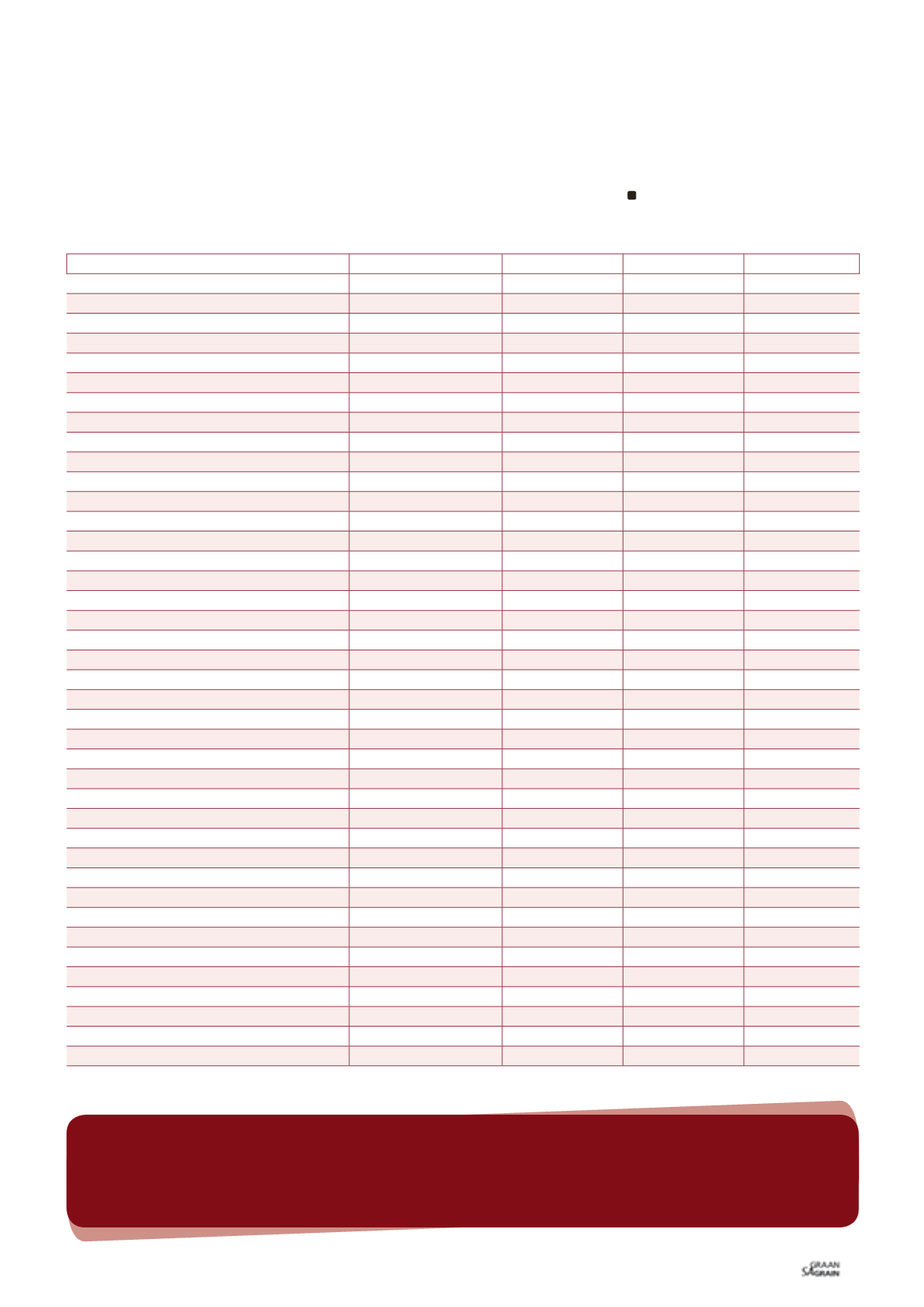

13

*Grain SA estimate

**Grain SA scenarios

GRAIN SA PROJECTION LOWER YIELDS AVERAGE YIELDS ABOVE AVERAGE

Updated

28 OCT

28 OCT

28 OCT

28 OCT

Marketing year

2015/1206*

2016/2017**

2016/2017**

2016/2017**

Area planted (x 1 000 ha)

2 653

2 551

2 551

2 551

Yield (t/ha)

3,75

3,19

4,22

4,53

CEC crop estimate ('000 ton)

9 942

8 146

10 768

12 026

Retentions

500

500

500

500

Minus: Early deliveries (current season)

Plus: Early deliveries (next season)

Available for commercial deliveries

9 442

7 646

10 268

11 526

Grain SA

Grain SA

Grain SA

Grain SA

('000 ton)

('000 ton)

('000 ton)

('000 ton)

Commercial supply

Opening stocks (1 May)

2 074

1 466

1 466

1 466

Commercial deliveries

9 420

7 624

10 246

11 504

Surplus (adjustment of the reconciliation)

Imports

770

2 406

500

Total commercial supply

12 264

11 496

12 211

12 970

Commercial demand

Commercial consumption

Food

4 620

4 620

4 620

4 620

Feed

5 000

5 196

5 096

5 090

Total

9 620

9 816

9 716

9 710

Other consumption

Gristing

47

47

47

47

Withdrawn by producers

105

105

105

105

Released to end consumers

185

185

185

185

Net receipts

31

31

31

31

Deficit

Total

368

368

368

368

Total SA consumption (commercial)

9 988

10 184

10 084

10 078

Exports

Products

180

180

180

180

Whole maize

630

630

760

1 560

Total

810

810

940

1 740

Total commercial demand

10 798

10 994

11 024

11 818

Carry-out (30 April)

1 466

502

1 187

1 152

Pipeline requirements (1,5 months)

1 203

1 227

1 215

1 214

Surplus above pipeline

263

-725

-27

-62

Carry-out as a % of SA consumption

14,67%

4,92%

11,78%

11,43%

Carry-out as a % of total commercial demand

13,57%

4,56%

10,77%

9,75%

Disclaimer

Everything has been done to ensure the accuracy of this information,

however Grain SA takes no responsibility for any losses or damage incurred

due to the usage of this information.

TABLE 3: SOUTH AFRICA’S 2015/2016 TOTAL MAIZE SUPPLY AND DEMAND ESTIMATES AND 2016/2017 SCENARIOS (

'

000 TONS).

December 2015

Concluding remarks

The discussion briefly presented possible future scenarios in the

South African maize market, prefaced by the importance of the maize

industry and its export earnings to the South African economy.

Possible scenarios for the 2016/2017 marketing year should be

viewed with caution as they might change in line with weather

changes and revision in the CEC’s area planted estimates. The sce-

narios were mainly presented for information purposes to assist

producers and other industry stakeholders to plan ahead, should

conditions favour any of the above mentioned scenarios.

The updates of these scenarios will be available on Grain SA’s web-

site at

www.grainsa.co.za.