Market overview

Markets

Januarie 2014

40

Market overview of grain

and oilseeds

FUNZANI SUNDANI AND WANDILE SIHLOBO,

ECONOMISTS, INDUSTRY SERVICES, GRAIN SA

Throughout November 2013, there have been

significant movements on the international

and domestic maize, soybean and wheat

markets; as well as notable volatility on the

exchange rate.

International markets

Maize markets

On the maize markets, prices have been moving

sideways, mostly pressured by large expected

global supplies coupled by a slower import

demand from China. On the side, an increasing

demand from the world market provided some

support for maize prices; with South Korea, the

EU and Japan among the top importers.

Natural disasters have also negatively affected

maize production, with most highlights on the

recent typhoon in Philippines that damaged

about 153 495 hectares of their arable land, of

which 20 951 is for maize.

In the Southern African region, Zambia is still

experiencing dry conditions and soil moisture

is not sufficient for 2013/2014 maize plantings.

Drought conditions in South America have

negatively affected maize production, the

Argentinian maize area forecast has recently

been decreased by 0,2 million hectares to

3,3 million hectares.

On the other hand, the US has been experien-

cing favourable weather conditions, thus

positive harvest progress. However, the US

market has recently faced some disappointing

news from the Chinese market; China rejected

US maize exports due to unapproved GMO

variety.

Soybean market

Soybean markets have also experienced

some sideways price movements with a lot

of pressure on soybean prices coming from

South America.

Dry conditions in Argentina have resulted in a

decrease in the area planted with maize, which

was substituted by soybean production. The

US has had favourable weather conditions

which gave support to the harvest progress.

Furthermore, increasing demand from the

world market also added some support for

soybean prices, with South Korea among the

top importing countries.

Oilworld

recently reported that world

exports of soybean are seen rising sharply by

4,5 million tons, which is an almost 20% rise

from the previous year. The driving force for

these exports is to be seen in the growing

requirements of the global crushing industry

and the rising demand for soy oil and soy

meal. Furthermore, the 2013/2014 soybean

world exports are expected to increase by

11 million tons to 108,6 million tons. Brazil

is again expected to be the world’s largest

exporter of soybeans at around 45 million tons

in September and August 2013/2014, followed

by the USA at an estimated 40 million tons;

Argentina is expected to be at 9,3 million tons;

Paraguay at 5,1 million tons; and Uruguay is

expected to be at 3,2 million tons.

Wheat markets

On the wheat markets, wheat prices have

largely been supported by an increasing

demand from Egypt, Japan, Lebanon,

Bangladesh, Chinese Taipei and South Korea.

On the other hand, wheat prices have been

pressured by an expected increase in wheat

production from South America; with

Argentinian 2013/2014 wheat production

expected to be at 8,5 million tons, which is

slightly up from last year’s production of

8,2 million tons.

Brazil’s Agriculture Ministry announced that

the government is planning to offer subsidised

loans to producers in order to expand wheat

acreage across the country. Brazil hopes to cut

reliance on foreign wheat, particularly US and

Argentinian wheat imports.

Furthermore, India continues to add pressure

on wheat prices, the country’s winter wheat

plantings for the 2014 harvest are estimated

to be complete at 17,9 million hectares,

compared to 15,8 million hectares at the same

time last year.

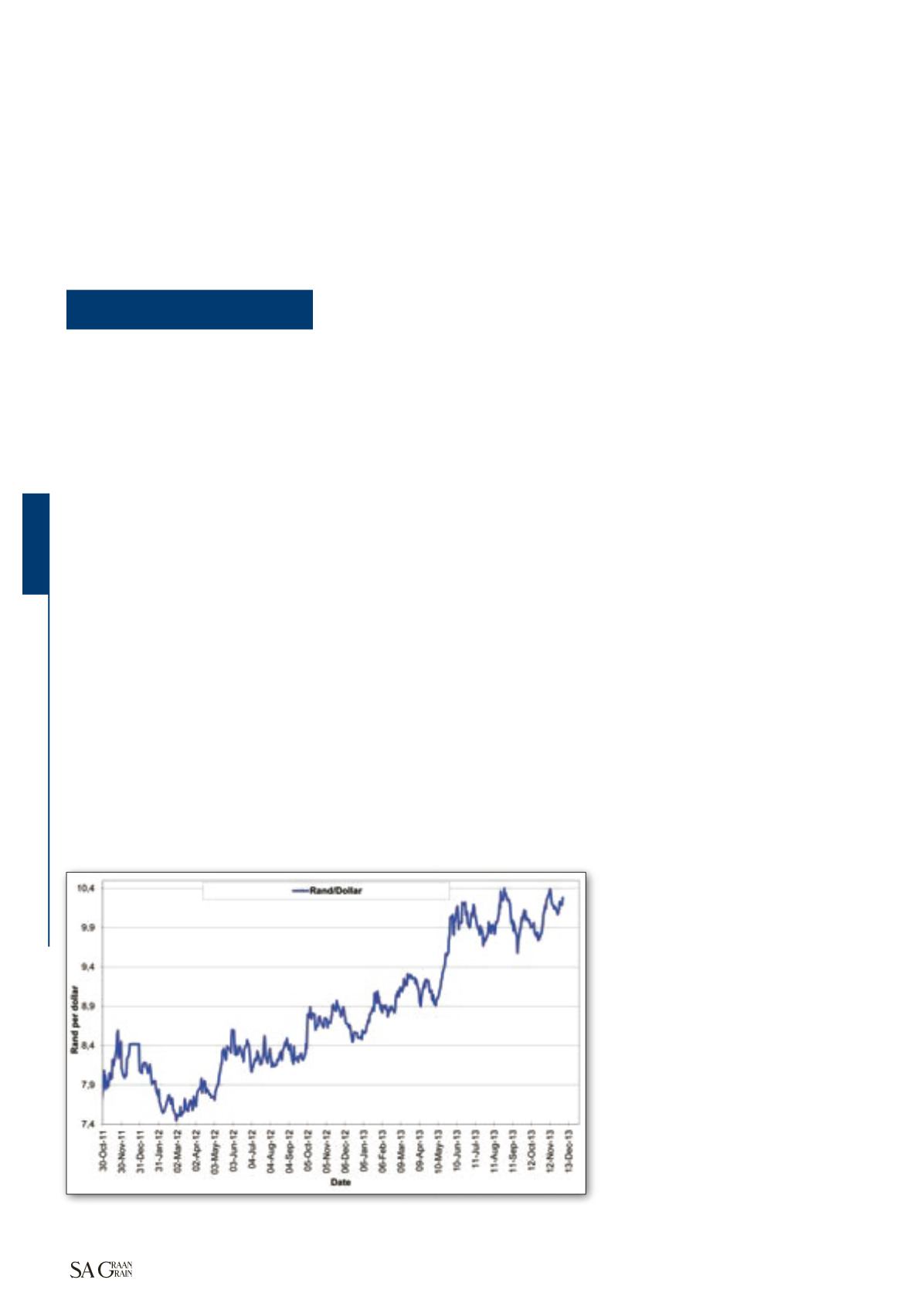

Exchange rate

The rand continues to trade at low levels

(

Graph 1

), currently trading around R10,30 to

the dollar. The recent pressure on the rand

value came after South Africa’s third quarter

GDP growth eased to 0,7%, from an upwardly

revised 3,2% in the second quarter.

The main reason for lower growth in the

third quarter was a 6,6% contraction in the

manufacturing sector, which was caused by

widespread strikes in the motor industry.

Furthermore, a strong US Purchasing Managers

Index (57,3) raised concerns about tapering

of stimulus measures. Concerns about the

local current account deficit also added some

pressure on the rand value.

– 30 November 2013

Graph 1: Exchange rate.

Source: Grain SA (2013)