Identifying strategic export markets for SA sorghum industry

t

his year, South Africa is confronted by drought and the

country is expected to be a net importer of grains. Nonethe-

less, that does not cease the need to grow export markets

for the South African grain industry, especially since the in-

dustry faces the challenge of high export concentrations in

traditional markets.

The need to grow export markets was widely echoed in several

sorghum specialists’ working group sessions. Hence, this article

will focus on identifying the strategic export markets for the

South African sorghum industry. The analysis will be done using

grain sorghum trade data, HS code 1007. We start by discussing

the trends in South Africa’s sorghum exports, Harmonised System

(HS) product classification for South Africa’s sorghum exports,

explore leading world importers and lastly suggest the strategic ex-

port markets.

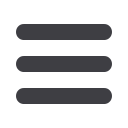

South African sorghum export trends

South Africa’s sorghum exports are generally irregular and incon-

sistent (see

Graph 1

). This lack of consistency can primarily be

attributed to uneven surplus levels and increasing production in tra-

ditional export markets.

Approximately 99% of sorghum is exported by South Africa to

the Southern African Development Community (see

Table 1

). Bot-

swana and Swaziland account for 98% of the South African sor-

ghum exports’ share. The other key export markets within the

continent are Kenya, Uganda and Sudan, which in total account

for 0,5% of South Africa’s export share.

Currently, Botswana’s domestic sorghum production is increasing,

which might limit its import needs in future. International Trade

Centre (2015) data shows that South Africa’s exports’ share in

WANDILE SIHLOBO,

economist: Industry Services, Grain SA

and

TINASHE KAPUYA

,

manager: Trade and Investment, Agbiz

GRAIN MARKET

overview

– 11 May 2015

ON FARM LEVEL

Junie 2015

48

COUNTRY

2010

2011

2012

2013

2014

AVERAGE SHARE OF TOTAL

Botswana

27 223

183 018

46 666

54 660

23 030

66 919

93,70%

Swaziland

2 901

3 814

3 180

4 107

2 255

3 251

4,60%

Uganda

1 204

-

-

-

6

242

0,30%

United Republic of Tanzania

993

-

-

-

2

199

0,30%

Mozambique

65

270

88

295

5

145

0,20%

Zimbabwe

156

36

-

28

493

143

0,20%

Angola

-

260

181

-

173

123

0,20%

Kenya

-

512

-

-

-

102

0,10%

Lesotho

87

31

19

168

12

63

0,10%

Namibia

78

13

1

217

6

63

0,10%

Sudan (North + South)

140

-

-

-

120

52

0,10%

Area not elsewhere specified

-

-

20

35

170

45

0,10%

Total SA exports top markets

32 847

187 954

50 155

59 510

26 272

71 348

-

Total SA exports to the world

33 036

187 968

50 162

59 523

26 330

71 404

-

TABLE 1: SOUTH AFRICA’S OVERALL SORGHUM EXPORTS TO SADC MARKETS (TONS).

Source: International Trade Centre (2015) and own calculations

Graph 1: South Africa’s sorghum exports.

SA Grain/

Sasol Chemicals (Fertiliser) photo competition