67

November 2017

September 2017 on the competitive nature

of 137 countries in 2017/2018, needs a

closer look. As part of the perfect storm

mentioned earlier, South Africa dropped 14

places among 137 countries from 47th most

competitive economy to the 61st most com-

petitive nation.

These 14 places that we have lost is the

most significant drop since the start of

this annual survey in 2004. What caused

this drop so suddenly in 2017?

Looking at the different pillar measures, it

becomes clear that we have lost our com-

petitiveness because of financial institu-

tions and the integrity of our corporate

governance. It used to be among the best in

the world, but dropped from 11/138 to

44/137 in 2017/2018.

Another reason for the drop in competi-

tiveness was that of institutions of state.

Previously we scored 40/138 and now it

dropped to 67/137. Both numbers show a

global decline in confidence in financial ar-

rangement and governance (KPMG and the

Guptas may be a case in point) as well as

a declining confidence in state institutions

due to issues such as institutionalised cor-

ruption and state capture allegations.

In addition, the WEF Global Competitive

Report publishes a list of issues making it

difficult to do business in a country. For

years the normal culprits in South Africa

were things such as restrictive labour rela-

tions, inefficient government bureaucracy,

inadequate infrastructure, policy instability

and inadequately educated workforce, top-

ping the list.

The 2017/2018 list brings new issues

to the fore and the top five now are:

Corruption, crime and theft, government

instability/coups, tax rates and insufficient

government bureaucracy.

It is in the context illustrated above that

the ANC is preparing for a leadership elec-

tion in December 2017. The intensity of the

leadership contest, as well as the uncertain-

ty about President Jacob Zuma’s exit strat-

egy, causes huge political uncertainty.

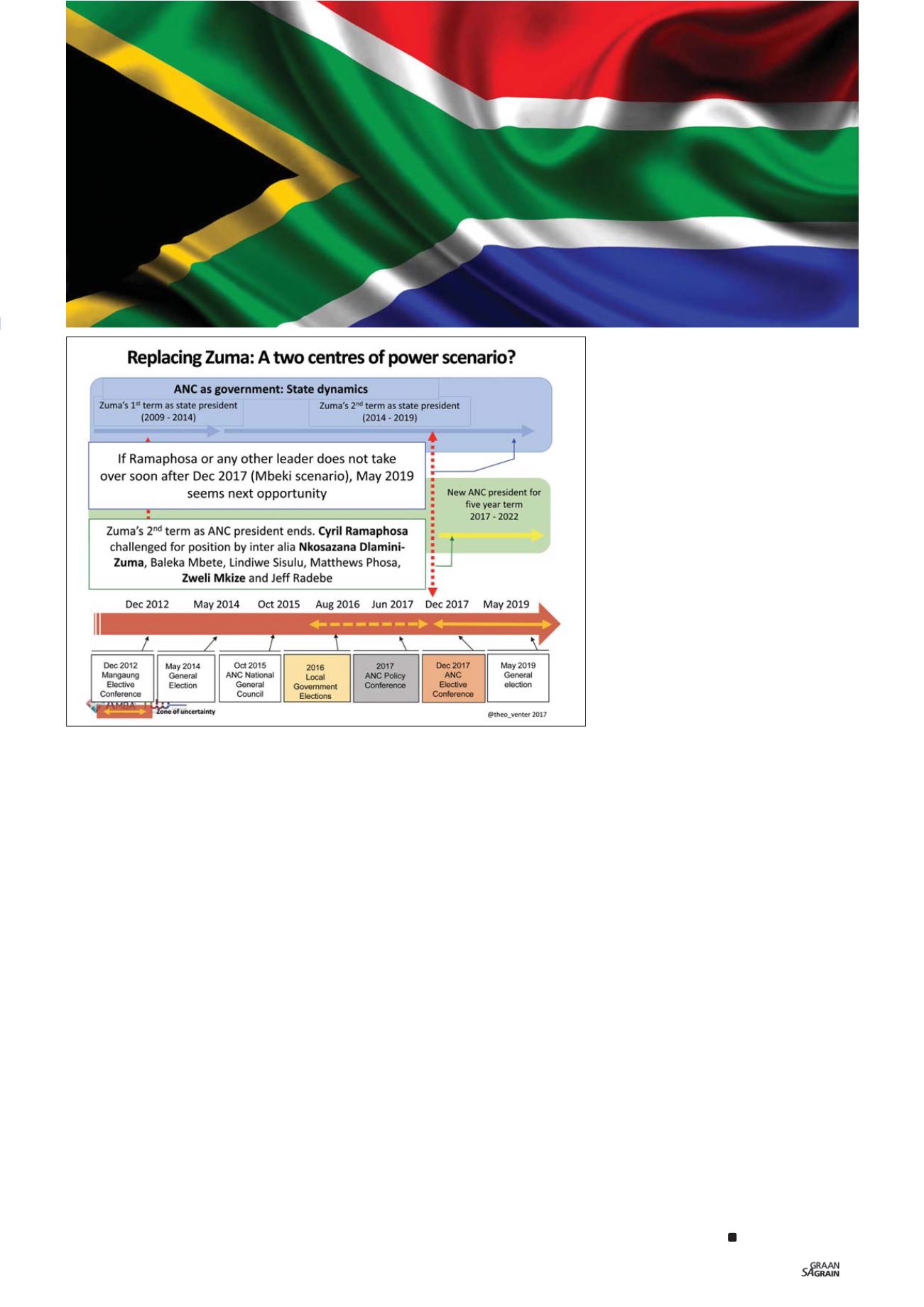

Figure 1

is an outline of the two roles

of the ANC in politics. Firstly, it is a politi-

cal party (Green) selecting leaders to

govern and secondly it constitutes a govern-

ment (Blue).

From this figure it is clear that the ANC has

not succeeded in closing the gap between

electing its leadership for the political party

(December 2017) and forming a govern-

ment after an election (May 2019).

This lack of synchronisation between party

leadership and governing leadership (presi-

dent and cabinet) has created the notion of

‘two centres of power’ within the ANC. It re-

fers to one leadership team in Luthuli House

and a different team sitting in the Union

Buildings. This scenario caused the ‘recall’

of President Thabo Mbeki in 2008, a scenar-

io that may play itself out again in 2018 with

regards to President Zuma.

At its 54th National Conference, arranged

for 16 to 21 December 2017, the ANC will

have to do three important things. Firstly, it

will have to amend its constitution, then it

will have to amend and approve its policy

framework and lastly elect the leadership

for the next five years.

President Zuma indicated that he is not re-

electable as president of the ANC and his

second term as State President will also

come to an end in May 2019.

Figure 2

shows

the different possible candidates for the

ANC election in December 2017.

Uncertainty about who will succeed Presi-

dent Zuma has added to the perfect poli-

tical and economic storm in South Africa

– especially due to the corruption charges

and state capture allegations linked to the

Zuma presidency.

At this stage two candidates are looking

like frontrunners, i.e. the Deputy President,

Mr Cyril Ramaphosa, and the ex-wife of

President Zuma, Dr Nkosazana Dlamini-

Zuma.

ANC tradition would favour the sitting dep-

uty president to take over from President

Zuma in December 2017, but the deep run-

ning factions in the ANC makes this predic-

tion extremely difficult. This uncertainty

adds to the view that South African politics

is currently in a holding pattern due to un-

certainty and this situation will continue at

least until late December 2017 and may only

be resolved in 2018.

Figure 2: Different possible candidates for the ANC election in December 2017.