63

August 2017

of the summer grain and oilseed crops.

New records in terms of production were

seen with the largest maize and soybean

crops ever recorded in South Africa.

According to the CEC the maize crop for the

season in estimated to be 15,6 million tons,

which leaves South Africa with an export-

able surplus of maize of around 4,1 million

tons for the season. The pace of the exports

will play a key role in the carry-over stocks

of maize at the end of the marketing season.

This can have a significant influence on the

maize prices for the new season.

One of the biggest issues amongst grain

producers is what the situation would be

like next year and what alternatives can be

considered when doing crop planning for

the new season.

One of the main decision variables that

needs to be considered is the profitability

of the enterprise for the season. Producers

need to make their calculations to determine

which crop or combination of crops will be

the most profitable and take their decisions

accordingly.

An angle that can be of use to producers

in order to take decisions is by making use

of price ratio calculations. The price ratios

provide an excellent overview of the rela-

tionship between the prices of the com-

modities.

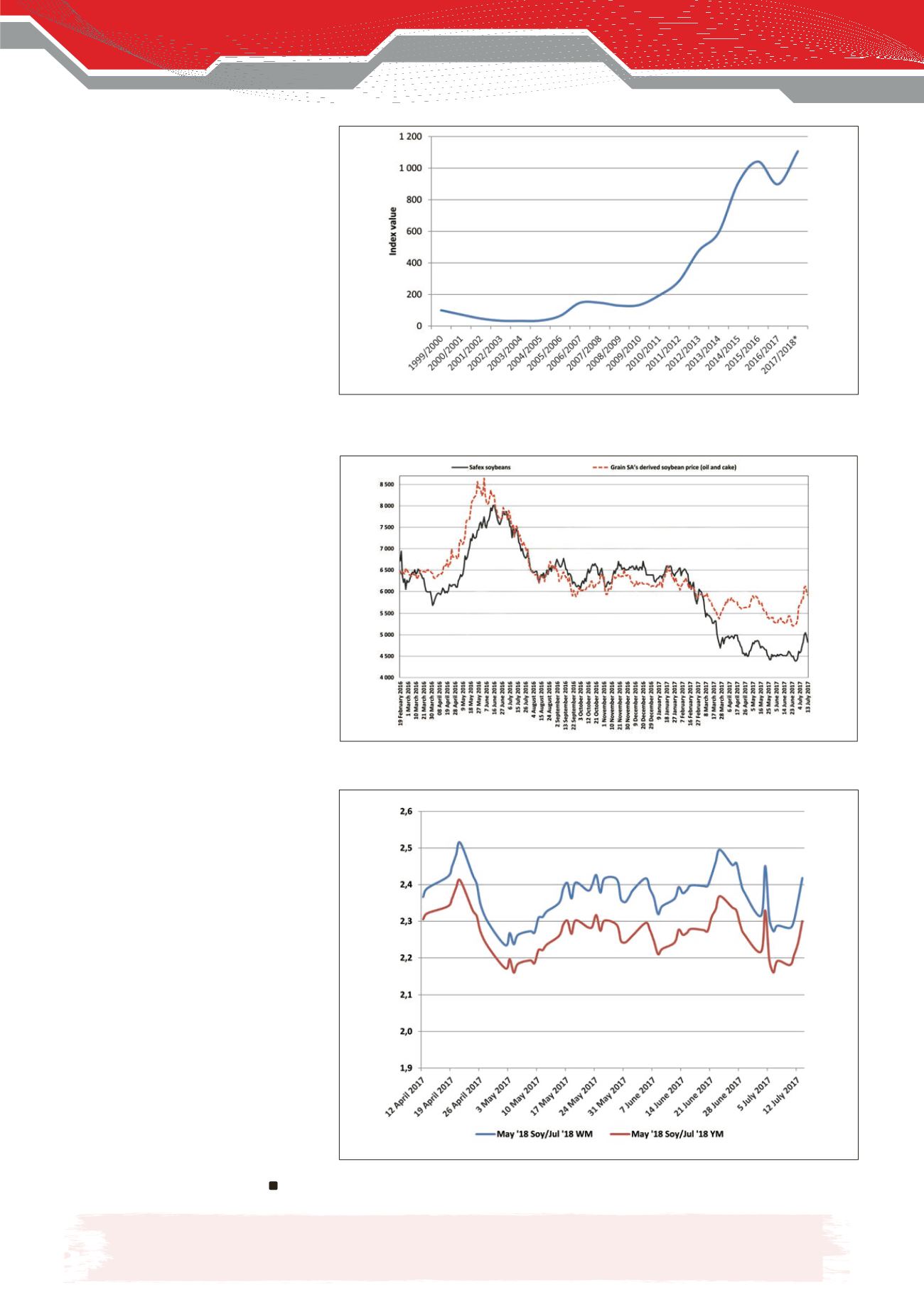

Graph 4

indicates the price ratios between

maize for delivery in July 2018 and soybeans

for delivery in May 2018. On average the

soybean prices need to be between 1,8 to

two times higher than that of maize across

the country to break even – depending on

the cost structures and yields in the differ-

ent regions. It is clear from Graph 4 that

the soybean prices for delivery in May 2018

are almost 2,3 times higher than July 2018

yellow maize prices and 2,4 times higher

than the July 2018 white maize prices from

early April 2017.

In conclusion

The exceptional production of most sum-

mer grains and oilseeds that was seen this

season filled the producers with gratitude

– especially after the previous difficult sea-

son. The good yields and large crops did,

however, have a huge negative impact on

the prices, which still place the profitability

of producers under pressure.

Proper planning will be essential for the

new season. This includes cost calculations,

proper crop planning as well as marketing

alternatives and utilisation of hedging strat-

egies to minimise further price risk.

Graph 2: Soybeans crushed for oil and oilcake on an index basis.

Source: SAGIS and own calculations

*Grain SA projection

Graph 3: Derived prices for soybean delivered in Randfontein.

Source: Grain SA

Graph 4: Price ratios of soybeans and maize for delivery in May and July 2018.

Source: Safex and own calculations

Disclaimer

Everything has been done to ensure the accuracy of this information, however Grain SA takes no responsibility for any

losses or damage incurred due to the usage of this information.