Market overview

Markets

Overview of the grain markets

WANDILE SIHLOBO, FUNZANI SUNDANI AND PETRU FOURIE, ECONOMISTS:

INDUSTRY SERVICES, GRAIN SA

Since 9 December 2013, there have been significant increases in the

domestic grain market. The main factors behind these movements have

been the exchange rate, old season stock levels in the USA, weather

conditions in South America as well as the demand from Asia and Africa.

International markets

Maize

On the international markets, much focus has been on the recent

US maize ending stocks for 2013/2014 that are projected at

406 400 000 tons, which is 40 894 tons lower than the previous estimate

(WASDE, 2014). There have been some major concerns about the

rejection of US maize by China, due to unapproved GMO variety

(International Grains Council [IGC], 2014).

In 2013, China rejected about 601 000 tons of US maize and maize

by-products. In South America, plantings in Argentina made limited

progress, with seeding finished on 4,4 million hectares (IGC, 2014).

Earlier rains in Argentina did help on the drought-affected crops; however

the return of dry, hot weather has raised some major concerns about the

yield prospects. In Brazil, after harsh, dry conditions in the early stages

of planting; recent rains were favourable for full season 2013/2014 maize

production.

Soybean

According to World Agricultural Supply and Demand Estimates (WASDE)

(2014) global soybean production for 2013/2014 is estimated at a record

of 286,8 million tons, up by 1,9 million tons; with major gains coming

from the US and Brazil. US 2013/2014 soybean production is estimated

to reach a record of 88,7 million tons (WASDE, 2014). At the same time,

Brazilian soybean production is estimated to increase by 1 million tons to

a record of 89 million tons; much of the increase is due to the increased

area that was planted.

Brazil starts harvesting in March and Argentina in April and it is expected

that price relief will be experienced from the end of February. In Argentina,

2013/2014 soybean production is estimated to be 57,5 million tons, which

is higher than last year’s production of 49,3 million tons (IGC, 2014).

On the other hand, there has also been consisted export demand in the

world market, with a large stake coming from China. China has recently

purchased about 350 00 tons of US soybeans.

Wheat

Analysis shows that global 2013/2014 wheat supplies have increased

by 1,5 million tons to 888,8 million tons. A large part of production is

expected from China and Russia. For 2013/2014 wheat production, China

is expected to increase by 1 million tons, at the same time in Russia,

wheat production is expected to increase by 300 000 tons. In the US, cold

weather temperatures have been a major concern for their winter wheat

production (IGC, 2014).

In South America, production is expected to decrease with 500 000 tons

in Argentina, due to an expected decrease in the harvested area. In the

European Union, 2013/2014 wheat production is expected to decrease by

200 000 tons, with slight downward revisions for the United Kingdom,

Finland and Denmark (WASDE, 2014).

Increasing demand is still observed from Egypt, Algeria, Japan and

Syria (IGC, 2014). The IGC (2014) further noted that favourable weather

conditions in India contributed to a 6% year-on-year increase in the area

planted, thus an expected increase in production. Some traders are of

the view that the government’s production

target of 92,5 million tons in India is going to

be exceeded.

Macroeconomic factors

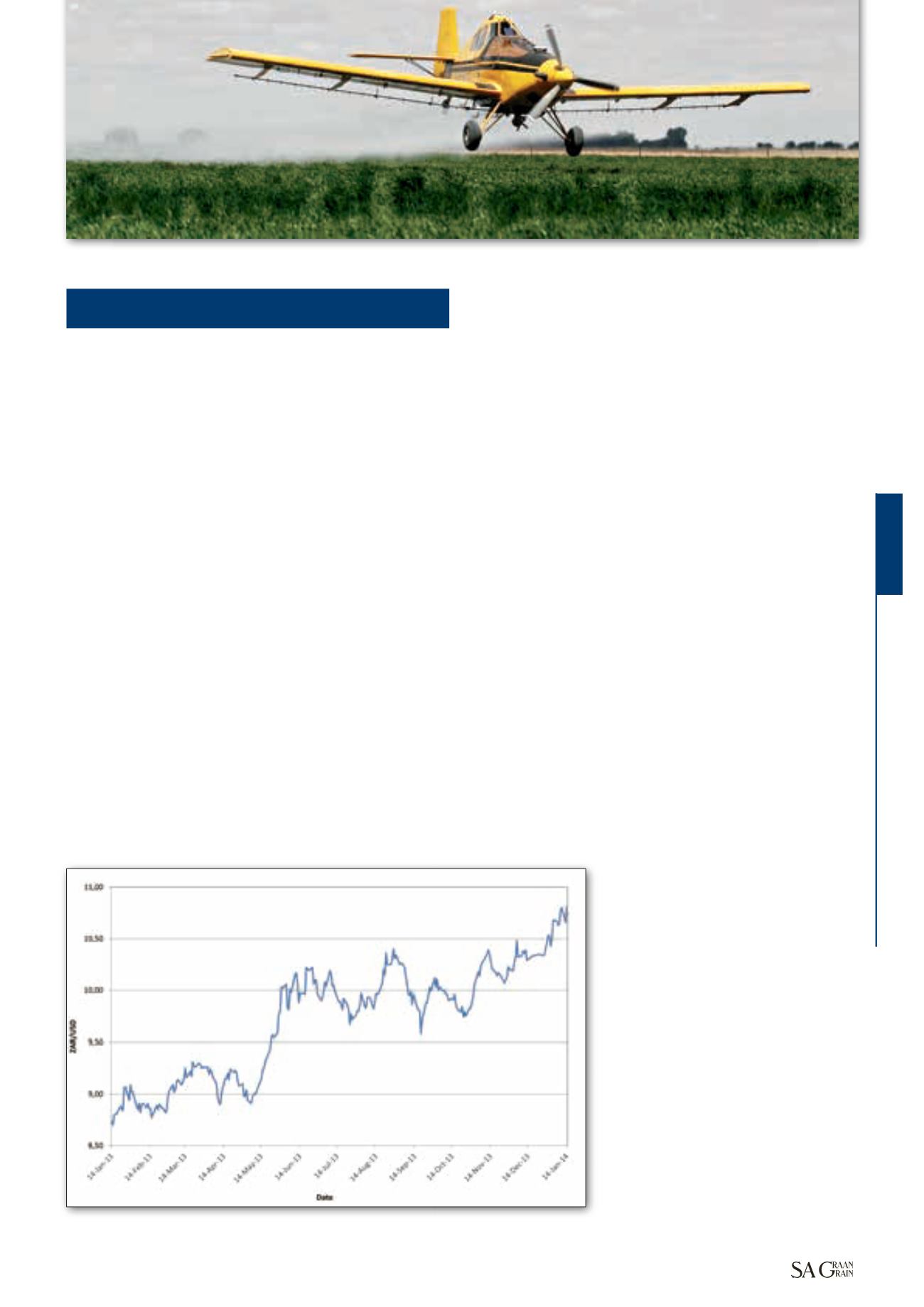

Exchange rate

During the past month, the rand has

significantly weakened against most major

currencies, reaching the high levels of R10,81

to the US dollar on 14 January 2014. From

14 January 2013 to 14 January 2014, the South

African rand has weakened by approximately

23%; from R8,73 to R10,81.

There are a number of domestic factors that

have contributed to the significant weakening

of the rand value, ranging from the widening

current account and budget deficit to global

economic conditions, but the most recent one

was the announcement by the United States

Federal Reserve bank (US Fed) of the start of

bond tapering this month (Nedbank Group

Economic Unit, 2014).

53

February 2014

Graph 1: Exchange rate.

Source: Grain SA (2013)

– 15 January 2014

SA Grain/

Sasol Nitro photo competition

Continued on page 54