Maart 2016

72

ON FARM LEVEL

South Africa’s soybean industry:

A brief overview

s

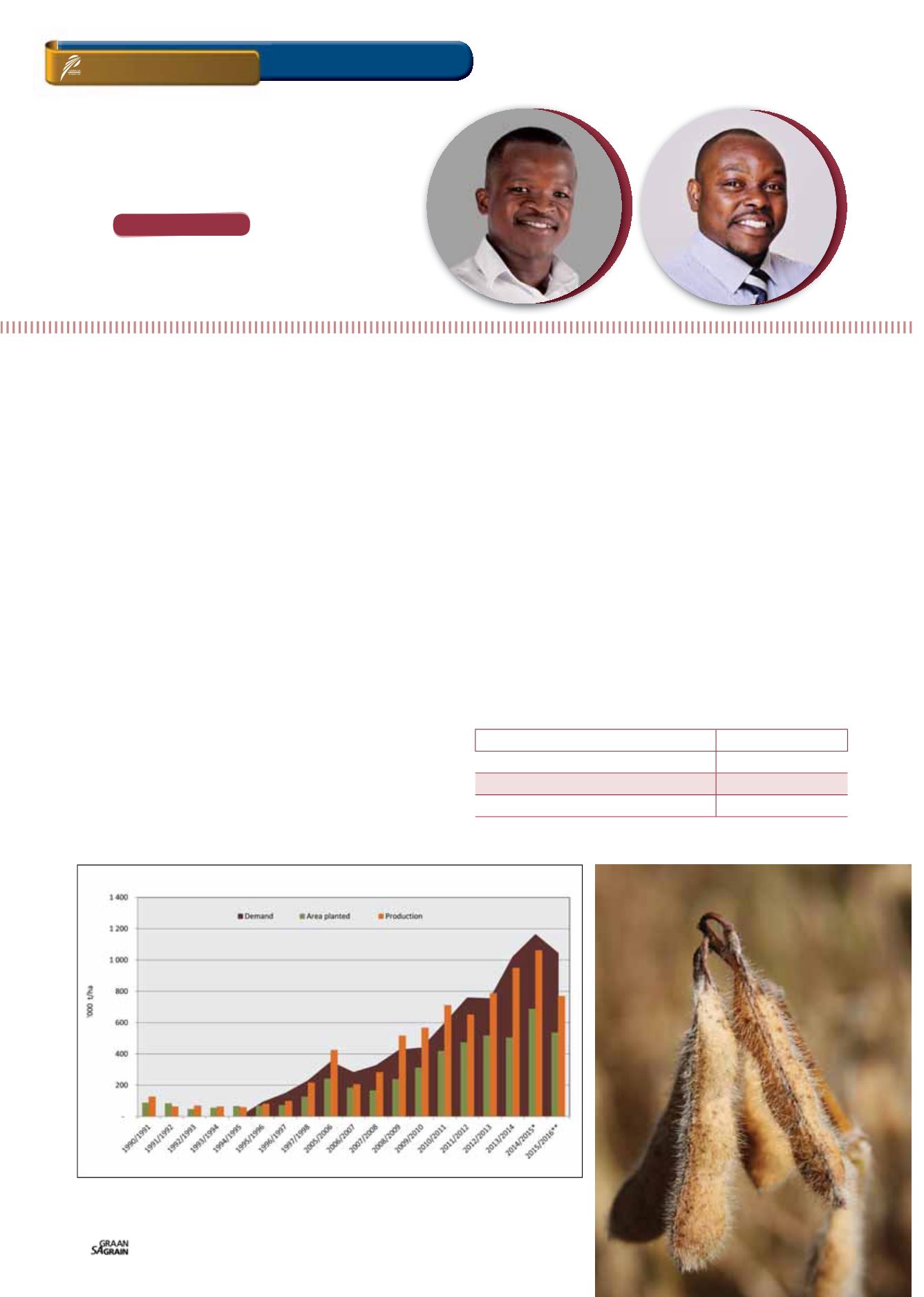

outh Africa has in recent years made significant invest-

ments in the domestic soybean crushing capacity. These

investments led to increases in the crushing capacity of

approximately 2,2 million tons plus.

Among others, investment towards soybean crushing

capacity was aimed at stimulating domestic soybean production,

as part of import substitution strategy. South African soybean pro-

ducers responded positively to these demand changes, and for the

first time the country’s production reached 1 million tons in the

2015/2016 marketing season.

Despite the increasing levels of soybean production, South Africa

still imports considerable volumes of soybean oilcake and oil, and

there is still considerable scope for production increases in order

to substitute these imports. In fact, South Africa’s domestic soy-

bean production is only a third of the country’s crushing capacity.

In the 2016/2017 marketing season, South Africa’s soybean pro-

duction is expected to decrease by 27% year-on-year, leaving room

for increases in oilcake and oil imports.

Moreover, the country is the largest importer of soybean oilcake in

Sub-Saharan Africa, accounting for an average of 72% of import

demand. According to the Protein Research Foundation, South

Africa’s soybean oilcake requirements in 2015/2016 will be

1,5 million tons, 55% of which would have to be imported.

Significant growth in oilcake and oil demand have been driven, to

a large extent, by increasing demand for animal feed, which in turn

has been stimulated by increases in the demand for high protein

food, more specifically within the growing middle class. In this arti-

cle, we briefly explore the soybean market structure by reflecting on

its production and trade trends.

Production perspective

Soybean is produced throughout the country, but significant pro-

duction takes place in the Free State and Mpumalanga provinces.

WANDILE SIHLOBO,

economist: Grain SA and

TINASHE KAPUYA

,

head: Trade and Investment, Agbiz

GRAIN MARKET

-overview

– 9 February 2016

Graph 1: South African soybean production.

Source: Grain SA (2016)

*1990/1991 - 1994/1995 = data limitations

YEAR

CAPACITY (TONS)

Crushing capacity in 2012

860 000

Estimated new crushing capacity in 2014

1 340 000

Estimated total capacity

+2 200 000

TABLE 1: SOUTH AFRICAN SOYBEAN CRUSHING CAPACITY.

Source: Protein Research Foundation and author’s deductions

Grain SA

/

Sasol Base Chemicals photo competition