South Africa’s soybean industry:

A brief overview

s

outh Africa is the largest importer

of soybean oilcake in sub-Saharan

Africa, accounting for an average

of 72% of import demand. With

an estimated soybean crushing

capacity of 2,3 million tons, South

frica remains the largest industrial user

of soybean in the sub-Sahara region.

The exponential growth in oilcake and oil

demand has been driven, to a large de-

gree, by increasing demand for animal feed,

which in turn, has been spurred on by an

increase in demand for high protein food

– especially within the growing middle class.

South African soybean production has

responded positively to these changing

demands, and for the first time ever, the

country’s production is projected to reach

1 million tons in the 2015/2016 season.

Despite the increasing levels of soybean

production, South Africa still imports con-

siderable amounts of soybean oilcake and

oil, and there is still scope to further in-

crease production in order to substitute

these imports.

In fact, South Africa’s domestic soybean

production is a third of the country’s crush-

ing capacity. In this article, we briefly

explore the soybean market structure by

reflecting on production, consumption and

trade trends.

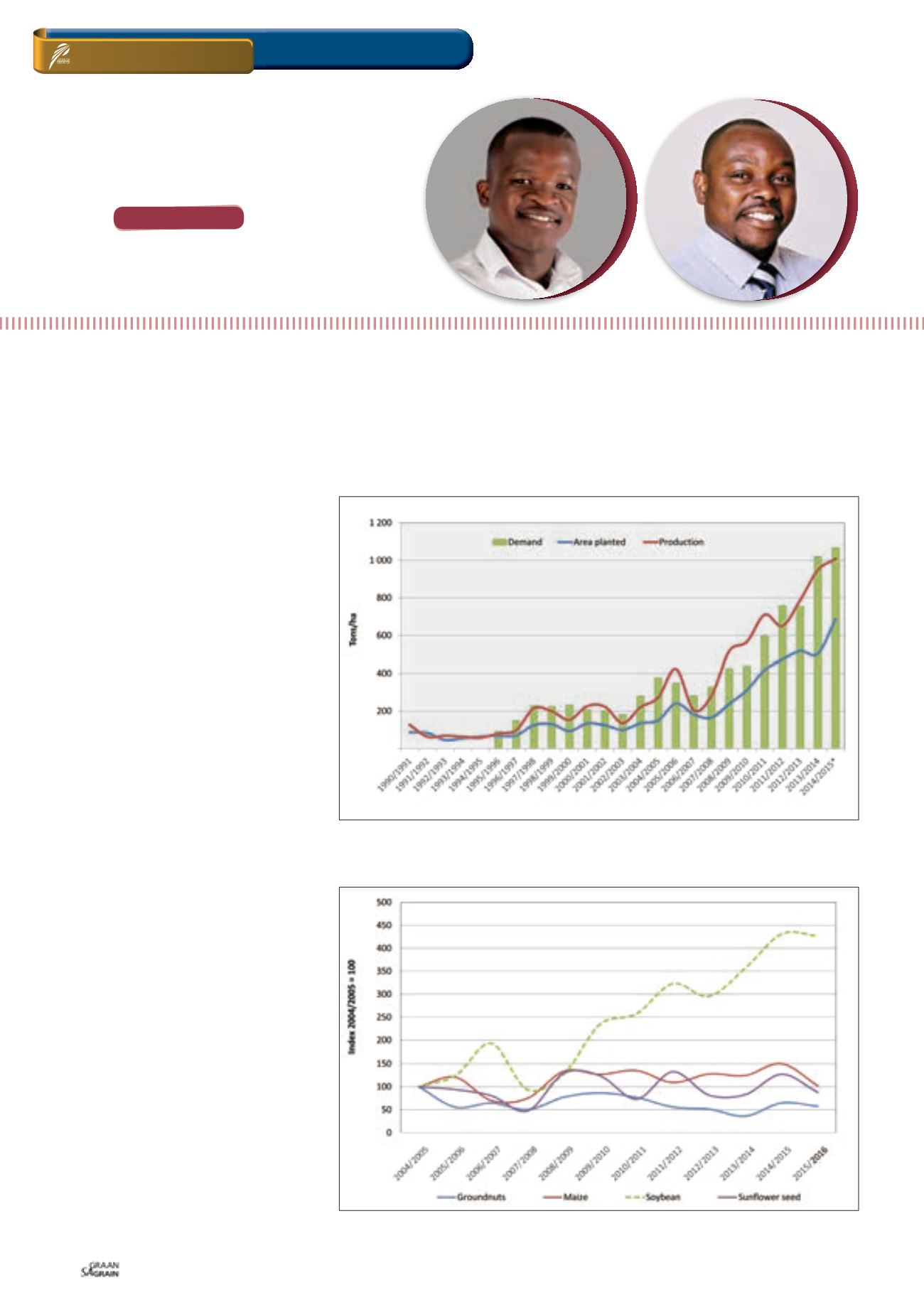

Production perspective

Soybean is produced throughout the coun-

try, with significant production in the Free

State and Mpumalanga provinces. South

African soybean production has varied

throughout the years, remaining mostly

above the domestic demand (

Graph 1

).

However, as from the 2012/2013 produc-

tion season, demand exceeded production

due to an increased demand from the new-

ly established crushing plants (

Table 1

).

Augustus 2015

66

ON FARM LEVEL

WANDILE SIHLOBO,

economist: Industry Services, Grain SA

and

TINASHE KAPUYA

,

head: Trade and Investment, Agbiz

GRAIN MARKET

overview

– 14 July 2015

Graph 1: South African soybean production.

Source: Grain SA (2015)

* 1990/1991 - 1994/1995 = data limitations

Graph 2: Summer grain production index.

Source: Grain SA (2015)