Junie 2015

36

FOCUS

Special

Value adding

The future of sunϐlower

production in South Africa

– a study by the Bureau for Food and Agricultural Policy (BFAP), funded by the

Oilseed Advisory Committee (OAC)

FERDI MEYER

and

GERHARD VAN DER BURGH,

both from the Bureau for Food and Agricultural Policy

O

ver the past two decades, the

South African sunflower industry

has been characterised by volatile

production levels with virtually

no real growth while domestic demand for

oilcake and vegetable oil has increased by

approximately 40%.

The imports of seed, oil and cake have grad-

ually been increasing to meet the rising do-

mestic demand levels. With approximately

double the amount of crushing capacity

available as the amount of sunflower seed

that is produced locally, the question arises

why the local industry can’t fill the gap of

imports and increase the local level of pro-

duction. Although the study took a holistic

view on the sunflower value chain, this arti-

cle will mainly focus on selected key drivers

of sunflower seed production.

Over the years, sunflowers have received

the status of an ideal crop to grow in South

Africa under conditions of low-input farming

and marginal cropping conditions. Sunflow-

ers’ ability to produce relatively consistent

yields under adverse weather conditions

and their overall characteristic of drought-

tolerance makes it an attractive crop for pro-

ducers in dryland production regions.

Sunflowers can also produce a crop on mar-

ginal soils with very little or no additional

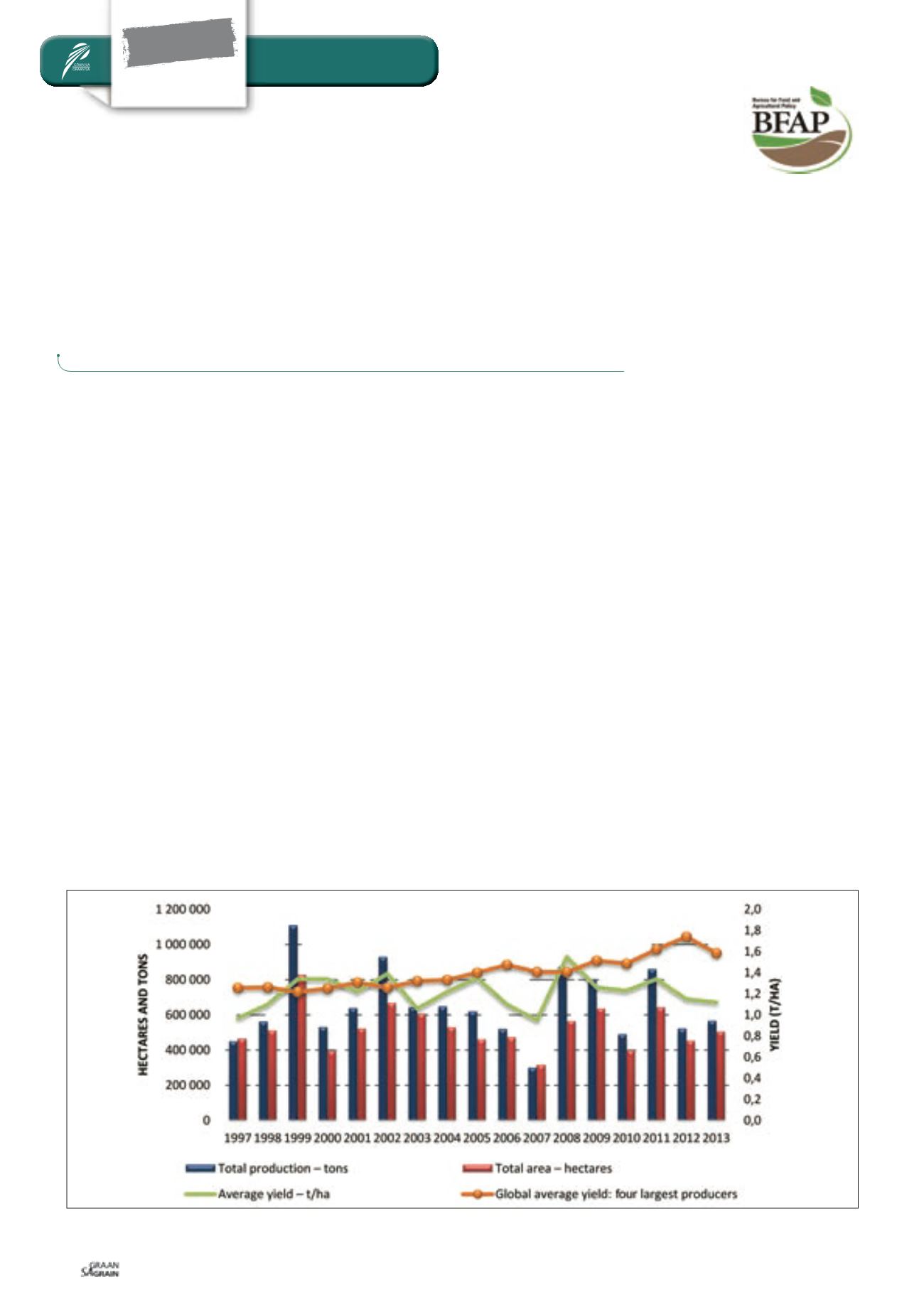

fertiliser. In 1999 the sunflower area reached

its peak when 828 000 hectares (

Graph 1

)

were planted. Production is concentrated

in the Free State (FS) and North West

Province (NW), which together account for

79%of the national area planted to sunflower.

Since its peak in 1999, the area planted has

followed a declining trend with greater re-

ductions in the North West Province com-

pared to the other production regions. The

reasons for these reductions differed from

one region to the next and included: The

adoption of new bio-tech maize cultivars

with better yields, practical producer con-

straints e.g. negative sentiments to the crop

based on historic incidents such as poor

emergence, Sclerotinia, falling over prob-

lems, bird damage and the possible exclu-

sion of marginal land under crop cultivation.

However, one underlying factor stood out

in all production regions for why produc-

ers are reluctant to expand the area under

sunflower production, and that is that under

ideal growing conditions or irrigation, sun-

flowers do not provide the same upward

potential as crops like maize and soybeans.

As a consequence, many producers see the

crop as a “catch crop” and preference is not

given to the timing of production, i.e. opti-

mal planting date and climatic conditions

(soils might be too warm or there might be a

lack of moisture, etc.).

It is not uncommon for producers in certain

production regions to leave sunflowers as a

last resort, waiting till the very last day to

plant, ”the 35th of January” in producers’

terms. The adverse effects of the wrong

planting dates have been trailed and prop-

agated to producers and those who have

adapted to guidelines of optimal cropping

practices have achieved improved yields.

It seems as if sunflower hybrids that are

currently available in the local market do

have the genetic potential to produce high-

er yields. Furthermore, the introduction of

advanced Clearfield Plus sunflower breeds

offers a major benefit in the management

of weeds and opens the opportunity for

growing sunflowers in no-till or minimum

till farming systems.

Graph 2

illustrates the gap between the ave-

rage yields obtained in the ARC-GCI yield

trials and the average yields obtained in the

Graph 1: Productivity of the South African sunflower industry.

Source: SAGIS (2014) and Oilworld (2014)