Desember 2015

12

ON GROUND LEVEL

GRAIN MARKET OVERVIEW

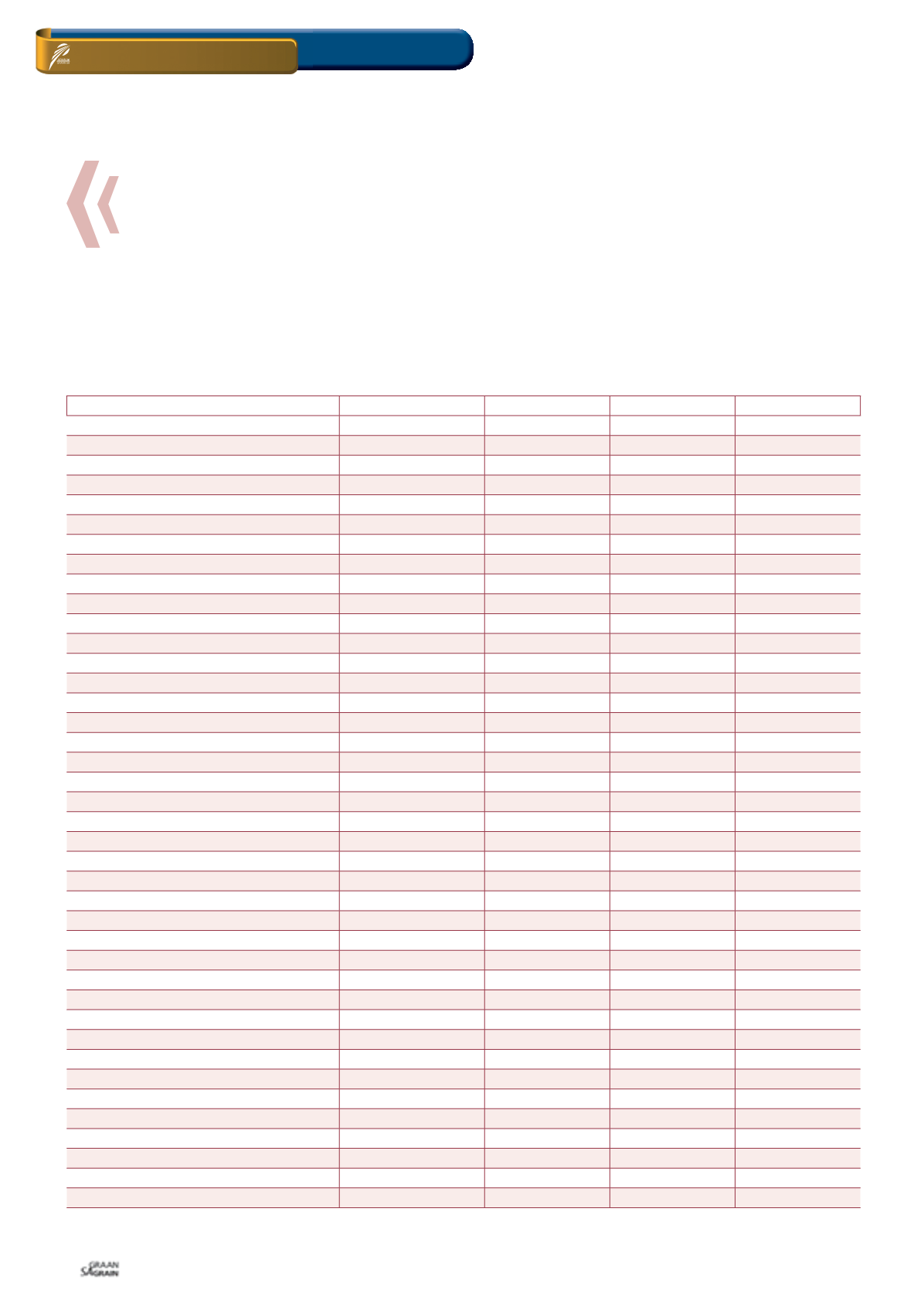

GRAIN SA ESTIMATE LOWER YIELDS AVERAGE YIELDS ABOVE AVERAGE

Updated

28 OCT

28 OCT

28 OCT

28 OCT

Marketing year

2015/2016*

2016/2017**

2016/2017**

2016/2017**

Area planted (x 1 000 ha)

1205

1129

1129

1129

Yield (t/ha)

4,35

3,50

4,50

5,30

CEC crop estimate ('000 ton)

5 239

3 952

5 081

5 984

Retentions

390

390

390

390

Minus: Early deliveries (current season)

367

367

367

367

Plus: Early deliveries (next season)

320

320

320

320

Available for commercial deliveries

4 802

3 514

4 643

5 547

Grain SA

Grain SA

Grain SA

Grain SA

('000 ton)

('000 ton)

('000 ton)

('000 ton)

Commercial supply

Opening stocks (1 May)

791

449

449

449

Commercial deliveries

4 802

3 514

4 643

5 547

Surplus (adjustment of the reconciliation)

Imports

700

2276

500

Total commercial supply

6 293

6 239

5 592

5 995

Commercial demand

Commercial consumption

Food

420

420

420

420

Feed

4 900

5 096

4 096

4 500

Total

5 320

5 516

4 516

4 920

Other consumption

Gristing

12

12

12

12

Withdrawn by producers

75

75

75

75

Released to end consumers

160

160

160

160

Net receipts

17

17

17

17

Deficit

Total

264

264

264

264

Total SA consumption (commercial)

5 584

5 780

4 780

5 184

Exports

Products

100

100

100

100

Whole maize

160

160

160

160

Total

260

260

260

260

Total commercial demand

5 844

6 040

5 040

5 444

Carry-out (30 April)

449

199

552

551

Pipeline requirements (1,5 months)

665

690

565

615

Surplus above pipeline

-216

-490

-12

-64

Carry-out as a % of SA consumption

8,04%

3,45%

11,55%

10,64%

Carry-out as a % of total commercial demand

7,68%

3,30%

10,96%

10,13%

TABLE 2: SOUTH AFRICA’S 2015/2016 YELLOW MAIZE SUPPLY AND DEMAND ESTIMATES AND 2016/2017 SCENARIOS (

'

000 TONS).

*Grain SA estimate

**Grain SA scenarios

This would then lead to a total production of 5,68 million tons.

Exports would mainly be for the BNLS countries at a volume of

600 000 tons. There wouldn’t be a need for imports (see Table 1).

Yellow maize

In the event of normal rainfall, South Africa might achieve a national

average yield of 4,5 tons per hectare. The CEC’s intentions-to-plant

show that producers might plant 1,12 million hectares to yellow

maize.

This would then lead to total production of 5,08 million tons. The

exports would just be for the BNLS countries and South Africa

would still need to import about 500 000 tons to satisfy the domestic

market requirements (see Table 2).

Above yields scenario

In the event that South Africa receives sufficient rainfall at an ap-

propriate time in an intended area of 1,42 million hectares for white

maize and 1,12 million hectares for yellow maize, South Africa would

return to a net exporter status and total maize exports would pos-

sibly reach 1,7 million tons. This scenario would also lead to lower

maize prices for producers, especially white maize. Yellow maize

prices would to some extent benefit from global export demand

(see Table 3).