Disclaimer

Everything has been done to ensure the accuracy of this information, however Grain SA takes no responsibility for

any losses or damage incurred due to the use of this information.

19

December 2016

Conclusion

There are, however, still a few uncertainties in the market ranging

from weather forecasts to the macroeconomic environment – which

can have a severe impact on the prices.

The recent rain that fell in large parts of the country’s maize pro-

ducing areas were sufficient for producers to start with plantings

within the normal planting window – especially towards the eastern

parts of the country. In the more western parts of the country there

are still areas that need some rain in order to start planting, but it

is currently still a bit early in the season and they still have time in

their normal planting window.

One important thing for producers is to identify the possible risks

that may arise during the coming season, whether it is production

or pricewise.

Once one knows what the possible risks are, one can start think-

ing of the different opportunities that arise when managing the

manageable risks. Price risk can largely be managed by hedging or

by means of diversification of crops.

WHITE MAIZE

YELLOW MAIZE

MARKETING YEAR

2017/2018**

LOWER

YIELDS

2017/2018**

AVERAGE

YIELDS

2017/2018**

HIGHER

YIELDS

2017/2018**

LOWER

YIELDS

2017/2018**

AVERAGE

YIELDS

2017/2018**

HIGHER

YIELDS

*Area planted (x 1 000 ha)

1 455

1 455

1 455

1 008

1 008

1 008

**Yields (t/ha)

3,4

4,0

4,4

4,6

4,9

5,4

**Production (x 1 000 ton)

4 947

5 820

6 402

4 637

4 939

5 443

('000 ton)

('000 ton)

('000 ton)

('000 ton)

('000 ton)

('000 ton)

Commercial supply

Opening stocks

558

558

558

723

723

723

***Commercial deliveries

4 862

5 735

6 317

4 292

4 594

5 098

Imports

120

0

0

1 710

820

0

Total commercial supply

5 540

6 293

6 875

6 725

6 137

5 821

Commercial demand

Commercial consumption

4 300

4 970

5 490

5 380

4 860

4 410

Total RSA commercial

consumption

4 406

5 076

5 596

5 690

5 170

4 720

Exports

580

580

580

350

350

540

Total commercial demand

4 986

5 656

6 176

6 040

5 520

5 260

Ending stocks (30 April 2018)

554

637

699

685

618

562

Pipeline requirements

(1,5 months)

538

621

686

673

608

551

Surplus above pipeline

17

16

13

13

10

11

Ending stocks as % of RSA

consumption

13%

13%

12%

12%

12%

12%

TABLE 1: POSSIBLE SUPPLY AND DEMAND SCENARIOS FOR THE 2017/2018 MARKETING SEASON.

*CEC first intentions to plant estimates

**Estimated yield and production possibilities for the 2017/2018 marketing season

***Includes deductions of estimated retentions

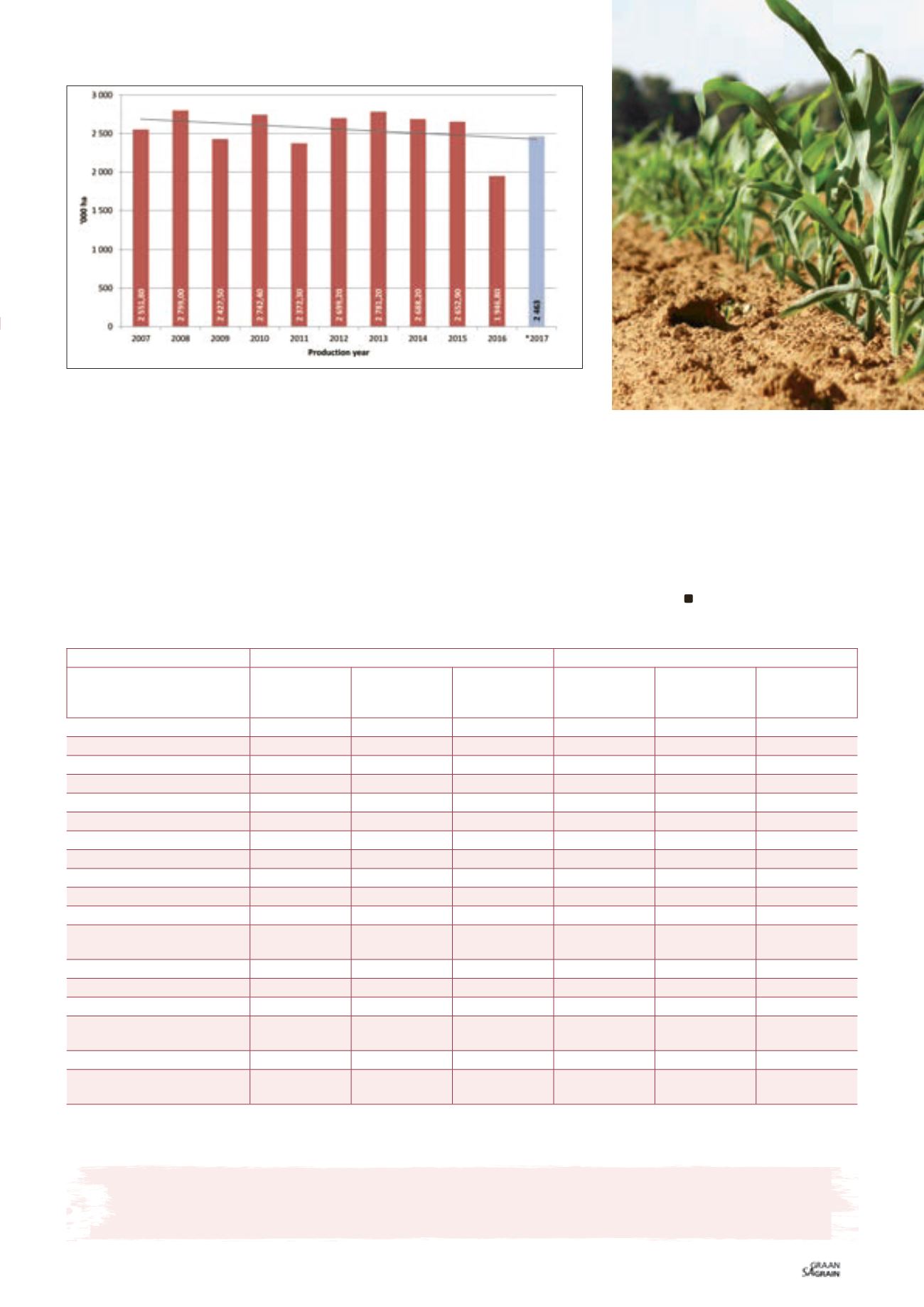

Graph 1: Total area planted to maize in South Africa.

*Intention to plant estimate

Source: Grain SA

Grain SA/Sasol photo competition

– Enrico Cronje 2011