43

May 2015

ON FARM LEVEL

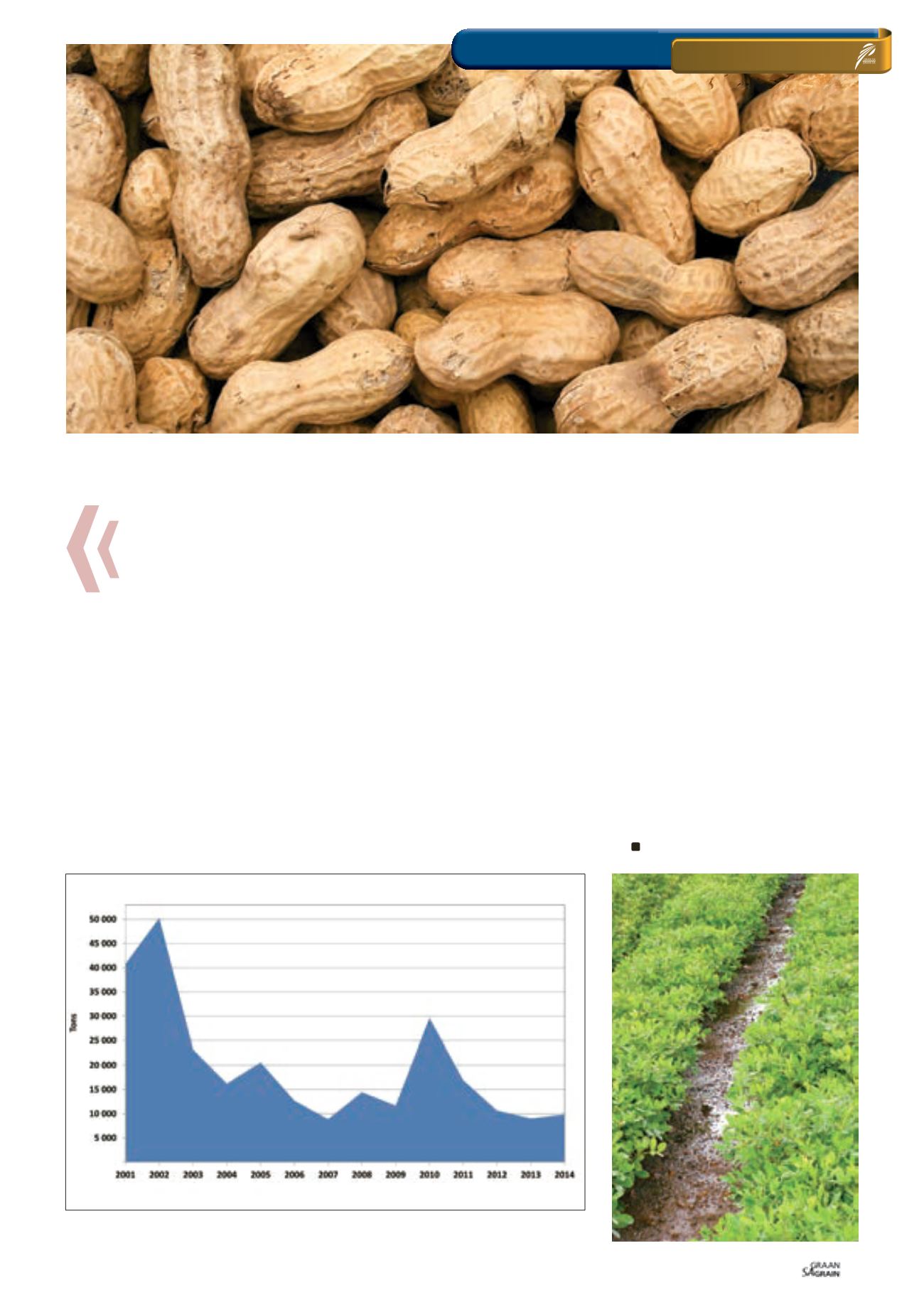

Graph 5: South African groundnuts exports.

Source:

Trade Map

(2015)

From 2010 to March 2015, international groundnut prices (US Run-

ner 40/50, Rotterdam prices) increased by 5%. The international

markets responded positively to these price increases. According

to

Oilworld

(2015), from 2010 to 2014, global groundnut production

increased by 4%. In 2015, global production is expected to decrease,

owing to unfavourable climatic conditions in China and India.

From 2010 to March 2015 the domestic prices (choice grade) in-

creased by 109%, from R5 500/ton to R11 500/ton. Producer prices

(sundry grade) increased from R3 500/ton to R8 000/ton. Producer

prices (crush grade) increased from R2 500/ton to R3 500/ton.

It is important to note that the South African groundnut industry

has not directly benefited in the global demand compared to other

producing countries. From 2010 to 2014, South Africa’s groundnut

exports decreased by 67%, from 29 655 tons in 2010 to 9 844 tons in

2014, according to

Trade Map

(2015) data (see

Graph 5

).

South African export perspective

The leading South African markets were Mozambique, Japan, Neth-

erlands, Belgium, Egypt, United Kingdom, Norway and Swaziland.

Exports to these countries were not consistent due to erratic domes-

tic production coupled with international competition.

On the other hand, there has been a 17% decrease on the imported

groundnut quantities, from 12 534 tons in 2001 to 10 395 tons in

2014. Over this period, the leading suppliers were Namibia, India,

Mozambique, United States, Zambia, Malawi and China.

Conclusion

The South African groundnut industry is confronting a downward

consumption trend due to a significant decrease in consumption.

South African consumers are highly price-elastic; hence there have

been relatively stable groundnut imports (lower prices). In addition,

the South African groundnut industry has not performed well inter-

nationally due to price competition and erratic production.

International buyers are seen to prefer consistent suppliers, high-

lighting the need for investment in local/South African high yield-

ing cultivars which will result in the ability of producers to take

advantage of the international demand for groundnuts. Finally,

higher yields per hectare may allow for more affordable domestic

prices in the edible market.

GRAIN MARKET OVERVIEW

SA Grain/

Sasol Chemicals (Fertiliser) photo competition