111

September 2017

He enjoyed interacting with the diverse set of people from across

the agricultural sector and says these interactions taught him to lis-

ten to other opinions and views, but at the end of the day to strive

to what would be the best for the success of the derivatives market

in South Africa.

Life after the JSE

Sturgess will continue his relationship with the JSE on a consul-

tancy basis to work on some of the new products like wool and lamb

as well as the Zambian derivative contracts which will be a first to

be traded and settled in US dollars. Although his interaction with

the JSE will continue on a regular basis, he now gets to spend time

away from the hustle and bustle of city life, by having relocated to

the Garden Route.

He and his wife, Jenny, whom he met at a guesthouse during one of

his numerous visits to the NAMPO Harvest Day, are venturing into

the hospitality industry. They have purchased a guest farm in the

Plettenberg Bay area.

‘I would not say it was part of a lifelong dream, but it gives us the

opportunity to raise our two sons, Mark (10) and Luke (8), out in

the countryside. It is an added bonus that we get to stay close to

the beach and mountains,’ he shares enthusiastically about this life-

style change.

Six questions to an industry leader

How does the South African commodity

trading platform compare internationally?

‘South Africa is globally recognised for the success we saw in mov-

ing from a regulated to a free market. With the success in liquidity we

have been able to attract setting up the derivatives market in South

Africa to such a degree that this was confirmed independently by a

study done by the United Nations Conference on Trade and Devel-

opment (UNCTAD) some years back. The success of the exchange

can be attributed mainly to the support and commitment from

our members and clearing members, the solid banking system we

have in South Africa, the robust support and integrity of storage

operators to guarantee products on silo receipts and then of course

committed people.’

There have always been rumours about the

possibility for market manipulation within

the futures exchange system. In your opinion,

is there any truth to these rumours?

‘The dedicated resources at the JSE that solely focus on market

regulation matters and the efforts of the Financial Services Board’s

directorate of market abuse must not be forgotten. Both these teams

work hard to ensure any market abuse is identified and penalised

accordingly. We have a clear set of cases that the FSB have pro-

cessed and those that were found guilty of market abuse were pe-

nalised. This area remains a very important one for the JSE and for

the integrity of the market place. Clients who feel they have a theory

around market abuse should rather contact the JSE’s regulation

department. They have access to all the derivatives data and can

accurately investigate any abuse claims.’

Location differentials have been a conten-

tious topic in the agricultural industry.

Is it justified and what are the producers’

biggest misconception about it?

‘I think grain producers are fully aware of my opinions around this

as we have discussed this subject on many a platform. My views

remain the same: The location differential model is well justified for

the derivatives market. Producers should rather pay more careful at-

tention to the spot basis contract we have in place for access to any

basis premiums.’

Is there a place in the future of the soft com-

modity trading environment for alternative ex-

changes that can become competitors to Safex?

‘When you look at any exchange that is successful, you see they have

managed to attract liquidity and so it is easy to enter or exit positions

on the exchange. I am not 100% sure the existing JSE Commodity

Derivatives market has really achieved that perfect liquidity state.

Earlier this year we were down 26% on contracts traded, so during

this period daily liquidity on most of our contracts would have been

lower. The big question is would another commodity derivatives

exchange in South Africa add to more liquidity or simply split it? At

the end of the day we only have so much underlying grain to trade.

Obviously, nothing prevents a competitor from starting up. I just

have my concerns around the potential liquidity impact.’

What can South African grain producers do

to become more competitive with their

international peers?

‘I have always had the view that our grain producers are already

very competitive and best of breed. Just look how they have man-

aged to increase yields and adopt the latest technologies. What we

did see in the early days of the derivatives business in South Africa,

is many would be speculators on the market. Over the years more

have turned to only use the market as hedgers, which obviously

is a more conservative but sustainable use of the derivatives mar-

ket instruments. I take my hat off and salute the grain producers of

this country!’

How do you see the future of agriculture in

South Africa and what is your message to

South African producers?

‘This question is very similar to the one often asked around where

prices will go: We know prices will go up and will go down, I am

just not sure in what order, though. On a more serious note, I ap-

preciate there will be good times and tough times for any industry

participant, but we should never forget why we do things. Farming

is in your blood – it is your passion. Make sure you are familiar with

the instruments around you that can reduce your risks – just to be

clear, the JSE market can assist you with your price risk.

‘I am an optimistic person by nature and remain optimistic that

South Africa and even select countries to the north of us will con-

tinue to evolve and become even stronger grain producers. It has

been a special journey for me and a privilege to have interacted

with so many different grain producers, often organised through

Grain SA. The conversations have always been robust, often tense,

but I can say we have always maintained our respect for each other.

For that, I can only say, thank you.’

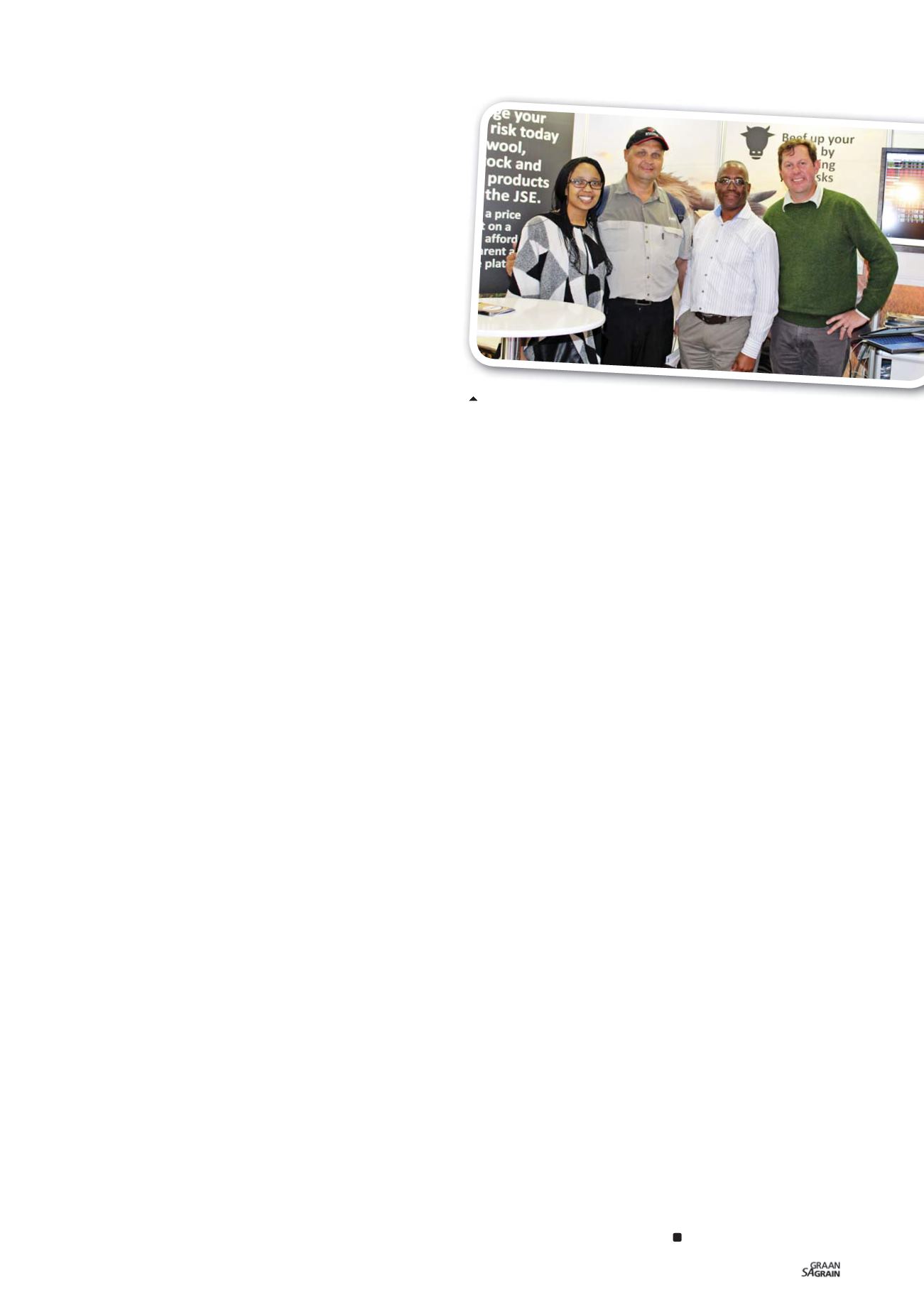

Chris was a regular face at the NAMPO Harvest Day. During May this

year the JSE team shared more about futures contracts for cattle

and sheep carcasses. Anelisa Matutu, Johann de Jager (visitor from

Gauteng) and Chris’s successor, Raphael Karuaihe, with Chris.