37

Stark contrast between current domestic

and global sorghum markets

s

ome time ago, the positive energy in the South African

sorghum industry was palp ble, driven y the prospect of

national biofuel production. However, over the past two

years, this positive energy seems to have subsided with

no clear direction about the future of this national project.

There were hopes that biofuel production would present market

opportunities and, in turn, promote sorghum production across

many parts of the country. Since none of these plans have materi-

alised thus far, there has been a renewed interest among sorghum

producers to explore export markets.

Brief context on South Africa’s

sorghum exports

South Africa is currently one of the smallest players in the global

sorghum export market, contributing a mere 1,4% of total world

sorghum exports. Global sorghum exports are concentrated with-

in the top six largest exporters (which are the United States [US],

Argentina, Australia, Ukraine, France and India) who account for

94% of the total global exports.

On average, South Africa exports 26 000 tons of sorghum per an-

num, of which about 98% is normally exported to Botswana. None-

theless, Sihlobo and Kapuya (2015) indicated that there is potential

for South Africa to increase sorghum exports to other key sorghum

consuming countries in the Far East such as Japan, Europe and pos-

sible African markets, such as Sudan and Ethiopia (see the full article

here:

http://www.grainsa.co.za/grain-market-overview-3).

This year, South Africa is once again confronted by drought and it

is expected to be a net importer of sorghum. This has further de-

flated the prospects for the growth of domestic sorghum production.

Our focus in this article is therefore on the current key market fun-

damentals driving the global and domestic sorghum markets.

Brief global perspective

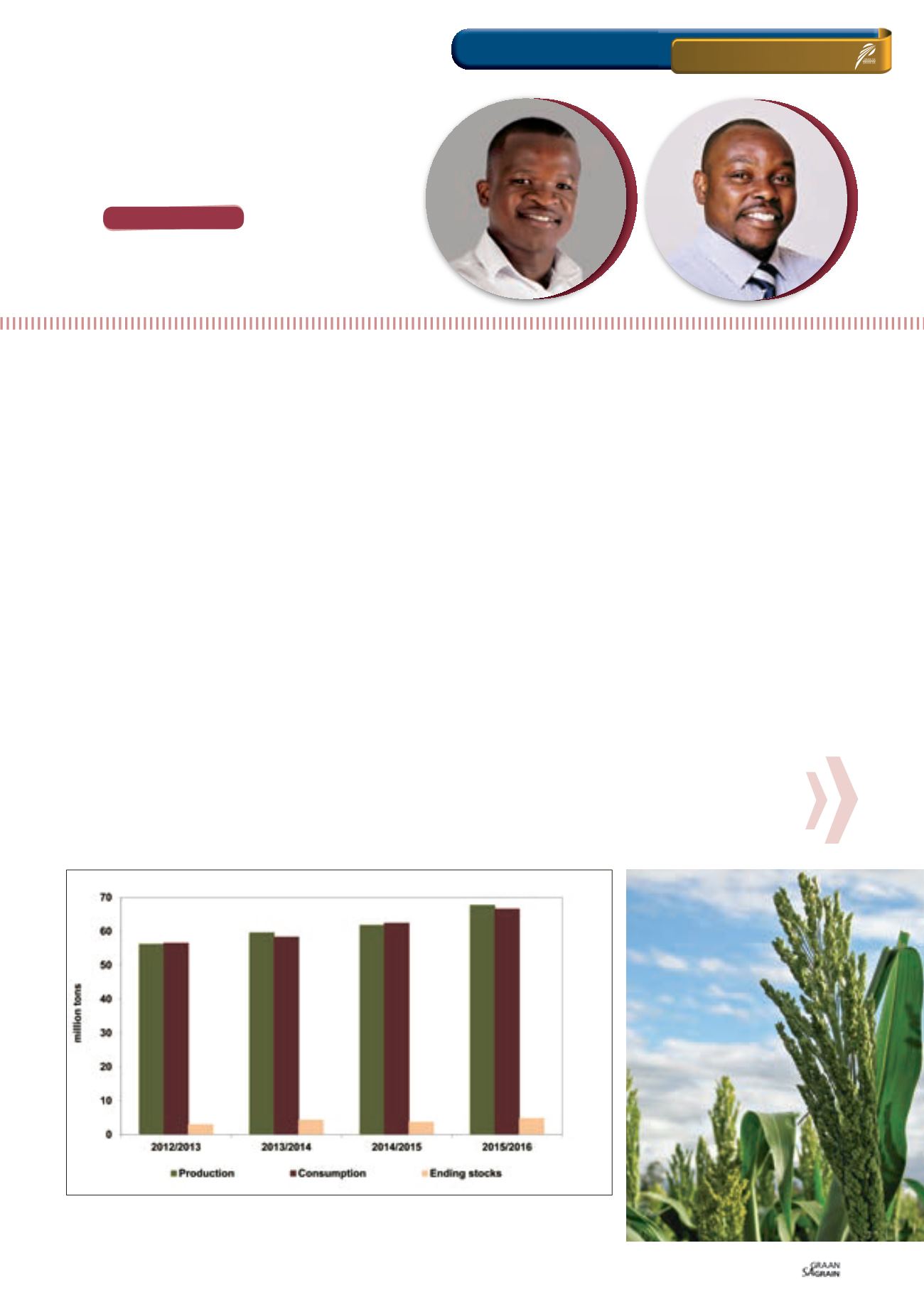

The 2015/2016 global sorghum production is forecasted at 68 mil-

lion tons, a 10% year-on-year increase and the highest production

level in 19 years. This increase is mainly due to increased produc-

tion in the US, Argentina, Australia, Mexico and India (

Graph 1

).

Among these leading producers, 2015/2016 sorghum production

is estimated as follows: The US is estimated at 15 million tons (in-

crease of 38% year-on-year), Mexico at 6,6 million tons (increase

of 5% year-on-year), India at 5,5 million tons (increase of 1% year-

on-year), Australia at 2,2 million tons (increase of 3% year-on-year)

and Argentina at 3,3 million tons (increase of 7% year-on-year).

WANDILE SIHLOBO,

economist: Grain SA and

TINASHE KAPUYA

,

head: Trade and Investment, Agbiz

GRAIN MARKET

-overview

– 17 March 2016

Graph 1: Global sorghum supply and demand estimates.

Source: International Grain Council and Grain SA

Data as at March 2016

ON FARM LEVEL

Grain SA/Sasol photo competition