_English2015.indd 8

2015/01/22 03:51:49PM

2015/02/03

08:56 AM

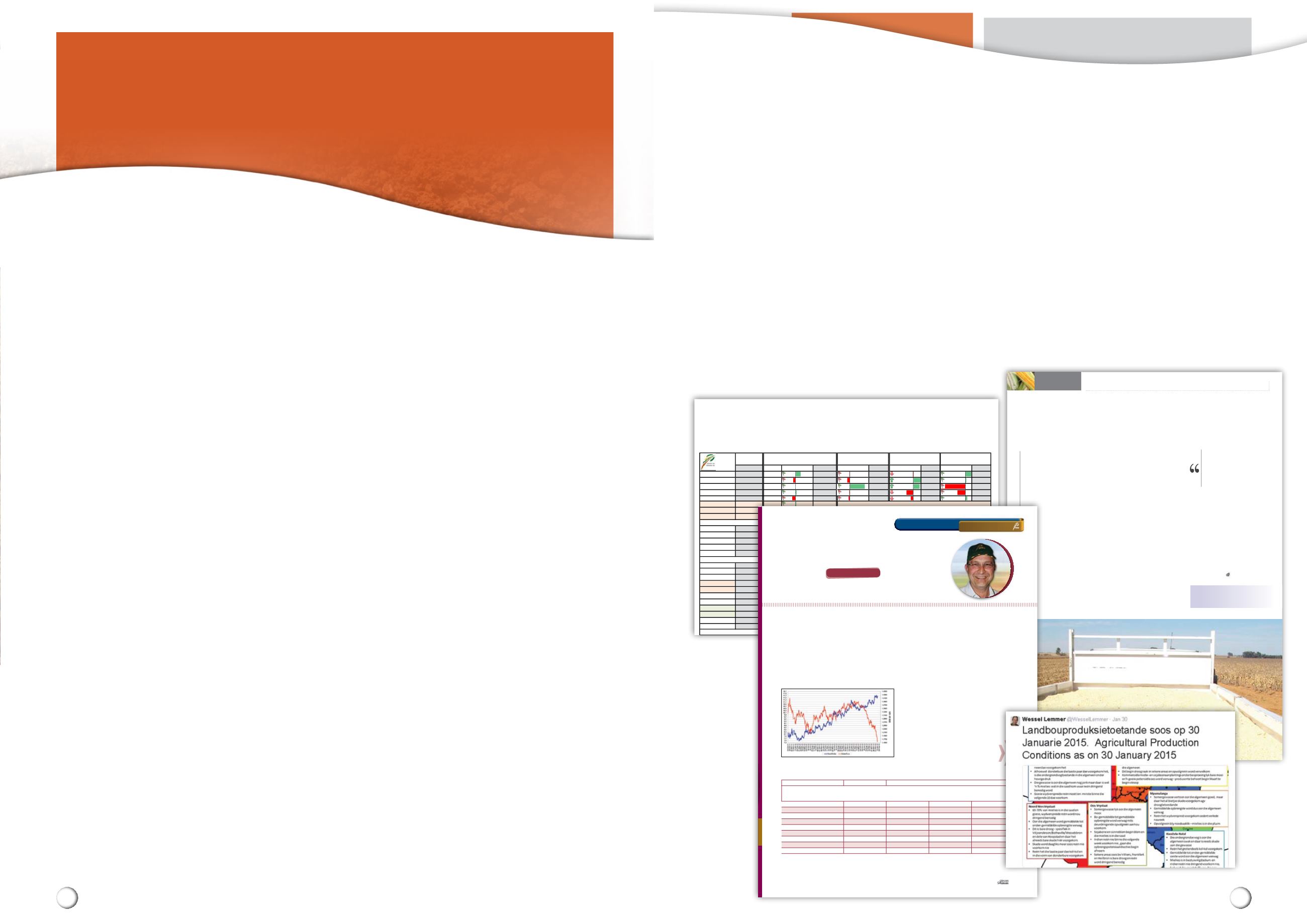

Grain SA's Morning Market Commentary

Wandile Sihlobo and Luzelle Botha

DATE

2015/02/03

Data

∆

∆%

Data

∆%

Data

∆%

Data

∆%

Data

DJIA-indeks

17361 196.09

1.1% 17165

0% 17387

0% 17372

12% 15445

Goud (Spot)

1274.55 -6.49

-0.5% 1281.04

-1% 1291.48

5% 1213.57

2% 1254.30

Brent$/vat

52.95

0.00

0.0% 52.95

8% 49.03

4% 50.77

-50% 106.11

1€:?US$

1.1328 0.002

0.2% 1.1305

0% 1.1356

-5% 1.1878

-16% 1.3506

1US$:?ZAR

11.53 -0.086

-0.7% 11.62

-1% 11.60

-2% 11.73

4% 11.14

∆CBOT

8vm :12nm*

R1686.85

2

0.1% R1684.58

∆CBOT

8vm :12nm*

R4086.46

-15

-0.4% R4100.97

∆CBOT

8vm :12nm*

R2103.09

-40

-1.9% R2143.35

CornMar15

371.50

3.25

0.9% 368.25

-3% 381.25

-8% 405.00

-21% 468.00

Corn Jul15

386.75

2.50

0.7% 384.25

-3% 397.00

-8% 420.25

-19% 476.75

SoybeanMar15

964.25

3.75

0.4% 960.50

-1% 973.75

-9% 1055.75

-14% 1119.50

SoybeanMay15

970.50

3.50

0.4% 967.00

-1% 981.25

-9% 1061.50

-13% 1120.75

WheatMar15

496.25 -5.75

-1.1% 502.00

-4% 519.00

-16%

591.75

-20%

621.25

SORGHUMMar15

2150

-70

-3.2% 2220

-7% 2300

-8% 2330

-39%

3500

WMAZFeb15

2180

83

4.0% 2097

10% 1982

3% 2113

-32%

3225

WMAZ Jul15

2176

80

3.8% 2096

9% 2005

2% 2127

-2%

2212

YMAZFeb15

2130

60

2.9% 2070

7% 1992

NA

-34%

3215

YMAZ Jul15

2122

64

3.1% 2058

6% 2009

-1% 2139

-4%

2213

SOY50Feb15

5575

-55

-1.0% 5630

0% 5555

-2% 5699

NA

SOYMay15

4835

-15

-0.3% 4850

0% 4815

-3% 5010

-19%

5990

SUNFeb15

5000

-80

-1.6% 5080

3% 4870

-1% 5075

-17%

6050

SUNMay15

4830

-29

-0.6% 4859

3% 4680

1% 4780

-6%

5145

WHEATFeb15

3908

-14

-0.4% 3922

0% 3904

-3% 4036

3%

3795

WHEATMar15

3950

-18

-0.5% 3968

0% 3950

-3% 4080

3%

3825

*CBOTSoyaMar sent/skepel08:00vandagvsCBOTSoyaMar12:00dievorigedag

*CBOTWheatMar sent/skepel08:00vandagvsCBOTWheatMar12:00dievorigedag

JongsteCBOTpryse tydensoornagverhandeling (Aangeteken tussen06:00 -07:00vm teenoor

12:00vmdievorigeverhandelingsdag

)

JongsteMTM-pryse (Aangeteken tussen07:00vm -08:00vmopdie jongste tweedatums)

SPOT=naastekontrakmaand

Letasbdievolgende:

DATE

2015/02/02

+ -WEEKAGO

2015/01/27

LATESTMARKET INFORMATIONTO23:00 (RSATIME)ASOBTAINED FROMVARIOUSMARKETREPORTS

+ -MONTHAGO

2015/01/06

+ -YEARAGO

2014/02/04

*CBOTCornMar sent/skepel08:00vandagvsCBOTCornMar12:00dievorigedag

ExternalMarket Factors:

TheRand strengthened by0.6%against theUSdollar from the levels seen atmidday yesterday,which is not supportive of

domestic commodity prices. International commodity prices arebullish this morning, with theexception ofUSWheat March15 contractmonth price.

Therefore, the price levels of the CBOT since12h00pm yesterday indicate apotential increaseofR5on themaize export parity prices, apotential

decrease ofR9on soybean import parity prices, and apotential decreaseofR37onwheat import parity prices.

Wheat:

USwheat prices aremainly pressured by favourable climatic conditions in theUnited States.There are reports of fading concernsover dryness

seenas threatening prospects forwinter wheat seedlings inparts of theUSPlains; showers this past weekend improved moisture forwheat. Kansasand

Nebraska,whichare keyUSwheat producers arealso reported tobeexperiencing favourable climatic conditions, after receiving rains ofabout1.25

inches and snowofup to8 inches over theweekend.

In the Black Sea,Russia showed strongwheat exports (1.5million tons) in January, in the runup to thewheat export tariff ofat leastE35 (Euros)a tonne

whichwent live on Sunday.Russia is the leading SouthAfrica’s wheat supplier, currently (2014/15), South Africa’s wheat imports from Russiaamounts

to246478 tons,which isabout 40%of the total imports. SouthAfrica’s 2014/15wheat imports are expected to reach1.7million tons.

Barley:

EU’s commission trimmed their 2015barley stocksestimates by310000 tons, to3.68million tons.While, their exports were upgraded by2

million tons from the lastestimate to8million tons.That rateofexports would still,however, bebehind last season's 8.77million tons.EU’s barley

shipments so far this season, areat5.09million tons, running260,000 tonshigher yearon year, the commission's estimate implies anexpectation ofa

slowdown inexports ahead.

Maize:

Yesterday,domestic maize prices received good support from dryweather conditions. Going forward, maize prices areexpected to remain

supportas recentweather forecasts continue to showno rain event this week.Weather forecasts canbe accessedat

and

.

Soybean

: International soybeanprices were slightly up,but there is still anegative sentiment in the soybean markets,owing to largeexpected supplies

fromBrazil. Moreover, recent reports talk of favourable climatic conditions in South America, whichmight further soften thesoybeanprices.Rainfall is

expected tobeabout average inArgentina this week,while average-to-above-average rains is expected inBrazil

Sources:

Agrimoney.com, wxmaps, RMD,Bloomberg, JSE,CME,Fin24, IGC,USDA.

Domestic Market Insights&Data:

International Market Insights&Data:

Foranyqueries

,please contact:Wandile Sihlobo, Email:

Dieverslag is vir inligtingsdoeleindesopgestelenalwordditasbetroubaarbeskoukanGraanSAniedieakkuraatheidofvolledigheiddaarvanwaarborgnie. Rig

navraeaanWessel

29

February 2015

OP PLAASVLAK

Die impak van weerstoestande op die

binnelandse mieliemark

d

ie weervooruitsigte vir Suid-Afrika, die omvang van

oordragvoorrade en verwagte diepsee mielie-uitvoer-

syfers skep onsekerheid oor die komende bemarkings-

jaar vanafMei 2015.

Hoe seker is die mieliehandel dat

voorra e voldoende gaan wees?

Inhierdieartikelworddrie scenario’sgeskepom ‘nbeterperspektief

opdie toekomstige vraag en aanbod-situasie virSuid-Afrika te kry.

Vraag en aanbod vir die

2014/2015-bemarkingsjaar (ou seisoen)

Die 2014/2015-bemarkingsjaar word deur ‘n nasionale gemiddelde

rekordopbrengs van 5,32 ton/ha gekenmerk.Produksie het 14,3mil-

joen ton beloop, terwyl die verwagte witmielie-uitvoersyfer van

600000 ton teleurgestelhet.

Die verwagte rekorduitvoersyfer van ,4 miljoen ton geelmielies

het egter daartoe bygedra dat die totale mielie-eindvoorraad wat

einde April 2015 oorgedra word na die 2015/2016-bemarkingsjaar,

beperkword tot 1 979 000 ton.

Die totale uitvoersyfer behoort 1 910 000 ton te beloop.Die surplus

bodiepyplyn kan 757 000 tonbeloop.Onderhierdiemarktoestande

neig pryse om nader aan uitvoerprysvlakke te verhandel. Met die

skryf van dié artikel as pryse ongeveer R600/ton bo uitvoerpari-

teit,wat indie verledeongewoon souwe s vir ‘n surplusproduksie-

jaar. Die voorraad mielies is dus nie noodwendig beskikbaar in die

markpleknie.

Vraag en aanbod vir die

2015/2

ngsjaar (nuwe seisoen)

Die nuwe bemarkingsjaar skop op 1 Mei af met ‘n groot oordrag-

voorraad van 1 979 000 ton. Tydens die skryf van hierdie artikel het

daaronsekerheidoorweervooruitsigtegeheers.

WESSEL LEMMER,

senior ekonoom:Bedryfsdienste,GraanSA

GRAANMARK

-oorsig

23 Januarie 2015

2014/2015

SCENARIO’SVIR 2015/2016SEMIDSOMER

‘NREKORDOPBRENGS

VAN 5,32TON/HAHET

DROËPRODUKSIE

TOESTANDE

4TON/HA

GEMIDDELDE

PRODUKSIETOE-

STANDE 4,7TON/HA

GUNSTIGEPRODUK-

SIETOESTANDE

5,4TON/HA

Beginvoorraad

589 000

1 979 000

1 979 000

1 979 000

12 137 000

13 959 000

Invoere

0

450 000

0

0

Aan d

000

12 213 000

13 585 000

15 407 000

Voedselverbruik

4 850 000

4 860 000

4 860 000

4 860 000

Voerverbruik

4 920 000

4 929 000

4 929 000

4 929 000

Uitvoere

2 110 000

705 000

2 065 000

2 395 000

Eindvoorraad

1 979 000

1 217 000

1 229 000

2 721 000

Surplusbodiepyplynvoorraad

757 000

-7 000

5 000

1 497 000

TABEL 1:DIEVRAAG ENAANBOD-BERAMINGVIRMIELIESVIRDIE 2014/2015-SEISOEN ENSCENARIO’SVIRDIE 2015/2016-BEMAR-

KINGSJAAR (MEI TOTAPRIL).

Produksie:VolgensdieNasionaleOesskattingskomitee vir 2014/2015 enopbrengsscenario’s.

Aanbod:Die som vandiebeginvoorraad,produksie, vroeë lewerings, terughoudings en saadproduksie.

Eindvoorraad:Anderongespesifiseerde verbruik isook in aanmerkinggeneem saammet voedsel en voerverbruik.

Surplusbodiepyplynvoorraad:Die termb ryfdie surpluswatoorblyna atdiepyplynvoorraad vandie eindvoorraa afgetrekis.Diepyplynvoorraad is voorraadwat

vir ‘nperiode van 1,5maandenodig i

by aannul is,beginpryseondersteuninggeniet.

Grafiek 1: ‘nVergelyking tussendie rand/dollar-wisselkoers endie

dollar/euro.