Oktober 2016

58

Disclaimer

Everything has been done to ensure the accuracy of this information, however Grain SA takes no responsibility for

any losses or damage incurred due to the use of this information.

UPDATED:

25 AUGUST 2016

SAGIS:

25 AUGUST 2016

GRAIN SA ESTIMATES:

25 AUGUST 2016

GRAIN SA PROJECTIONS:

25 AUGUST 2016

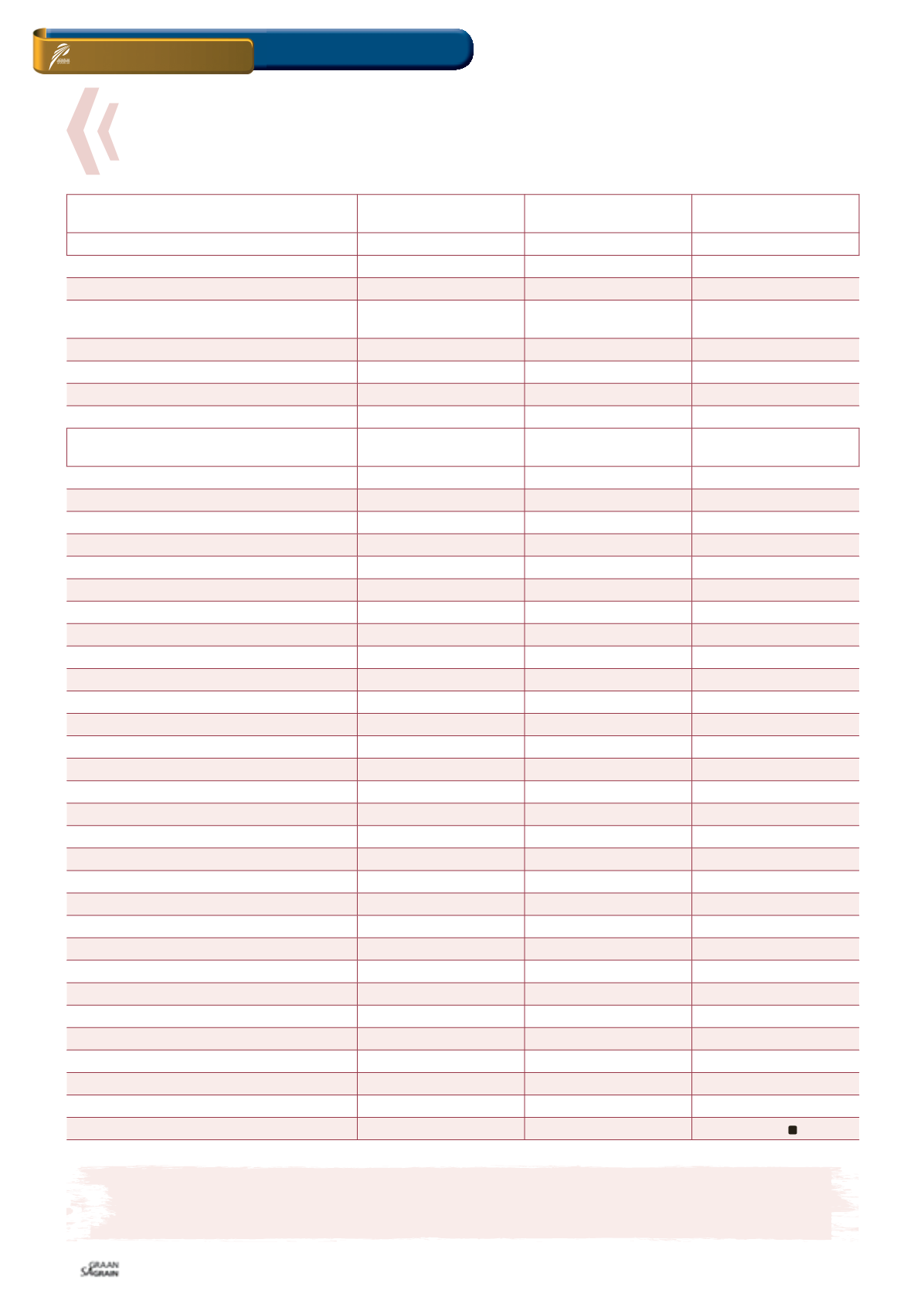

MARKETING YEAR

2014/2015

2015/2016

2016/2017

Area planted (x 1 000 ha)

477

482

498

Yield (t/ha)

3,67

3,02

3,38

Crop Estimates Committee (CEC) crop estimate

(‘000 ton)

1 750

1 457

1 683

Retentions and production of seed

0

35

35

Minus: Early deliveries 2015

13

13

13

Plus: Early deliveries 2016

13

13

13

Available for commercial deliveries

1 750

1 422

1 648

SAGIS

('000 TON)

GRAIN SA

('000 TON)

GRAIN SA

('000 TON)

Commercial supply

Opening stocks (1 October)

489

597

813

Commercial production

1 700

1 422

1 648

Surplus (adjustment of the reconciliation)

15

Imports

1 832

2 000

1 600

Total commercial supply

4 036

4 019

4 061

Commercial demand

Commercial consumption

Food

3 109

3 100

3 085

Feed

4

3

23

Total

3 113

3 103

3 108

Other consumption

Gristing

Withdrawn by producers

1

4

3

Released to end consumers

3

4

4

Seed for planting purposes

23

21

19

SAGIS

7

0

11

Total

34

29

38

Total South African consumption

3 147

3 132

3 146

Exports

Products

18

18,7

18,85

Whole wheat

274

56

215,95

Total

292

75

235

Total demand

3 439

3 206

3 381

Carry-out (30 September)

596,8

813

680

Pipeline requirements

681

679

676

Surplus above pipeline

-85

133

4

% imported of South African consumption

58,2%

63,9%

50,9%

Carry-out as a % of South African consumption

19%

26%

21,6%

Carry-out as a % of total commercial demand

17,4%

25,3%

20,1%

TABLE 2: SUPPLY AND DEMAND OF SOUTH AFRICAN WHEAT.

Source: Grain SA

ON FARM LEVEL

GRAIN MARKET OVERVIEW