There’s a need for increased

investments in the South African

groundnut industry

o

ver the past ten years, the South African population

showed positive growth. The middle-class has grown

and displayed changes in their diets; focussing on more

high protein foods such as chicken and meat, conse-

quently increasing the demand for feed (yellow maize

and soybeans).

However, these changes have not benefited the groundnut (peanuts)

industry. The South African edible groundnut consumption has been

decreasing over time, while the market for peanut butter has main-

tained a relatively stable consumption trend.

The significant decrease in edible groundnut consumption is due

to “consumer price sensitivity”, which is indicative of the degree to

which consumers’ behaviours are affected by the price of a product.

In this article, we briefly explore the groundnut market from a pro-

duction, consumption and export market perspective.

Production perspective

The past ten years has seen a decrease in South Africa’s groundnut

production (see

Graph 1

). However, the previous season showed a

slight recovery.

In 2014/2015 South Africa’s groundnut production amounted to

74 500 tons, which is 80% higher than the previous season. This

increase was due to an increase in area planted; from 46 900 hec-

tares to 52 125 hectares. However, this was still 35% lower than the

2004/2005 production, which was planted on 71 500 hectares.

In 2015/2016, the groundnut area planted increased by 11% year-on-

year, but production is set to fall by 11% year-on-year, due to current

drought conditions.

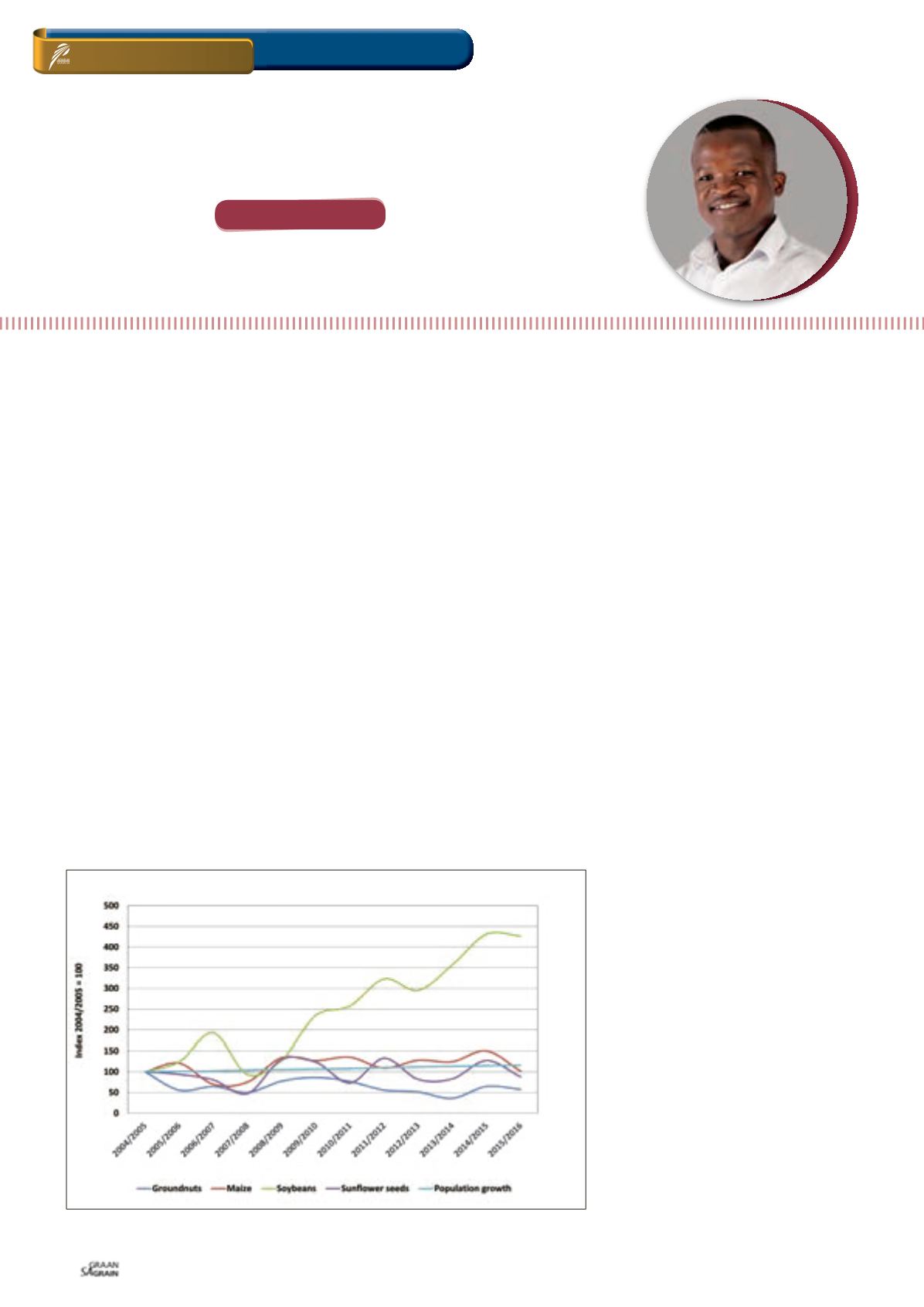

When compared to maize, soybeans and sunflower seed, groundnut

production was the only crop that showed a significant production

decrease in the past ten years. Out of all the abovementioned crops,

soybeans are the only crop that showed exceptional growth, owing

to the additional demand created by new crushing plants. Over this

same period groundnut yields, relative to other commodities, have

been decreasing (see

Graph 2

), with soybeans and sunflower seed

following a similar trend, though to a lesser extent. In contrast, maize

continues to show increasing yield gains

due to seed varieties, beneficial climatic

conditions and other production factors.

Consumption perspective

From 2004/2005 to 2015/2016, the South

African population grew by 16%, now es-

timated at 54 million people. This growth,

coupled with the increasing middle-class,

affected the demand for food and maize;

soybean and sunflower yields catered or

provided for the increasing domestic con-

sumption. However, the groundnut market

is experiencing the opposite.

Graph 3

illus-

trates South Africa’s groundnut consump-

tion against population growth.

In South Africa, groundnuts are mainly con-

sumed in two forms, as edible nuts as well

as processed peanut butter. The peanut

butter market consumption has been fairly

stable throughout the years, just below

24 000 tons per year. This market grew sig-

nificantly in 2014/2015, reaching 27 641 tons

WANDILE SIHLOBO,

economist, Industry Services, Grain SA

GRAIN MARKET

-overview

– 14 April 2015

ON FARM LEVEL

Mei 2015

40

Graph 1: Grain and oilseed production index.

Source: Grain SA (2015)