41

April 2015

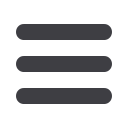

MARKETING

YEAR

2004/

2005

2005/

2006

2006/

2007

2007/

2008

2008/

2009

2009/

2010

2010/

2011

2011/

2012

2012/

2013

2013/

2014

2014/

2015

2015/

2016

Month*

May

May

Apr

Apr

Apr

Apr

May

Apr

Apr

Apr

Apr

Apr

Stock**

3 108 2 746 2 070 1 049 1 581 2 131 1 758

994 1 417

589 2 301 1 215

Month*

Apr

Apr

Apr

Apr

Apr

Apr

Apr

Apr

Apr

Apr

Apr

Apr

Stock**

3 148 3 169 2 070 1 049 1 581 2 131 2 336

994 1 417

589 2 301 1 215

Imports

219

360

931 1 120

27

27

0

421

11

80

100

500

Stock level

Less the im-

ports

2 929 2 809 1 139

-71 1 554 2 104 2 336

573 1 406

509 2 201

715

Processed

quantity/month

607

622

638

669

718

722

738

745

745

779

806

811

Pipeline

required

45 days

911

45 days

933

45 days

957

45 days

1 004

45 days

1 077

45 days

1 082

45 days

1 107

45 days

1 118

45 days

1 117

45 days

1 169

45 days

1 209

45 days

1 217

Surplus/Short-

fall above pipe-

line required

2 018 1 876

182 -1075

477 1 022

651 -545

289 -660

992 -502

Actual days for

stock end of

April

155

152

54

47

66

89

95

40

57

23

86

45

* Month with lowest stock level.

** Stock level: The NAMC project the stock level at end of April 2015 at 2,3 million tons and at the end of April 2016 as 1,2 million tons

A note on imports: According to the World Watch Institute report published on 10 March 2015, many countries have turned to international markets to help meet their

domestic food demand. Imports of grain worldwide have increased fivefold between 1960 and 2013. However, importing food as a response to resource scarcity creates

dependence on global markets. It has two clear dangers. First, not all countries can be net food importers. At some point in time the demand for imported food exceeds the

capacity to supply it. Second, excessive dependence on imports leaves a country vulnerable to supply interruptions, whether for natural reasons or political manipulation.

The report concludes that an import strategy may be unavoidable for some nations, but it should be considered only reluctantly by countries that can meet their food needs

in more conventional ways. It is crucial to conserve agricultural resources wherever possible.

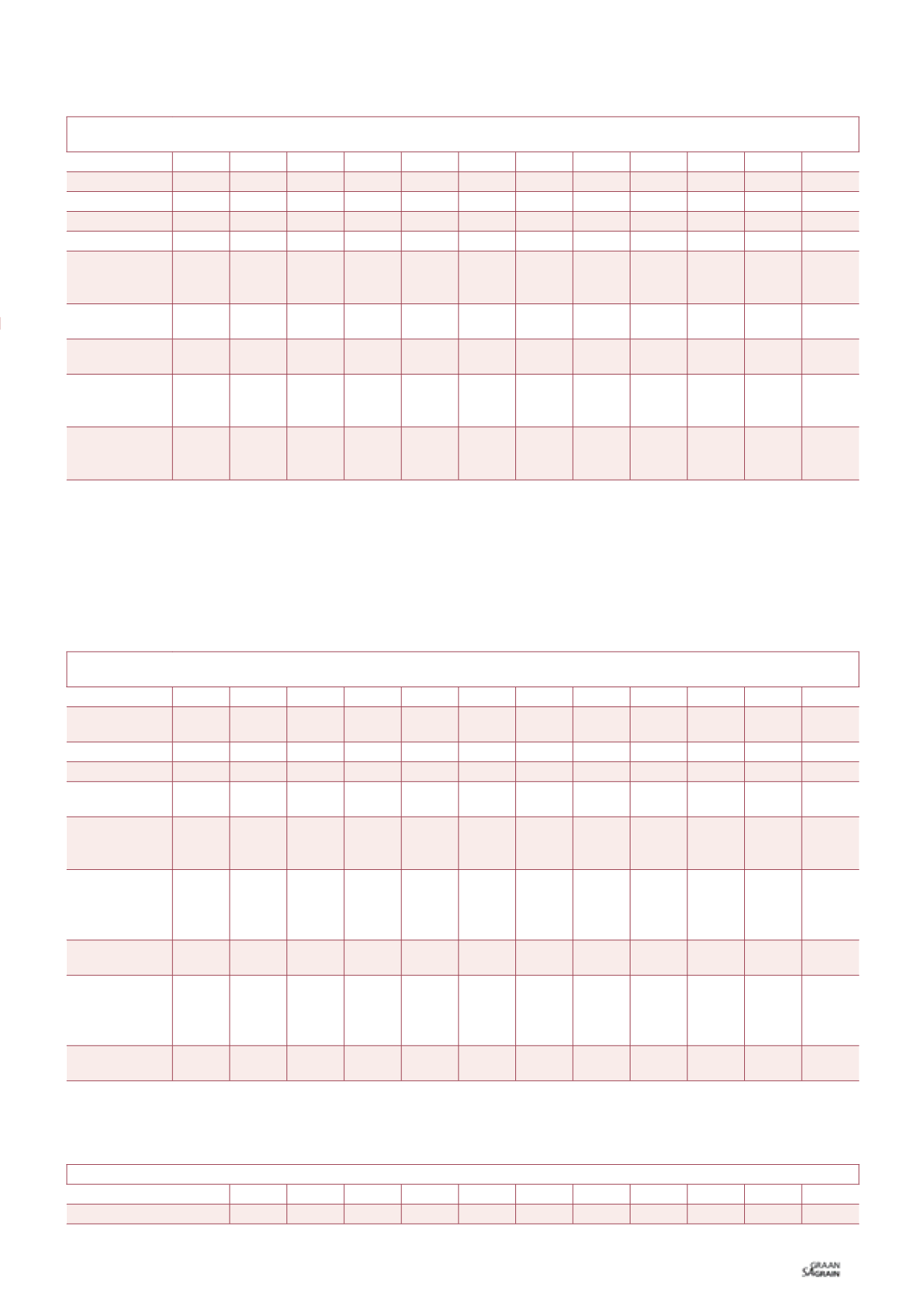

TABLE 1: THE PIPELINE REQUIREMENT FOR MAIZE (X ‘000 TONS).

MARKETING

YEAR

2004/

2005

2005/

2006

2006/

2007

2007/

2008

2008/

2009

2009/

2010

2010/

2011

2011/

2012

2012/

2013

2013/

2014

2014/

2015

2015/

2016

Production

9 482 11 450 6 618 7 125 12 700 12 050 12 815 10 360 12 121 11 811 14 250 9 665

Month*

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Mar/

Apr

Ending stock**

3 148 3 169 2 070 1 049 1 581 2 131 2 336

994 1 417

589 2 301 1 215

Imports

219

360

931 1 120

27

27

0

421

11

80

100

500

Early deliveries

March & April

212

91

550

668

352

322

172

615

842

497

580

489

Imports and

producer deliv-

eries

438

451 1 481 1 788

379

349

172 1 036

853

577

680

990

Stock levels

before imports

and producer

deliveries

2 717 2 718

589

-739 1 202 1 782 2 164

-92

564

12 1 704

225

Pipeline

required

45 days

911

45 days

933

45 days

957

45 days

1 004

45 days

1 077

45 days

1 082

45 days

1 107

45 days

1 118

45 days

1 117

45 days

1 169

45 days

1 209

45 days

1 217

Surplus/Short-

age above

pipeline require-

ment*

1 806 1 785 -368 -1 743

125

700 1 057 -1 210 -553 -1 157

495 -992

Processed in

March & April

1 214 1 244 1 276 1 338 1 436 1 444 1 476 1 490 1 490 1 558 1 612 1 622

TABLE 2: THE ANNUAL IMPORT REQUIREMENT.

* Indication of import need.

Source: SAGIS, 2015 and own calculations

TABLE 3: POPULATION GROWTH VERSUS MAIZE DEMAND.

Source: SAGIS, 2015 and Abstract of Agricultural Economics (2013)

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Population growth X000 46 888 47 391 47 851 48 687 49 321 49 991 50 587 51 771

NA NA NA

Local demand

7 283 7 462 7 660 8 029 8 613 8 658 8 857 8 941 8 935 9 349 8 379