24

Oktober 2015

TRACY DAVIDS,

Bureau for Food and Agricultural Policy

FOCUS

Animals

Special

Expanding livestock production

to support feed grain demand

over the next decade

M

eat consumption has globally expanded rapidly over the

past decade, particularly in developing regions where

rising income levels resulted in dynamic class mobility

and improved living standards. Consequently, dietary

intake has become increasingly diversified, as protein consumption

increases relative to traditional starches (OECD-FAO, 2015).

South Africa has been no exception – strong economic growth from

2000 to 2008, combined with increasing social grant payments,

created a significant demand stimulus and as the most affordable

source of animal protein, chicken consumption expanded more than

any other meat type, increasing by more than 80% since 2000. While

still positive over the past five years, meat consumption growth has

slowed following the global financial crisis.

Consumer income levels, combined with a continuously expanding

population, remain the core drivers of meat consumption over time.

Hence the medium term outlook for meat consumption presented by

the Bureau for Food and Agricultural Policy (BFAP) is largely depend-

ent on the turbulent macroeconomic environment in which South

Africa presently finds itself.

While the short term outlook for economic growth in South Africa

remains cautious, international institutions such as the International

Monetary Fund (IMF), Organisation for Economic Cooperation and

Development (OECD) and the World Bank project a recovery in the

longer term, with average annual growth exceeding 3% over the

coming decade.

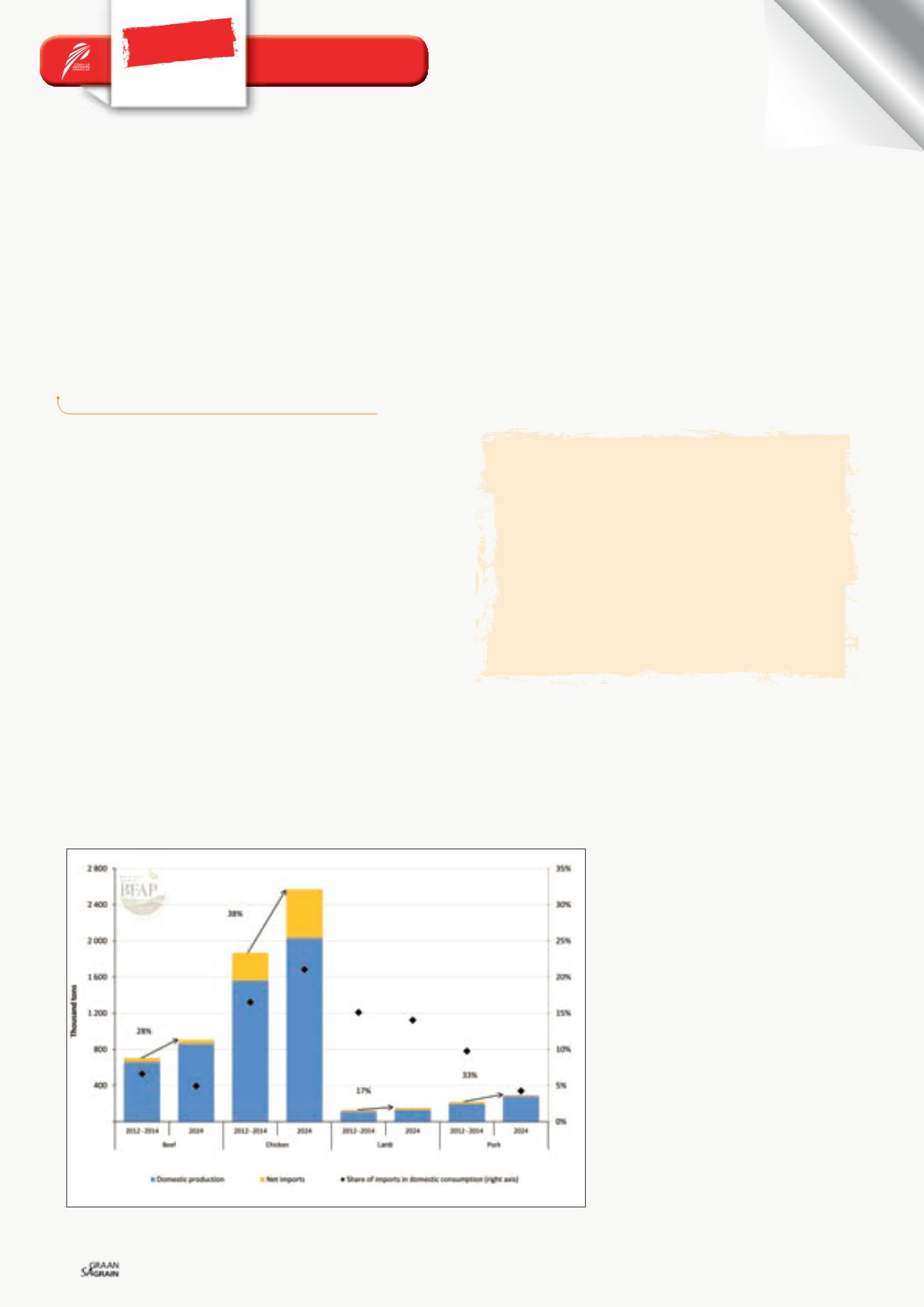

Consequently, the outlook for total meat consumption remains

positive, with relative prices and consumer preferences driving the

choice between different meat types over time. Projected expan-

sion of 38% over the coming decade allows chicken to continue its

dominance of the meat complex, account-

ing for more than 65% of additional meat

consumed over the ten year period.

Beef consumption is projected to increase

by 28%, resulting in almost 200 000 tons of

additional beef consumed by 2024. Despite

its small share in the meat complex, pork

consumption continues to rise, increasing

by 33%, whereas lamb, as the most expan-

sive option, is projected to expand by 17%

by 2024 (

Graph 1

).

Graph 1 further illustrates that South Africa

remains a net importer of meat products

and in light of the projected growth in con-

sumption, the extent to which the additional

demand will be met from domestically pro-

duced products, will depend largely on the

competitiveness of South African producers

in the global context. Over the past decade,

domestic chicken production in particular

has not kept pace with the rate of demand

growth and the share of imported products

in domestic consumption has increased

from 10% in 2000, to 20% by 2014.

Graph 1: South African meat consumption, production and net imports: 2024 versus 2012 - 2014

base period.

“

The 2015 edition of the

BFAP Baseline presents a positive

outlook for livestock production in

South Africa over the next

decade, which will in turn stimulate

the demand for feed products.

“