“down under”?

– measuring and comparing the competitiveness of

the South African wheat industry with Australia

C

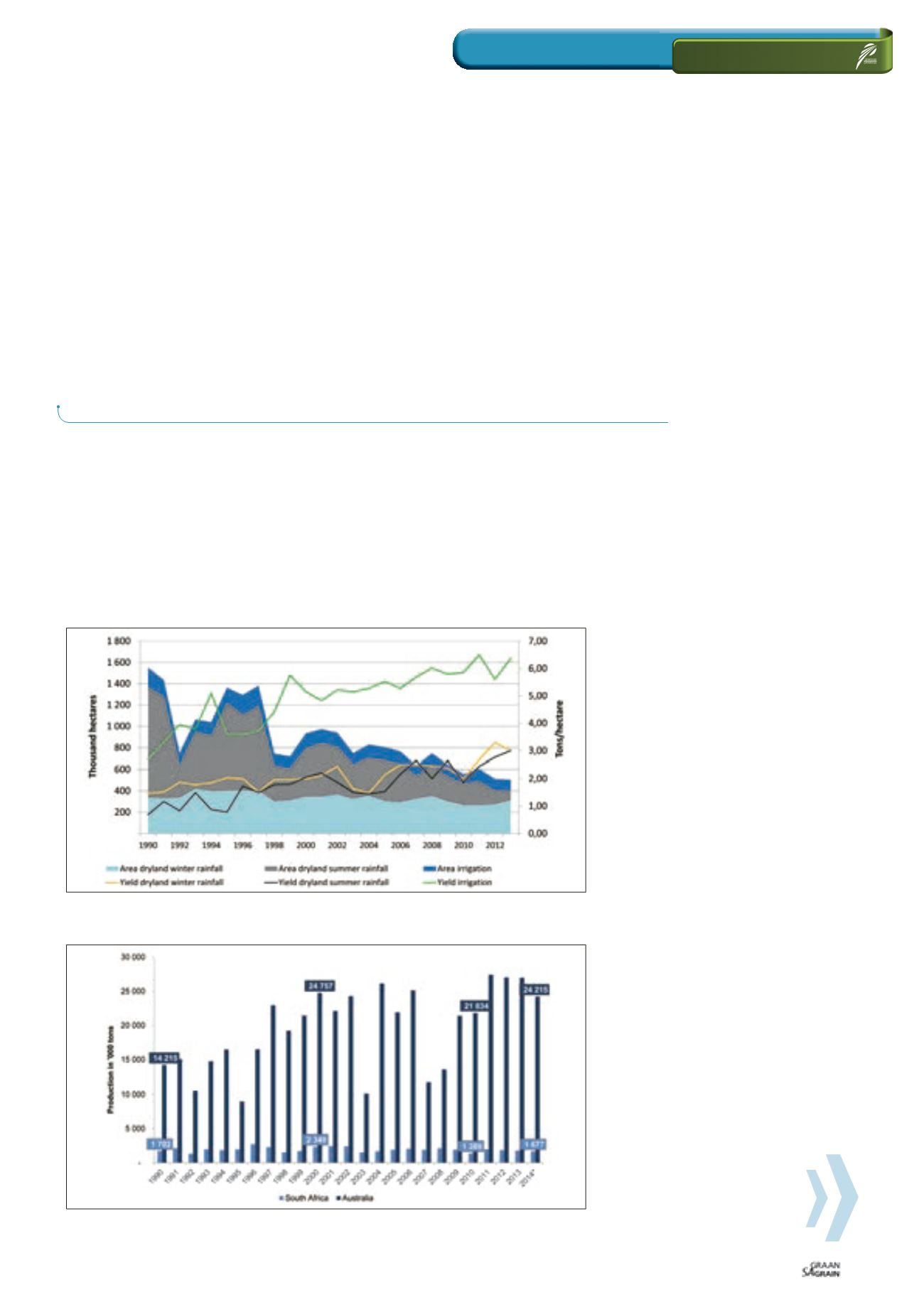

oncern has been shown about the persistent decline of

areas sown to wheat in South Africa. In 1982, South Africa

cultivated more than two million hectares of wheat and

have ever since declined to 482 000 hectares in 2014 with

the majority of the area lost in the summer rainfall region, or more

specifically, the Eastern Free State (

Graph 1

).

A number of drivers have influenced this reduction over the past

three decades where profitability, production risk and more

favourable alternative crops were the main contributors.

Technology in maize and more recently, soybean seed varieties

led to a steeper increase in yield levels which favour these

summer crops above wheat production. Currently, the question

is being asked whether climate change has influenced traditional

precipitation during key growth stages of wheat in the Eastern

Free State, forcing yield and yield growth trends downwards.

Furthermore, the adoption of conservation and rotational farm

practise in the Western and Southern Cape, led to a consolidation

of hectares between wheat, barley, canola and pasture crops.

Graph 1 illustrates the loss in area over

the past two decades and in particular, the

summer rainfall region. The graph further

illustrates the yield trend for dryland and

irrigated wheat.

In this article, a comparison is made be-

tween South African and Australian wheat

industries in order to measure and bench

mark the relative competitiveness of the

South African wheat industry with a large

global player such as Australia.

Industry overview: South

Africa and Australia

In the following graphs, comparisons are

made between South Africa and Australia

for total production, yield per hectare and

US$ value per ton for the period from 1990

to 2014. It is projected that Australia will

produce more than 24 million tons of wheat

in 2014 under approximately 13,83 million

hectares compared to 1,68 million tons

of wheat in South Africa under 482 000

hectares (

Graph 2

). Area under wheat

production has increased from 9 million

hectares in 1990 to 13,83 million in 2014.

Graph 3

illustrates the dryland wheat

yield trends from 1990 to 2014. As can be

observed from the graph, South African

(winter rainfall region) yield levels have

tracked those of Australia until 2000.

Towards 2014, wheat yields in South Africa

had outperformed the average obtained by

Australian producers. The average yield

obtained in Australia in 2013 was 2 tons

per hectare compared to South Africa’s

2,92 tons per hectare (winter rainfall region).

51

February 2015

RELEVANT

DIVAN VAN DER WESTHUIZEN

and

LINDSAY TRAPNELL,

The Bureau for Food and Agricultural Policy (BFAP);

Acknowledgement:

ASHLEY HERBERT,

Agrarian management, Perth

Graph 1: Areas of production for wheat and yields per hectare for dryland and irrigated regions of

South Africa.

Graph 2: Wheat production in South Africa and Australia (1990 to 2014).

Source: BFAP, 2014 and Australian Bureau of Census and Statistics, 2013