Augustus 2017

62

o

ver the past 20 years, the con-

sistent improvements in soy-

bean production have steadily

improved the competitive posi-

tion of soybeans among other

arable crops, with soybeans that

cover over 62% of the global oilseed pro-

duction. Consequently global oilseed pro-

duction has been growing since the 1980s.

Moreover, it showed a more rapid growth

trend since 2012.

Over the past ten years, global soybean

production rose by 61%, from 218 mil-

lion tons in 2007/2008 to 352 million in the

2016/2017 marketing season. The key driv-

ers in the increasing soybean production

are the United States of America, Brazil

and Argentina.

Consequently, there was a matched rise in

the world ending stocks. According to the

latest World Agricultural Supply and De-

mand Estimates (WASDE) report the world

ending stocks of soybeans are projected to

be 93,53 million tons for the 2017/2018 mar-

keting season, which is equal to about 80%

of the record crop produced by the US in

2016.

A noticeable trend in agricultural markets

is that ample stocks lead to subdued prices

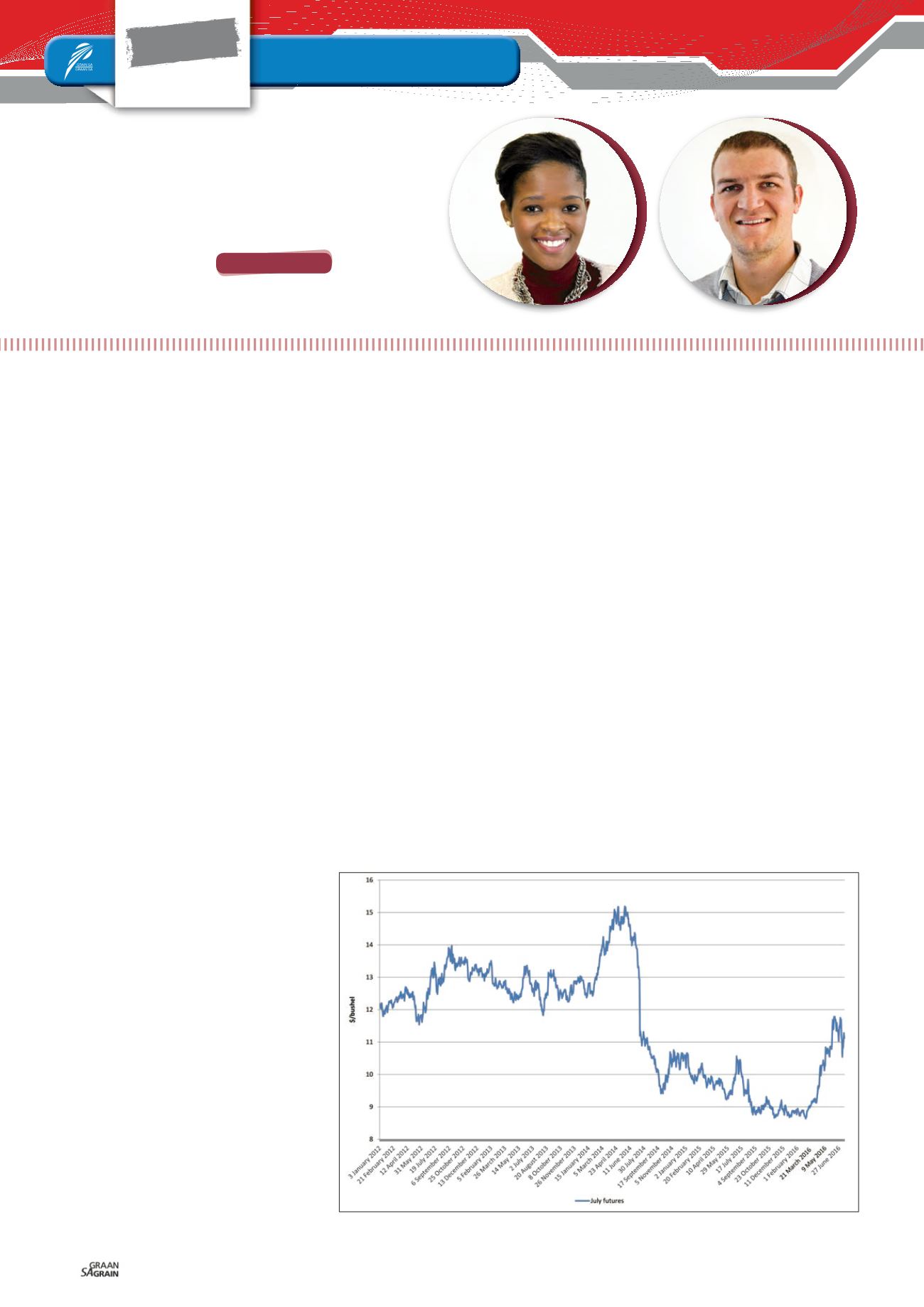

over time. In the past two years, the CBOT

soybean prices were trading at the low-

est levels since 2012, with limited price

gains at the back of large carryover stocks,

which placed pressure on the international

soybean prices (

Graph 1

).

Overview of local

soybean trends

Looking at the recent soybean production

figures in the South African market, one

can conclude that the local market presents

a similar trend to the international one with

good growth in production that was seen

from 2012 onwards.

According to the National Crop Estimates

Committee’s (CEC) fifth production forecast

for the 2017/2018 marketing season, South

Africa is likely to harvest an all-time record

soybean crop of 1,34 million tons.

The crushing of soybeans also showed

some good growth over the recent few

years.

Graph 2

shows the local soybean

crushing per marketing year on an index

basis with the 1999/2000 marketing year

as the base year. It is clear that soybean

crushing increased with more than 1 000%

from the base year and the local crushing of

soybeans is estimated to reach just over

1 million tons for the season.

The local soybean prices have been under

pressure since the harvesting has start-

ed, but found some good support lately.

Graph 3

shows the local soybean price

and the derived soybean price. The derived

price is a calculated price of what it will

cost to import the two by-products from

crushing soybeans namely soybean oil

and oilcake.

When the local price is trading below the

derived price and the crushing margin is

positive, the crushers will tend to crush

more soybean locally, which is positive for

the local demand of soybeans. When the

local price is higher than the derived price,

the crushers will tend to crush less soy-

beans locally since it is then cheaper to im-

port the oil and oilcake separately.

Currently the local prices are still well below

the derived price and the crushing margin

is positive. In the latest monthly SAGIS

figures the soybean crushing for May was

reported to be 11 285 tons more than the

three-year average for May.

New season outlook

The current marketing year was an excep-

tional year in terms of production for most

FOCUS

Soybeans

Mini

Soybean market outlook

MICHELLE MOKONE,

agricultural economist, Grain SA and

LUAN VAN DER WALT,

agricultural economist, Grain SA

GRAIN MARKET

overview

– 13 July 2017

Graph 1: CBOT soybean prices in $/bushel from 2012 to July 2017.

Source: CME Group