Februarie 2015

56

RELEVANT

The area of wheat grown in the same

year by 3,925 South African producers

averaged 154 hectares per producer

(DAFF, 2011). This shows that the Australian

producers grew almost three times the

number of hectares of wheat than the South

African producers.

On those hectares each Australian grower

produced on average 1,005 tons of wheat

which was twice or 100% greater than the

amount of 505 tons produced by each South

African producer. Australian producers

were more profitable because they were

able to spread their overhead costs over a

much larger number of units of output.

Conclusions

The analysis provided an illustration that

South African wheat producers are not that

bad off when compared to a major wheat

producing country such as Australia. In

some instances, South African producers

outperformed Australian producers with

specific reference to market prices, yield

levels and hence, profitability.

Thus, from the analysis one could ask

the question why the area has declined

substantially when local producers can

compete against major global players

such as Australia. This is due to a number

of reasons. The long-term reduction in

areas sown to wheat in South Africa was

due to reductions in plantings by dryland

producers in the summer rainfall region.

This is primarily due to a lower number of

hectares being sown to wheat over time

by producers in the Free State. Climatic

conditions and more favourable returns

in crops such as maize and soybeans

in the Free State mitigated strongly against

wheat production.

Graph 8

proves that the gross returns

(price multiplied by yield) for maize and

more recently soybeans have outpaced

wheat, making the former more favourable

crops to cultivate.

The comparison of the South African wheat

producer compared with the Australian

grower revealed that the latter continued to

grow wheat and actually increased the

area sown because they enjoyed large

economies of size.

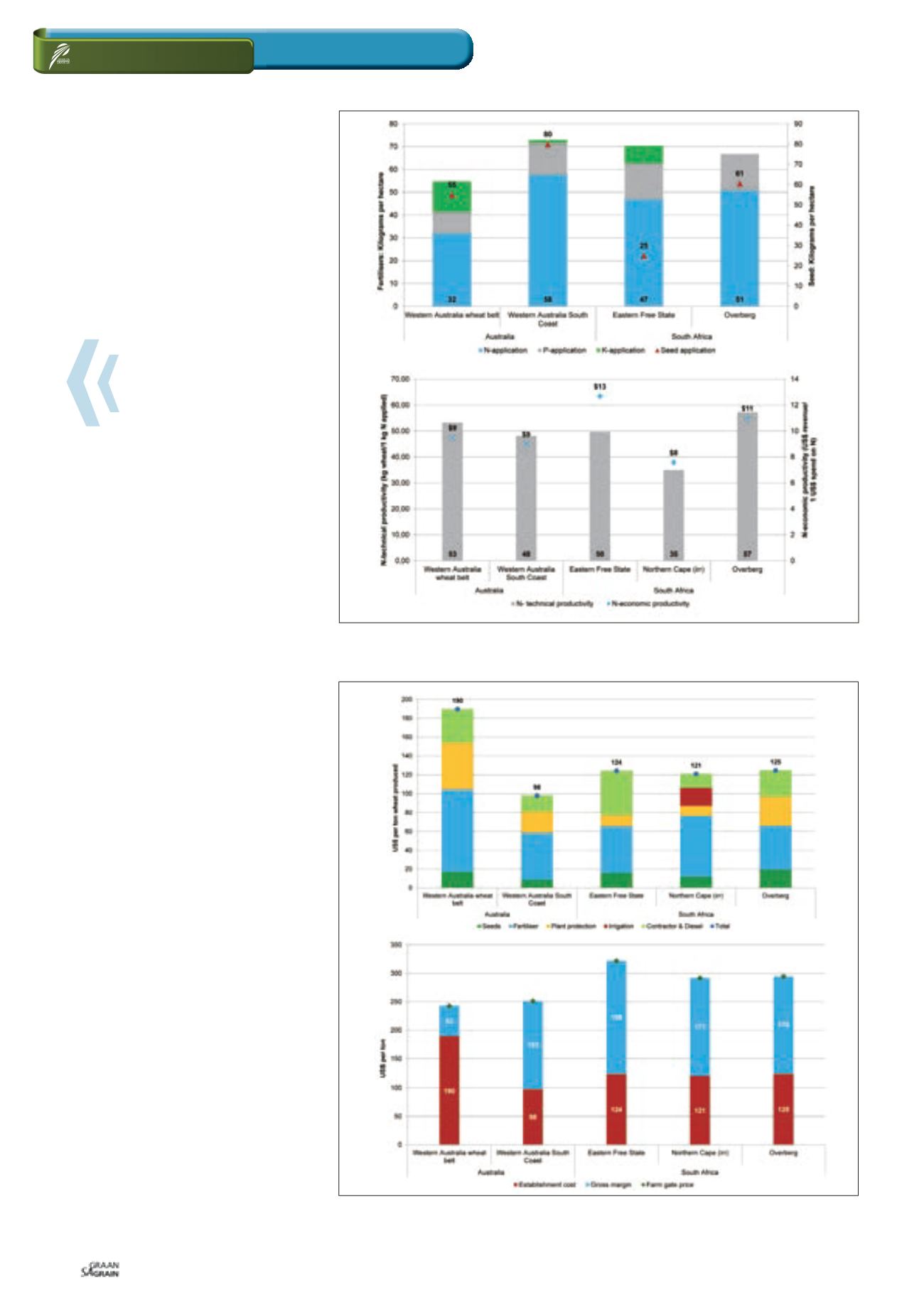

Graph 6: Fertiliser application and seed application rates and productivity indicators in Australia and

South Africa.

Source: BFAP, 2014 and agri benchmark, 2014

Graph 7: Establishment cost in US$ per ton wheat produced and gross margins in Australia and

South Africa.

Source: BFAP, 2014 and agri benchmark, 2014

How do we

compare with

“down under”?