Product information

25

April 2018

Planting less

Other structural solutions would be either

planting less or increasing demand in the

country.

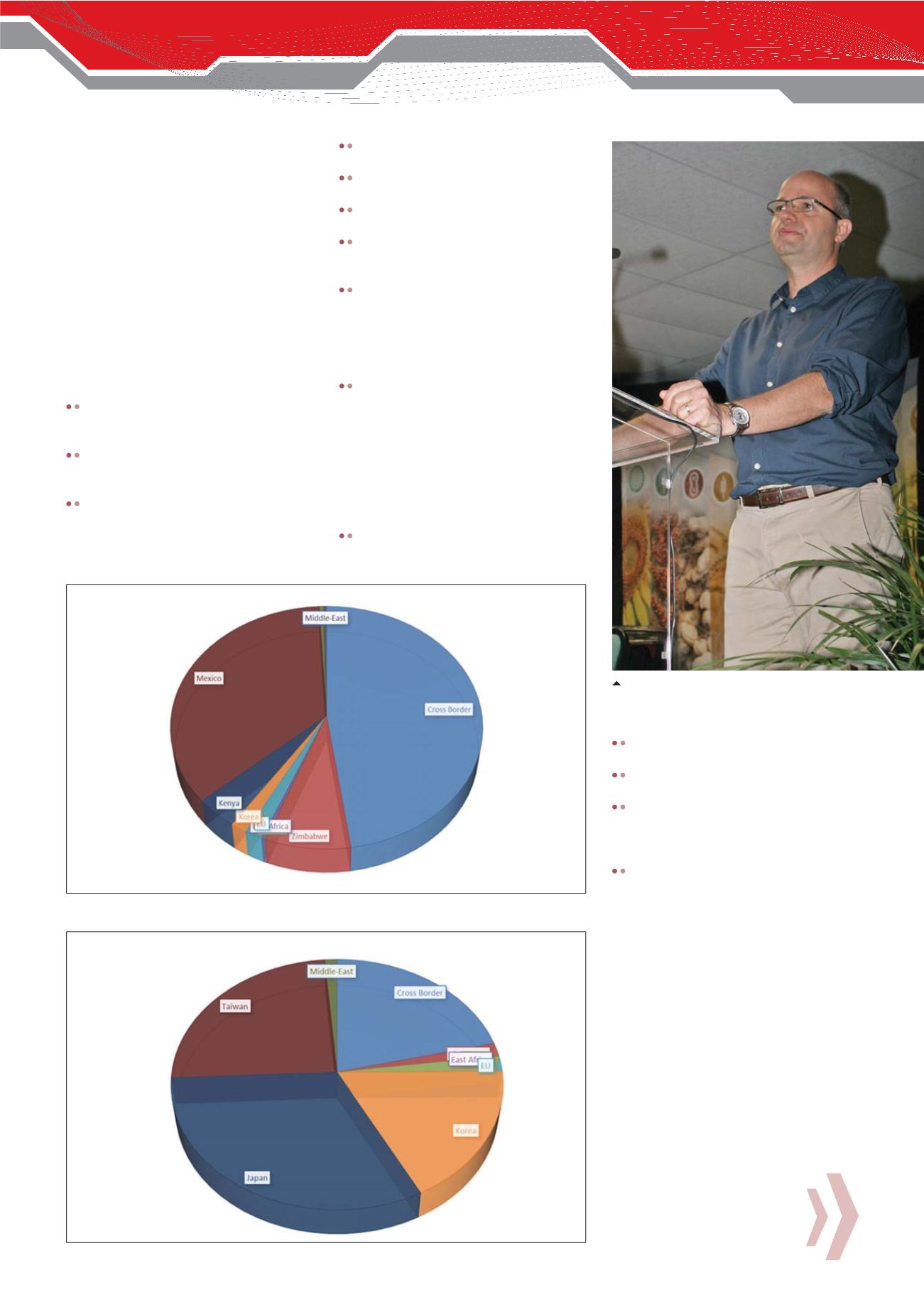

Export destinations

Our exports have traditionally flowed re-

gionally, cross-border but exports are

moving sideways at present (

Graph 3

and

Graph 4

). Recent exports to Mexico could

be a once-off as the USA usually supplies

them. In most instances we are competing

with the USA, so South African producers

are always on the back foot.

Other influences

Freight spreads – cost of freight influ-

ences our ability to compete with the

competition.

China has a surplus of maize and partici-

pates in the market as an exporter not

an importer.

Protocols, biosafety and phyto-sanitary

regulations: Without agreements in

place no exports are possible. These

take time and require expertise.

Malaysia doesn’t like USA maize but

we still must compete with Brazil.

Iran is a good option but we’re still work-

ing on bio-safety protocols.

Vietnam is open to South African grains

and COFCO will ship there soon.

EU is not a logical destination in terms of

freight economics but we are shipping

there at present.

Venezuela imports 1 million tons/year

grains and is an attractive white maize

destination for our product. They pay

R300/ton premium and Jetten says

South Africa is close to agreement with

them.

The world is not waiting for South Afri-

can soybean exports. The product is not

well known and variation in quality is a

challenge.

Differentiation and cost

leadership

There is no great opportunity for differentia-

tion on any grain commodity:

Our maize product is considered best

in the world: Low moisture, low foreign

matter, minimal breaks but struggling to

get a premium.

Soybeans have variable quality and low

oil content.

Cost of moving grain in South Africa is

expensive.

Rail versus road: There is improved

movement by rail but there are limita-

tions to numbers of rail trucks on export

corridor (32 per day).

Terminals: Port logistics are not as ef-

ficient e.g. Argentina loads one vessel

per day, Durban loads the same vessel

in five days – this costs us.

Value-adding

Crush capacity

Increased crush capacity has absorbed in-

creased production – but not everything.

This limitation is based on the absorption of

local meal in the feed industry.

Vertically integrated

value chain

There are substantial volumes of frozen chick-

en imports. This needs to be stopped and

translated into local poultry production which

consumes locally produced grain. This would

make a significant impact and will assist both

maize and soybeans in local markets.

Ethanol from maize

Support for the ethanol industry is a logi-

cal choice.

Graph 4: South African yellow maize exports from 2011 to 2017.

Ronald Jetten

Graph 3: South African maize exports from 2011 to 2017.