Bearish for too long: A brief review

of domestic and global wheat market

fundamentals

s

outh African wheat producers are approaching the plant-

ing season, with the Nation l Crop Estimate C mmit-

tee expected to release the planting intentions data on

26 April 2016. In the previous season, South African wheat

producers planted 482 150 hectares of land, which was a

positive increase of 1% from the area planted in 2014.

Nonetheless, production turned out lower than expected as a result

of an ongoing drought in some areas of the Western Cape Prov-

ince such as the Swartland, led to lower yields. At the moment the

weather conditions still indicate a dry outlook but indications from

a number of weather forecasters are that South Africa might get

some rainfall this season, as the El Niño event transits into La Niña.

The market conditions are also slightly

favourable with the wheat import tariff

having increased to an all-time high of

R1 224,31/ton. In this article, we will briefly

explore the current domestic and global

wheat market conditions.

Domestic market

conditions

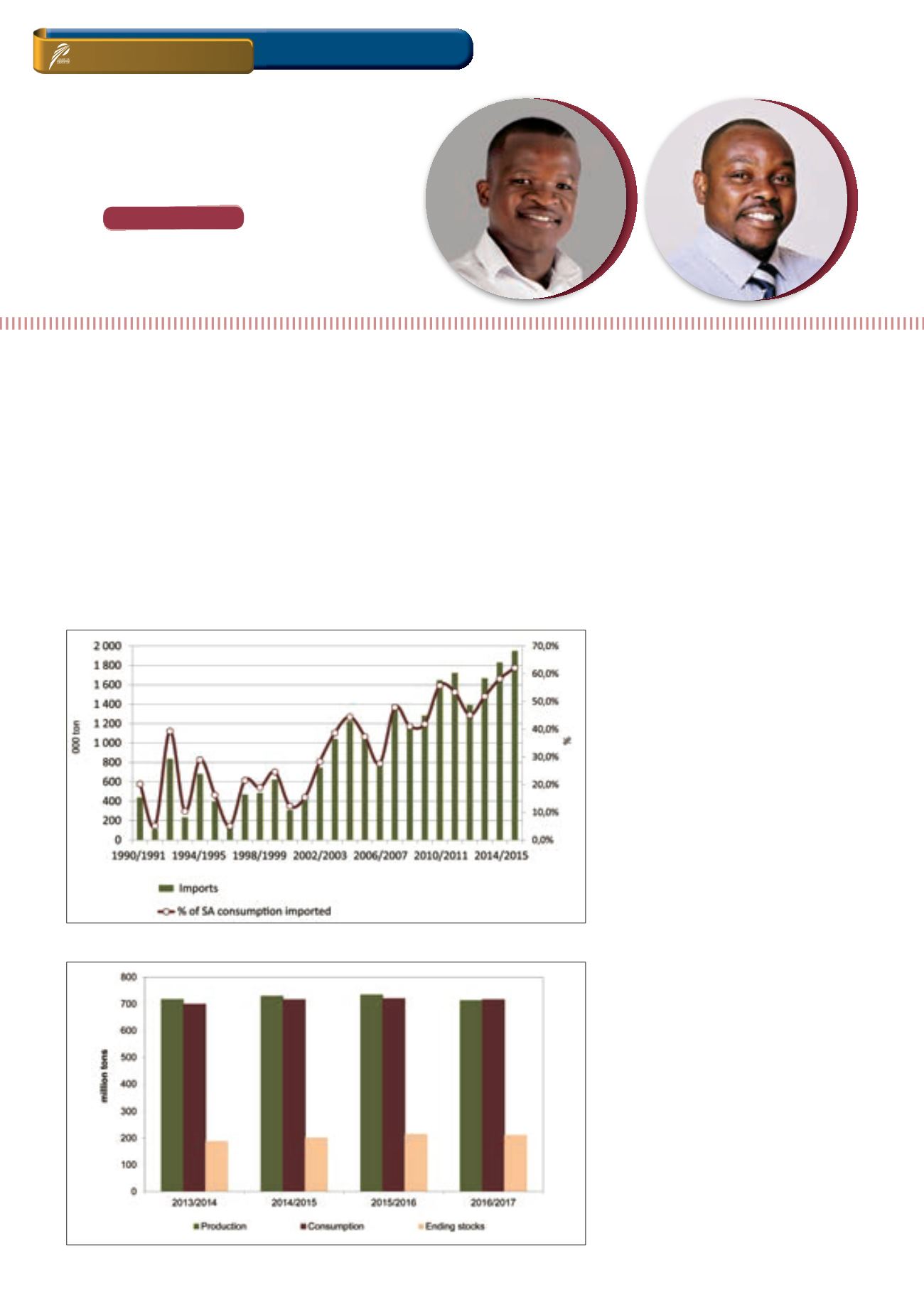

The 2015/2016 South African wheat pro-

duction was 1,46 million tons, which is 17%

lower than the previous season’s crop and

the lowest since the 2010/2011 season. Us-

ing this production figure, Grain SA esti-

mates that South Africa’s 2015/2016 wheat

imports could reach 2 million tons.

According to Grain SA’s database, which

dates as far back as the 1990/1991 season,

this would be the highest import volume on

record and resonates with the increase in

South Africa’s wheat consumption, which is

now roughly above 3million tons (

Table 1

). At

the same time, South Africa continues

to export wheat to regional markets. The

2015/2016 wheat exports are forecasted at

287 000 tons, which is 5 000 tons lower than

the 2014/2015 exports.

To some extent these aforementioned fac-

tors have been supportive of domestic

wheat prices. Moreover the existing wheat

import tariff and the weaker rand against

the US dollar have added support to do-

mestic wheat prices. At the time of writing,

the wheat nearest contract month price and

December 16 contract month price were up

by 22% and 18% respectively compared

WANDILE SIHLOBO,

economist: Grain SA and

TINASHE KAPUYA,

head: Trade and Investment, Agbiz

GRAIN MARKET

-overview

– 15 April 2016

Mei 2016

40

ON FARM LEVEL

Graph 1: South Africa’s wheat imports and share of annual consumption.

Source: Grain SA

Graph 2: Global wheat supply and demand estimates.

Source: International Grain Council and Grain SA

Data as at April 2016