Ons handhaaf ’n uitstaande rekord van prestasie

in die nasionale sojaboonproewe, jaar na jaar.

Ons veelsydige pakket bied die optimale kultivar

om jou winsgewendheid te verbeter.

Sojabone waarop jy kan staatmaak.

® Geregistreerde handelsmerke van PANNAR BPK, © 2016 PANNAR BPK

2016/SOY/A/15

www.pannar.com infoserve@pannar.co.zaSaam boer ons

vir die toekoms

™

VAN PLAAS TOT

HUIS: ’N BEWESE

SUKSESREKORD.

UITSONDERLIKEPRODUKTE

ENGEWASPAKKETTE

ULTRAMODERNE

NAVORSINGEN

ONTWIKKELINGSTEGNOLOGIE

GEWASVOORSORG

OPTIMALISEER

PRODUKSIE

GEWASBESKERMINGS-

BESTUURSPRAKTYKE

Grain SA/Sasol photo competition

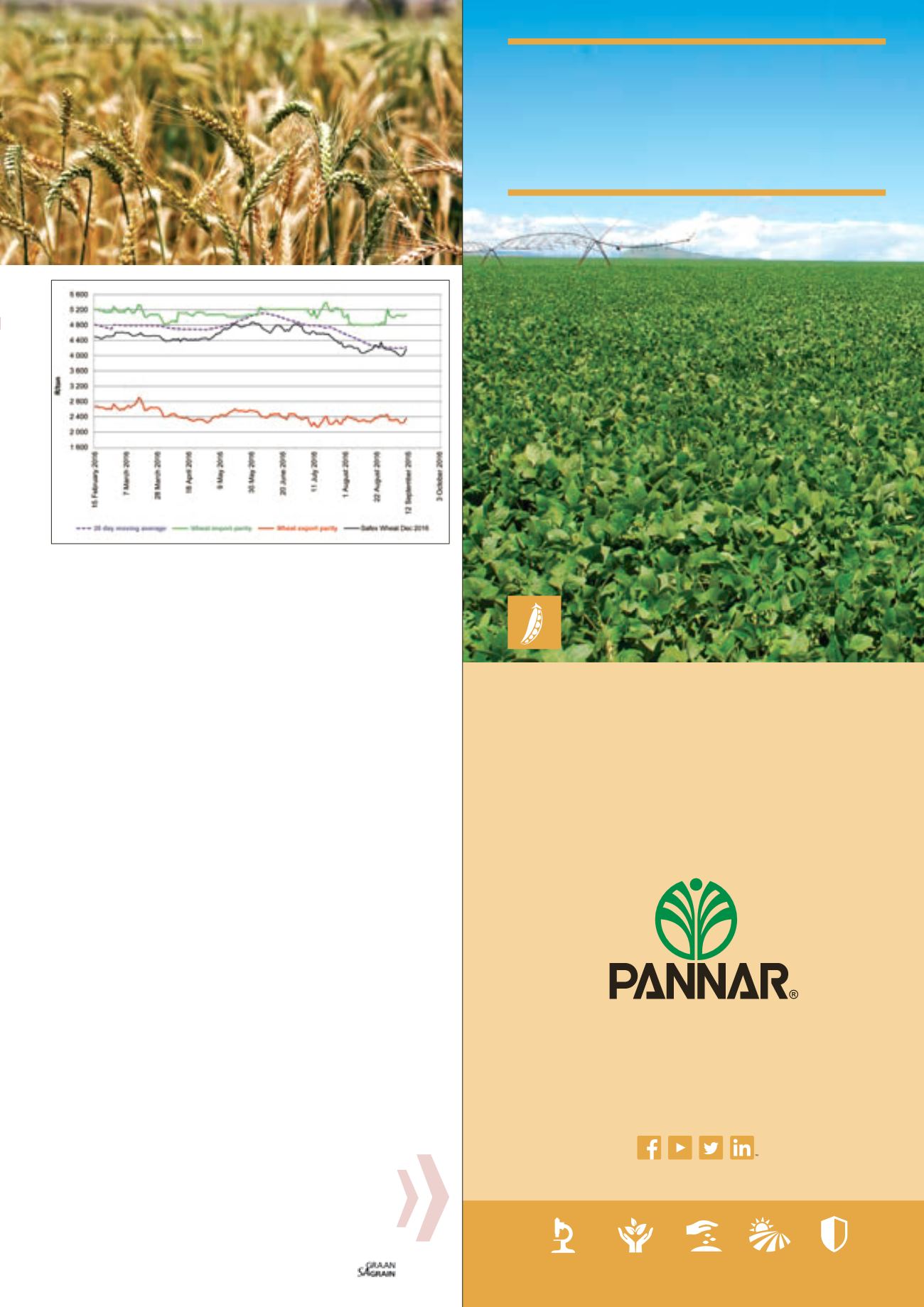

import parity levels (

Graph 2

). This is also mainly due to an oversup-

ply of wheat in the country.

For the 2015/2016 marketing year the local production is at

1,4 million tons, which means in order to satisfy a total demand of

3,2 million tons, total imports of 1,8 million tons are needed. The

current imports marketing season – specifically for South Africa – is

at 1,9 million tons as of the beginning of September. This is already

more than the previous season’s total imports.

Although it is close to the end of the marketing season, there is

still time left and it is expected at a current import rate of almost

40 000 tons per week that the marketing season will end at more

than 2 million tons (which is a historic high). This record high for

imports occurred irrespective of the high import tariffs. The bulk of

the imports occurred mainly in timeframes when the tariff was trig-

gered, but not yet published – more specifically after a 30 day period.

The delay in the tariff implementation resulted in additional imports

– which created the current oversupply.

It is expected that demand will decrease with almost 233 000 tons,

mainly due to lower exports (217 000 tons). This means that the

carry-over stock increased with 200 000 tons. The higher imports

and lower exports resulted in carry-over stock of 813 000 tons.

Given the new outlook and production condition in the wheat

producing areas and the larger carry-over stock, one would suspect

that the imports for the 2016/2017 season would decrease for the

new season.

The result of the oversupply is that local wheat is not sold on the

local market currently and that trading activities are relatively low.

This also has a direct impact on the producer’s ability to pay produc-

tion cost loans.

The current prices also put pressure on the margins of producers

and high yields are required in order to make a profit (

Table 2

). The

supply is enough to for at least three months, meaning that there

is enough stock for up to December. Therefore, in terms of market-

ing it would be advisable – if at all possible – to market the produce

as late as possible (and when stocks are limited).

Graph 2: Wheat import/export parity levels delivered at Randfontein.

57