80

Augustus 2018

Removal of VAT crucial

for industry’s survival

T

he sorghum industry was over-

whelmed by Finance Minister

Nhlanhla Nene’s decision to appoint

an independent panel of experts to

review the current list of zero-rated value-

added tax (VAT) items. Sorghum is one of

those items on which VAT is currently lev-

ied. This happened after the 2018 Budget

speech in which an increase in VAT from

14% to 15% was announced: The first in-

crease since 1994.

Sorghum meal competes directly with

maize meal and the VAT on sorghum makes

sorghum products less competitive than

maize products. This limits consumers who

want to diversify with products in the same

food basket – specifically consumers in the

lower income group.

Grain SA, with the support of the sorghum

industry, submitted a proposal and ap-

pealed to Treasury to consider the zero-

rating of sorghum and sorghum meal, as the

industry is faced with numerous challenges

which can lead to its demise.

While writing this article, Grain SA has not

yet received any feedback on the outcome

of the request that sorghum should be

zero-rated.

Problem statement

South Africa prides itself as being the most

food secure country on the African con-

tinent. However, on household level, the

country is still lacking, mainly due to the

affordability levels of some food products.

While sorghum features well in terms of

quality, safety and availability, the afford-

ability remains a key concern.

This is regrettable as sorghum has numer-

ous health benefits and has a big role to

play in a more balanced diet, particularly

among the lower living standards measure

(LSM) groups, who don’t have the buying

power to access additional nutritious sup-

plements. These facts led to Grain SA and

the sorghum industry believing that a relief

in terms of VAT on sorghum related foods

can have a far more positive contribution

in improving South African households’

food security.

The unfair impact of VAT on sorghum and

sorghum meal products compared to other

grain and oilseed commodities puts the

consumption of sorghum at a disadvantage

to substitute products. Consequently, the

VAT on sorghum also contributes to the de-

crease in consumption as it has an impact

on consumer prices.

Consumption and

production

Sorghum is indigenous to Africa and is the

staple food for a big part of the South Afri-

can population. It is mainly used for human

Petru Fourie,

research co-ordinator and production cost analyst, Grain SA

S

O

R

G

H

U

M

Spotlight

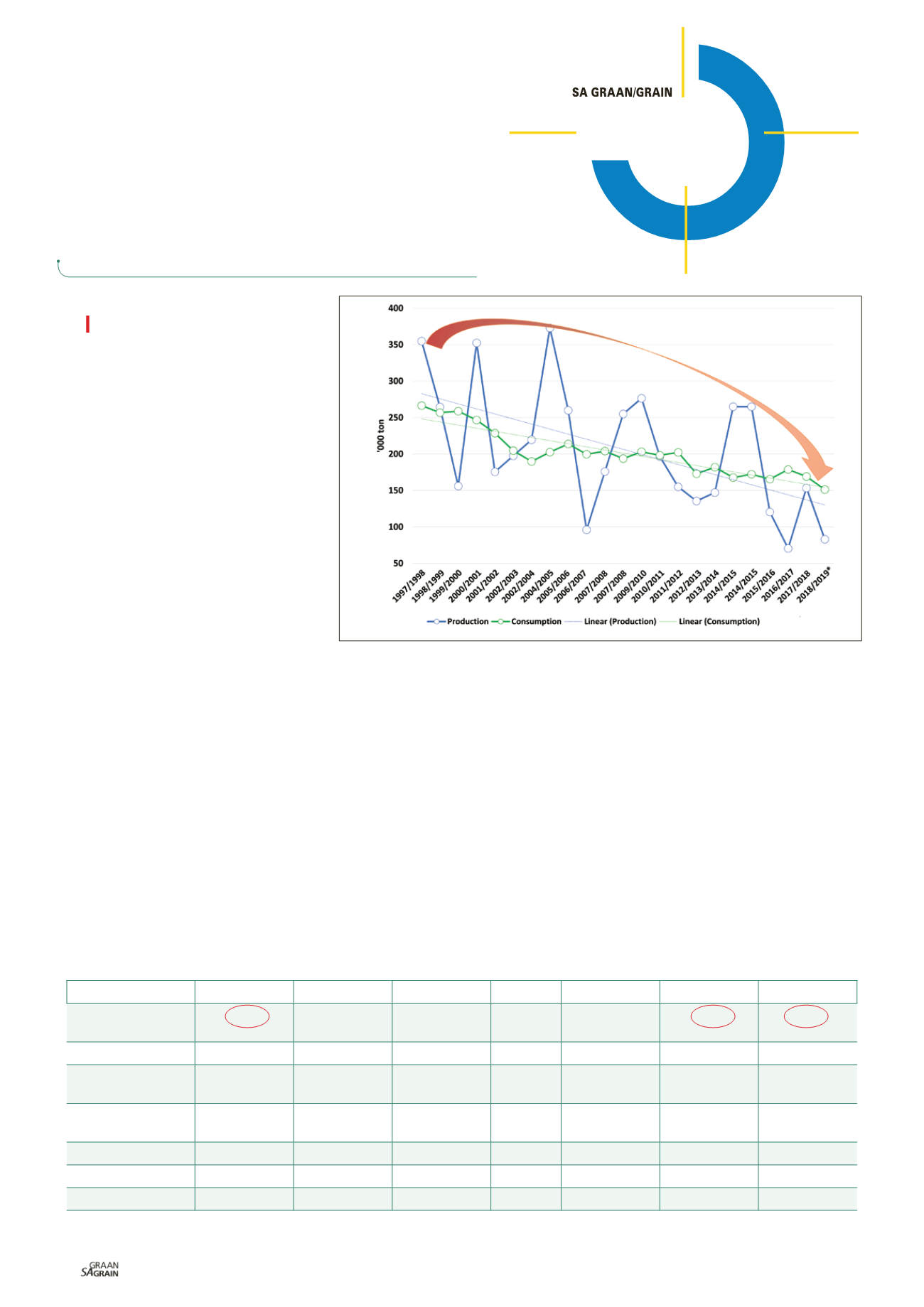

Graph 1: Total South African sorghum consumption and production.

Source: SAGIS, 2018

*Outlook

COOKED PER 100 G PROTEIN (G)

CHO* (G)

ENERGY (KJ)

FAT (G)

FIBRE (G)

ZINC (MG)

IRON (MG)

Mabella

(sorghum flour)

3

21,8

471

1

0,7

0,79

1,3

Rice

2,7

27,5

531

0,3

0,4

0,46

0,2

Maize meal super

fortified

1

11

200

0,4

1,1

0,27

0,6

Maize meal super

unfortified

1,1

11

210

0,3

1,1

0,1

0,2

Bread (brown)

9

43

1 029

1,4

5,5

4,49

4,1

Millet

3,5

23,3

499

1

0,4

0,91

0,6

Potato

1,5

15,5

318

0,1

1,5

0,26

0,6

Table 1: The nutritional values of sorghum compared to substitute products (per 100 g).

* Carbohydrate

Source: BFAP, 2018