11

December 2015

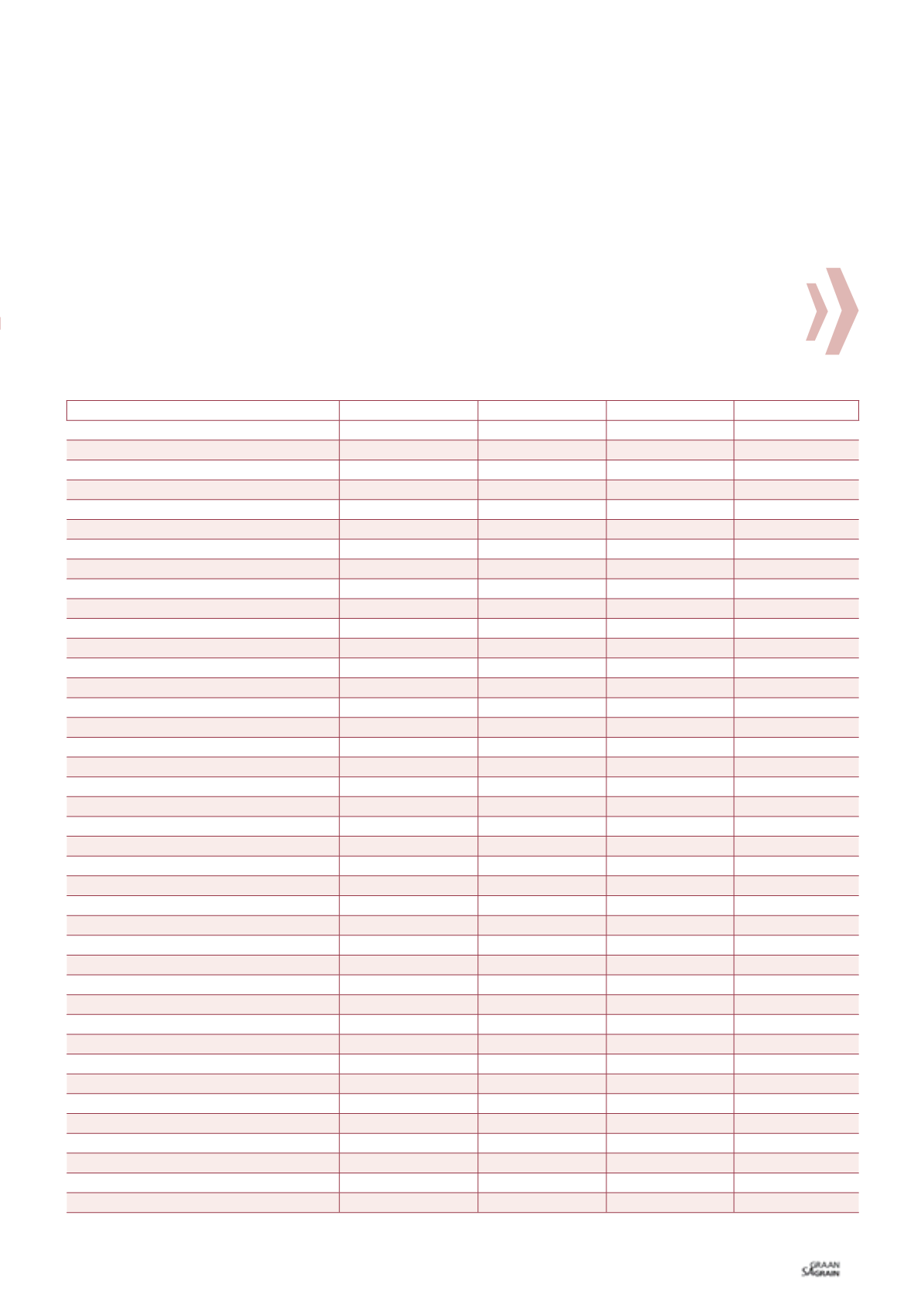

GRAIN SA ESTIMATE LOWER YIELDS AVERAGE YIELDS ABOVE AVERAGE

Updated

28 OCT

28 OCT

28 OCT

28 OCT

Marketing year

2015/2016*

2016/2017**

2016/2017**

2016/2017**

Area planted (x 1 000 ha)

1 448

1 422

1 422

1 422

Yield (t/ha)

3,25

2,95

4,00

4,25

CEC crop estimate ('000 ton)

4 703

4 194

5 687

6 043

Retentions

110

110

110

110

Minus: Early deliveries (current season)

175

175

175

175

Plus: Early deliveries (next season)

200

200

200

200

Available for commercial deliveries

4 618

4 109

5 602

5 958

Grain SA

Grain SA

Grain SA

Grain SA

('000 ton)

('000 ton)

('000 ton)

('000 ton)

Commercial supply

Opening stocks (1 May)

1 283

1 017

1 017

1 017

Commercial deliveries

4 618

4 109

5 602

5 958

Surplus (adjustment of the reconciliation)

Imports

70

130

0

0

Total commercial supply

5 971

5 256

6 619

6 975

Commercial demand

Commercial consumption

Food

4 200

4 200

4 200

4 200

Feed

100

100

1 000

590

Total

4 300

4 300

5 200

4 790

Other consumption

Gristing

35

35

35

35

Withdrawn by producers

30

30

30

30

Released to end consumers

25

25

25

25

Net receipts

14

14

14

14

Deficit

Total

104

104

104

104

Total SA consumption (commercial)

4 404

4 404

5 304

4 894

Exports

Products

80

80

80

80

Whole maize

470

470

600

1 400

Total exports

550

550

680

1 480

Total commercial demand

4 954

4 954

5 984

6 374

Carry-out (30 April)

1 017

302

635

601

Pipeline requirements (1,5 months)

538

538

650

599

Surplus above pipeline

479

-235

-15

2

Carry-out as a % of SA consumption

23,09%

6,86%

11,97%

12,27%

Carry-out as a % of total commercial demand

20,52%

6,10%

10,61%

9,42%

TABLE 1: SOUTH AFRICA’S 2015/2016 WHITE MAIZE SUPPLY AND DEMAND ESTIMATES AND 2016/2017 SCENARIOS (

'

000 TONS).

*Grain SA estimate

**Grain SA scenarios

Lower yields scenario

White maize

In the event of below normal rainfall, South African producers might

achieve a national average yield of 2,95 t/ha. The National Crop

Estimates Committee’s (CEC) intentions-to-plant data shows that

producers might plant 1,42 million hectares of white maize. This

would then lead to a total production of 4,19 million tons. Assuming

that domestic consumption remains constant due to higher prices

and exports would only be for Botswana, Namibia, Lesotho and Swa-

ziland (BNLS countries), South Africa would have to import

130 000 tons of white maize to meet the domestic demand (Table 1).

Yellow maize

In the event of below normal rainfall, South African producers might

achieve a national average yield of 3,50 t/ha. The CEC’s intentions-

to-plant show that producers might plant 1,12 million hectares to

yellow maize. This would then lead to total production of 3,9 million

tons. Assuming that domestic consumption would slightly increase

on the back of an increase in the livestock industry and exports will

just be for the BNLS countries, South Africa would have to import

2,27 million tons of yellow maize to meet the domestic demand

(see Table 2).

Total maize imports

Total maize imports of 2,4 million tons would cost the South Afri-

can economy ± R8 billion. This would have a negative effect on the

economy, resulting in a widening current account deficit and possi-

ble influence the exchange rate movements. South Africa’s economy

needs capital inflows to finance the current account deficit, thus any

significant outflows would be negative for the economy.

Average yields scenario

White maize

In the event of normal rainfall, South Africa might achieve a national

average yield of 4 t/ha. The CEC’s intentions-to-plant show that pro-

ducers might plant 1,42 million hectares to white maize.