Market overview

Markets

Februarie 2014

54

The US Fed decided to reduce the size of its

asset purchasing programme of $85 billion

by $10 billion to $75 billion with effect from

January 2014.

Currently, the US economy have been gaining

strong momentum; with recent manufacturing

data coming out stronger than expected, hence

paving up a way for the US Fed to start with the

stimulus tapering (Nedbank Group Economic

Unit, 2014). There are still some expectations

that the rand will continue to trade at low levels,

due to concerns about further labour unrests,

widening current account and budget deficit as

well as the uncertainty of the outcome of the

upcoming elections.

On the other hand, the weak rand supports

domestic commodity prices (yellow maize,

white maize, soybean etc), thus sparking up

gains from the exporting commodities.

Domestic factors

Growing conditions in maize

producing areas

The eastern part of the country (Mpumalanga

and Eastern Free State) where yellow maize is

predominantly planted looks good in general,

with follow-up rains frequently occurring. In

small areas of Mpumalanga too much rain

occurred, leading to some waterlogging;

however the extent of the damage to the crops

is not so detrimental.

The western parts of the country, more

specifically the North West Province started

off with a very dry season and almost no

underground moisture. Thankfully rain

occurred during the beginning of December

making it possible for producers to plant,

although the subsurface moisture has still not

recovered. Seedlings are currently very small.

Some areas in the North West Province are

reported to be very dry, where follow-up rain

remains very critical.

In general, conditions look favourable in the

North Western Free State and Central Free

State although the Hertzogville/Hoopstad

area did not receive enough rain which led

to producers planting less than they had

anticipated. The western parts of the country

require and are dependent on follow-up rain.

Wheat

Producers in the Western Cape completed

their wheat harvest during the end of last year.

Producers in the Swartland region achieved

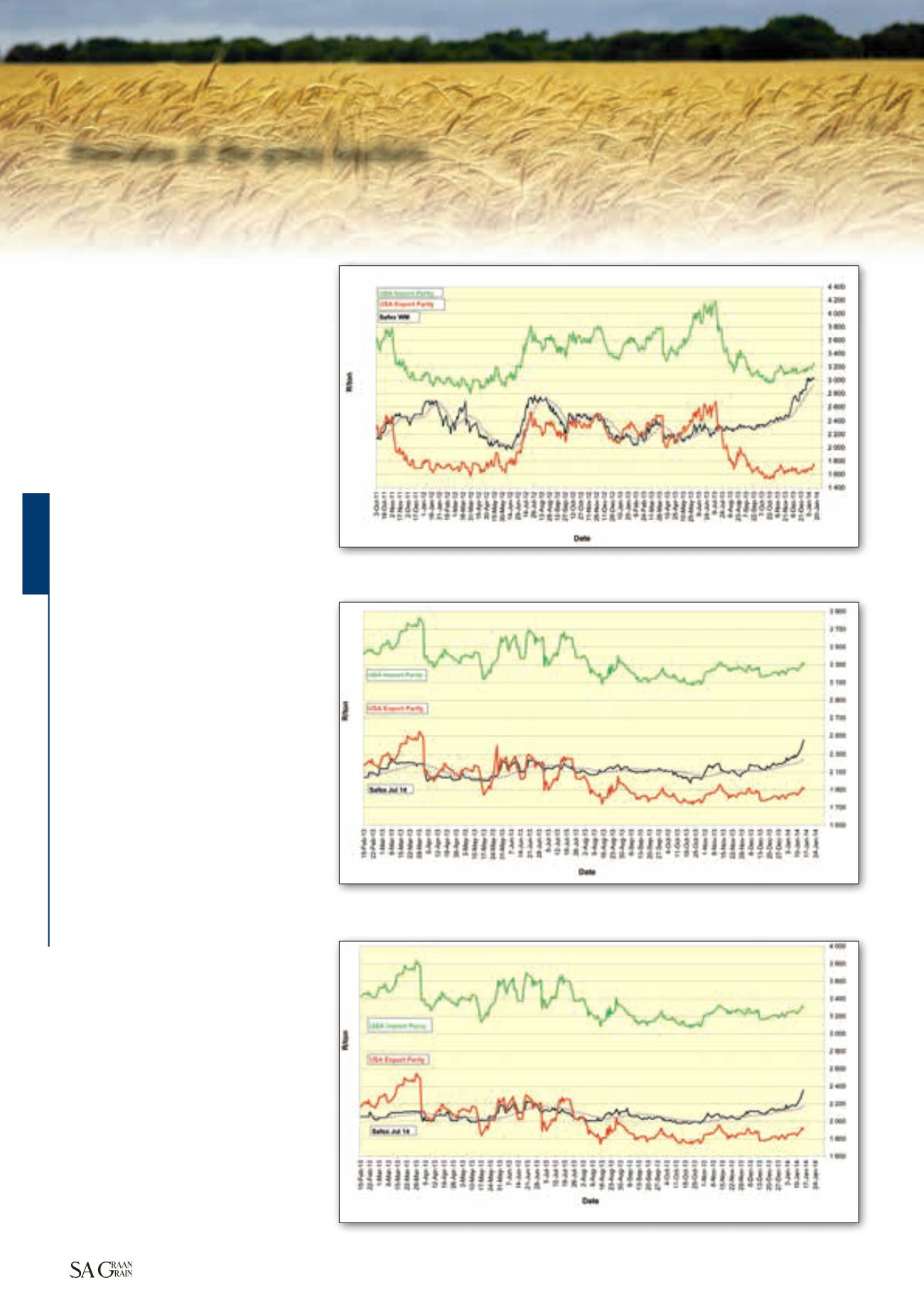

Graph 2: Prices of white maize delivered in Randfontein.

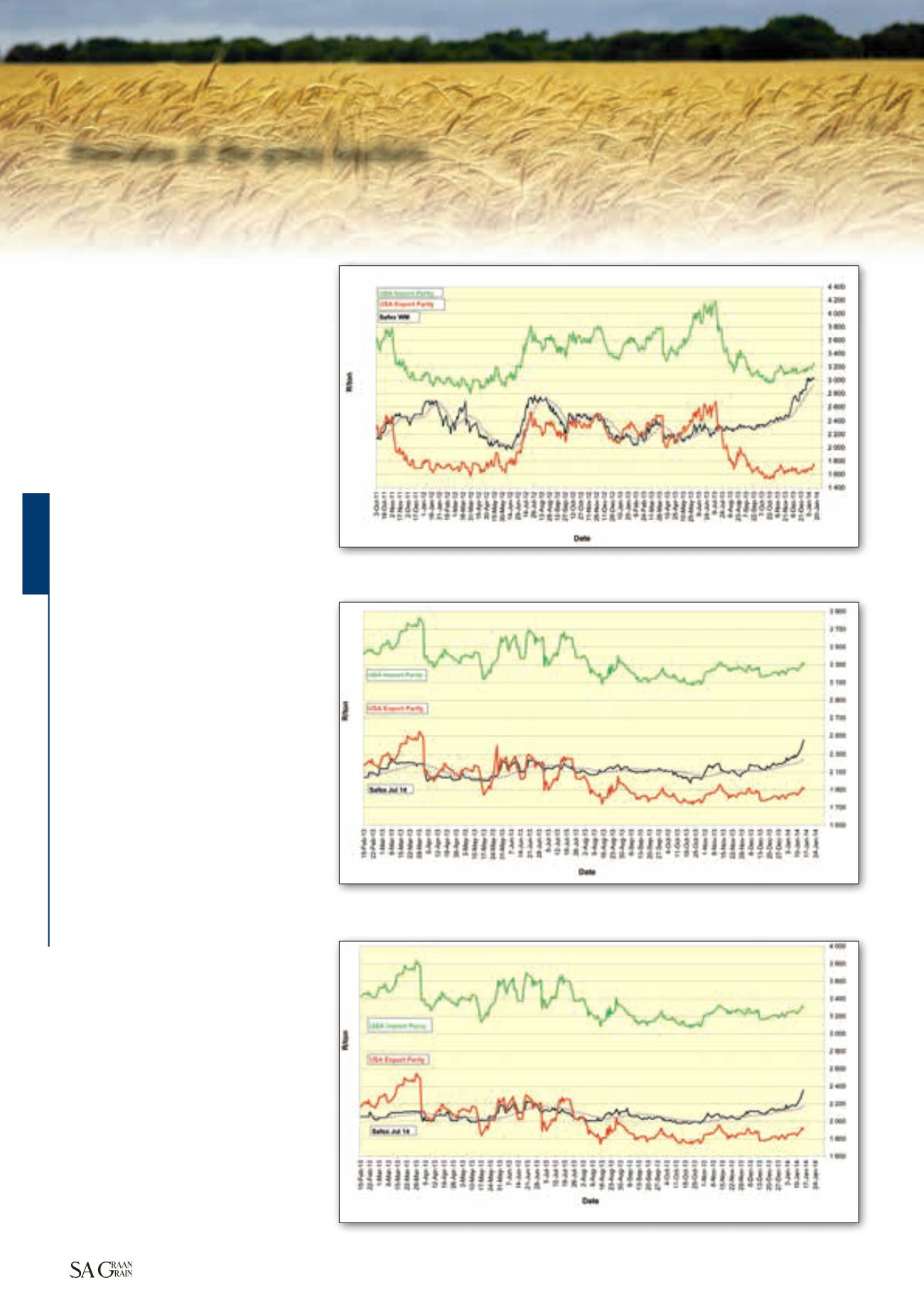

Graph 3: Prices for new season white maize delivered in Randfontein.

Graph 4: Prices of new season yellow maize delivered in Randfontein.

Overview of the grain markets

Continued from page 53