Oktober 2018

62

Diesel refund survey

results

highlight key problem areas

D

iesel is an important input cost

for many producers. In terms of

agriculture’s total expenditure on

intermediate goods and servic

es, fuel represented approximately 9%

(R12 billion) in the 2016/2017 financial year.

The diesel refund system supports primary

producers in the agriculture, forestry,

fishing and mining sectors by giving full or

partial relief for the fuel levy and the road

accident fund levy. These levies form part

of the per litre price of diesel. Businesses

involved in qualifying activities can apply

to register for the system with SARS and

then claim a refund, based on the use (not

purchases) of diesel.

The aim of the system is to support the

international competitiveness of the agri

culture, forestry, fishing and mining sectors.

Furthermore, it aims to provide relief from

the road related tax burden, for certain non-

road users involved in qualifying activities.

According to the Organisation for Economic

Co-operation and Development (OECD)’s

Producer Support Estimate, the level of

subsidies for South African agriculture is

amongst the lowest in the world. In this

context, the diesel refund is the main

support mechanism available to South

African producers.

The system was first introduced in

2000, using a phased approach. The ad

ministration of the refund system is

linked to the VAT system and accordingly,

businesses need to be registered for VAT

to register for the diesel refund. For this

reason, the payment of the diesel refund is

linked to other departments within SARS,

such as VAT and debtors. Taxpayers need

to be cognisant of their net position in terms

of VAT and diesel refunds as this has an

impact on the processing and payment of

diesel refunds. Maintaining detailed records

and supporting documents is crucial when

claiming a diesel refund.

However, complying with the logbook

requirements can be problematic. There

is uncertainty as to the specific logbook

requirements that are used by auditors

when auditing diesel refund claims and this

can lead to delays in the audit process and

payment of the refunds. The diesel refund

is conditional in the sense that until a claim

has been audited, SARS may cancel a claim

that was previously approved.

The diesel refund system is a valued sup

port structure for the qualifying industries,

such as agriculture. However, delays in the

payment of refunds have an impact on cash

flow, leaving a gap in cash flow that needs

to be managed.

Emerging farmers, not registered for VAT,

cannot currently use the refund system

(except for those in the sugar industry).

However, the National Treasury and SARS

are in the process of reviewing the system

and hosted further stakeholder consulta

tions during August 2018. One of the

proposals is to separate the administration

of the diesel refund and VAT systems.

Within this context, Agri SA and the

South African Institute of Tax Professionals

(SAIT) collaborated to conduct a survey

among users of the diesel refund system.

The aim of the survey was to identify any

problems experienced with using the

current system. The results will be used

to engage with SARS on how these issues

On farm level

Diesel Refund / VAT / SARS

Inputs

r Requier Wait,

head: Economics and Trade, Agri SA

a d

Erika de Villiers,

head of Tax Policy,

South African Institute of Tax Professionals

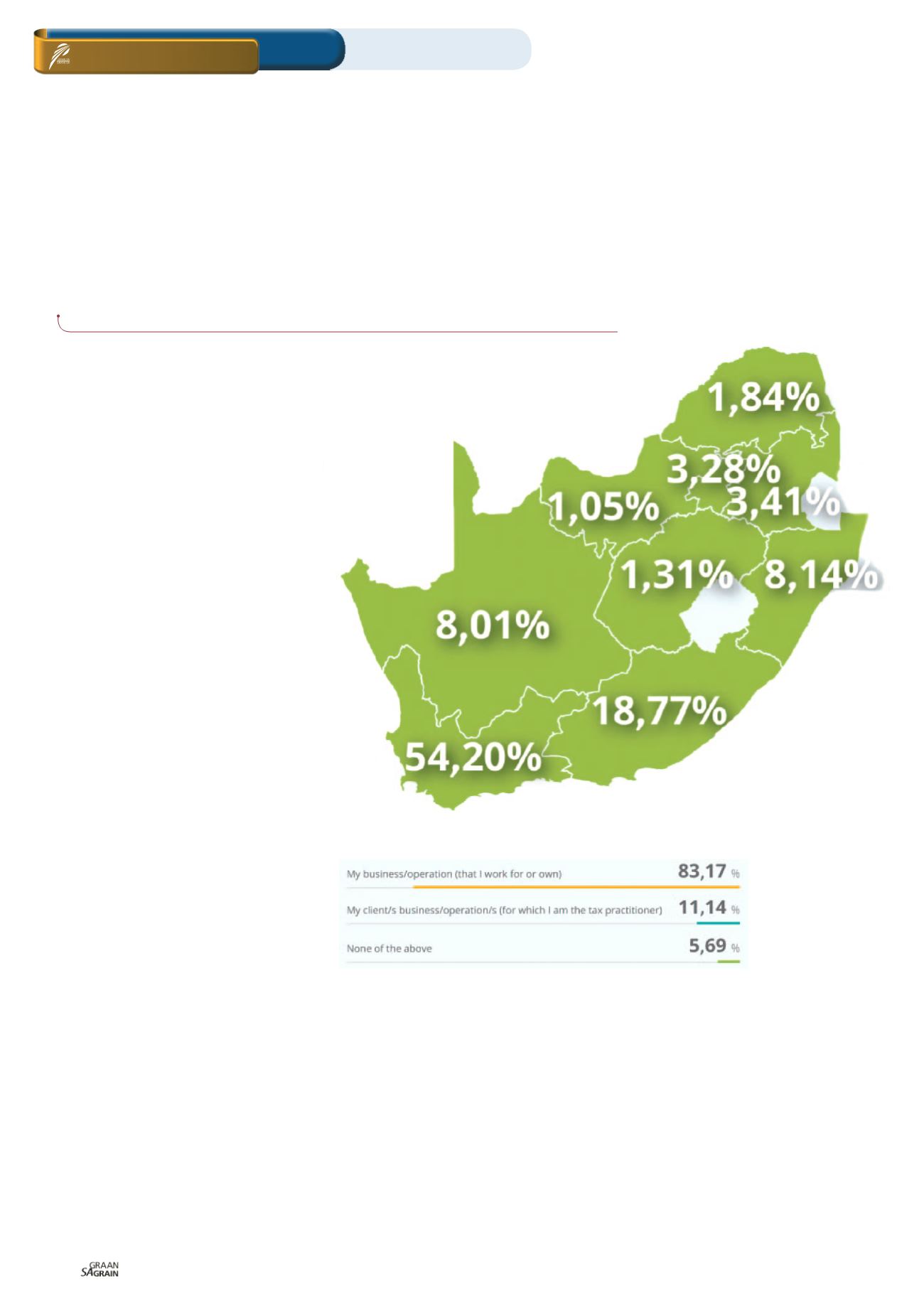

1. In which province/s do you submit VAT

returns for diesel refund claimants?

2. On whose behalf do you claim the diesel refund?