The signiϐicance of China in grain

and oilseed global markets

c

hina continues to be an important player in the grain

markets, particularly when referring to demand. The

country is the second largest cereal (grain) importer, ac-

counting for 6% of the global traded cereals in 2014.

Moreover, China is also a leading importer of oilseeds, ac-

counting for 42% of the global traded oilseeds in 2014.

Hence, the current economic slowdown has caused major con-

cerns in the grain markets, which has led to increased volatility in

prices. In this article, we will briefly explore the Chinese grain and

oilseed market structure, in a view to present its significance in the

global grain and oilseed markets (which also influences the South

African grain and oilseed markets).

Chinese cereal (grain) import perspective

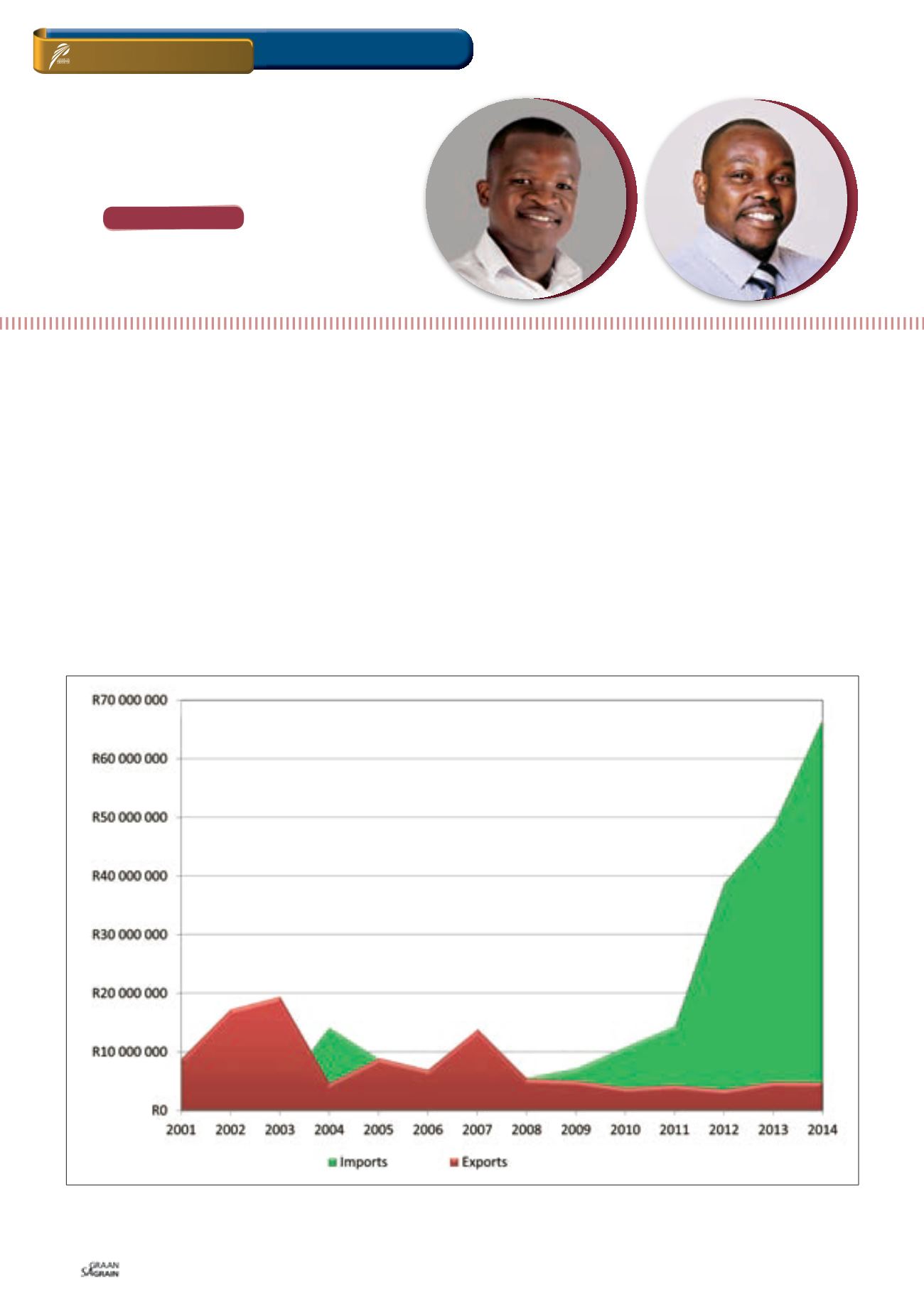

China has been the net importer of cereal since 2008, with im-

ports increasing significantly between 2009 and 2014, from

R7,3 billion to R67 billion. Although various factors contributed

to this increase, the most significant has been an increased con-

Oktober 2015

56

WANDILE SIHLOBO,

economist: Grain SA and

TINASHE KAPUYA

,

head: Trade and Investment, Agbiz

GRAIN MARKET

overview

– 15 September 2015

ON FARM LEVEL

Graph 1: Chinese cereal imports and exports in rand value.

Source: International Trade Centre (2015)

* Cereal = Maize (HS Code: 1005), Wheat (HS Code: 1001), Rice (HS Code: 1006), Rye (HS Code: 1002), Barley (HS Code: 1003), Sorghum (HS Code: 1007),

Oats (HS Code: 1004) and Buckwheat, millet and canary seed (HS Code: 1008)