73

March 2016

South African soybean production has

always varied throughout the years, but

mostly above the domestic demand (see

Graph 1

).

However, from the 2013/2014 production

season, demand outstripped production

on the back of increasing demand from

the newly established crushing plants (see

Table 1

).

This gap is expected to widen in the

2016/2017 marketing season due to low-

er expected production on the back of a

drought.

Soybean production grew by 63% between

the 2011/2012 to 2014/2015 production sea-

sons. At the same time, the area planted

increased by 57%. The key underlying fac-

tor behind this growth was the demand

from the crushing plants. It is important to

highlight that of the estimated 2,2 million

tons plus of total crushing capacity, about

1,3 million tons are dual – meaning that it

can crush both sunflower seeds and soy-

beans (see Table 1).

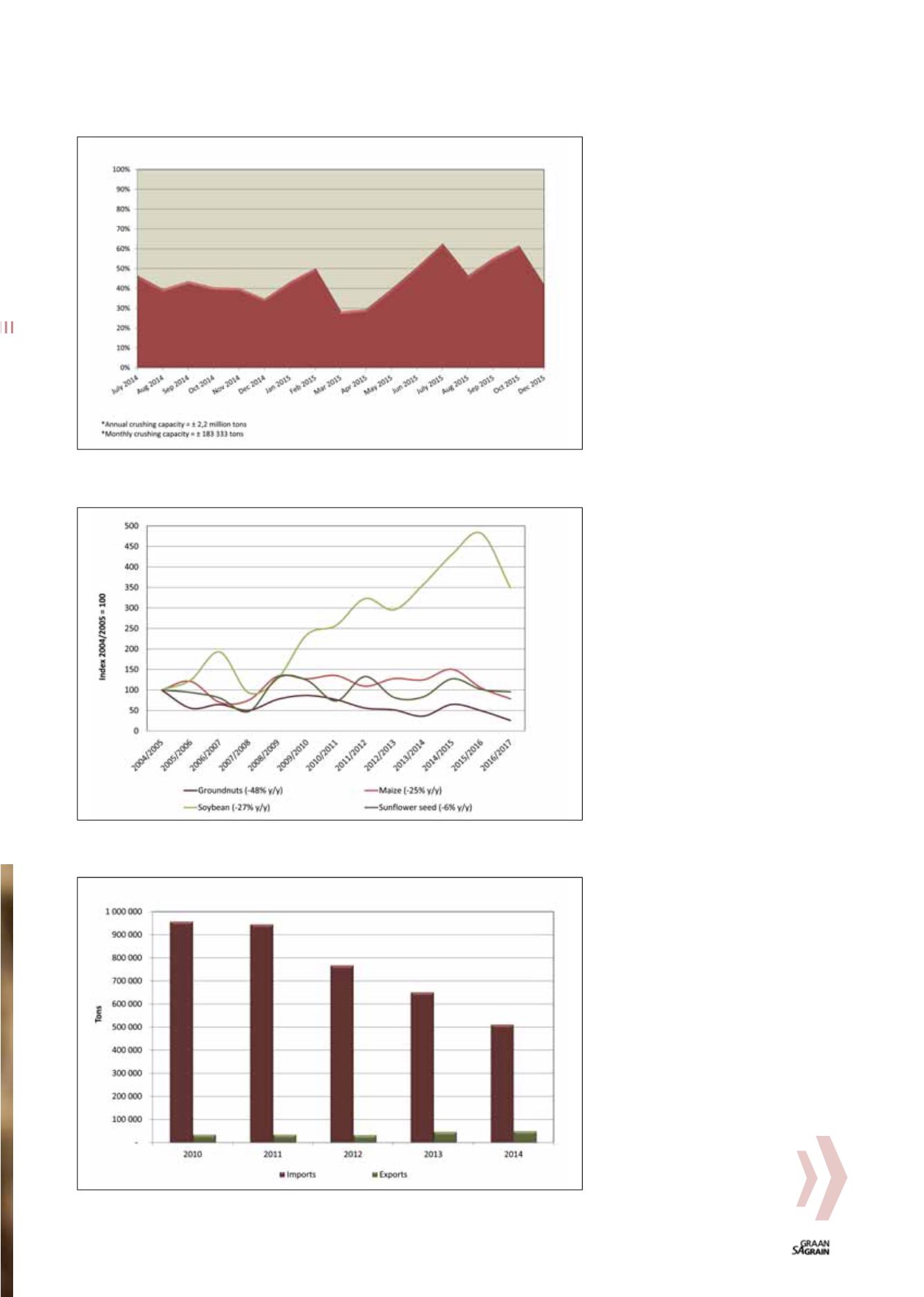

Moreover, the crushing plants are not yet

crushing at full capacity. The highest crush-

ing reached so far was 62% of the monthly

rate in July 2015 and December 2015 (see

Graph 2

). The reason for this might be at-

tributed to the current higher prices as well

as some mechanical issues within the firms,

as some were still in their final stages of

construction.

Closer look at production

South Africa’s 2016 total summer crop is

expected to decrease by 24% year-on-year.

Of these, soybean production is expected

to decrease by 27% year-on-year to

768 560 tons. This expected decrease in

production is due to the current drought

conditions which have led to a decrease

in area planted as well as possibilities of

lower yields.

Nonetheless, over the past twelve years the

soybean crop showed significant growth

when compared to maize, sunflower seeds

and groundnuts (

Graph 3

). Of all the afore-

mentioned crops, groundnuts is the only

crop that showed significant decrease,

due to a decrease in yields and domestic

demand, particularly in the edible peanut

market.

Over these years, soybean yield levels did

not show any significant changes. With

the exception of 2016/2017, national yields

averaged at around 1,21 tons per hectare.

It is worth noting that the crop increase in

2015/2016 would possibly have been higher

than the estimated 1 million tons’ produc-

tion, as the area planted increased 37%

year-on-year. However, this increase was

overshadowed by the current drought con-

ditions.

Graph 2: South African soybean monthly consumption versus estimated monthly crushing capacity.

Source: Grain SA (2016)

Graph 3: Summer grain production index.

Source: Grain SA (2016)

Graph 4: South African soybean oilcake imports and exports.

Source: Trade Map (2016)