November 2024

| LERATO RAMAFOKO, AGRICULTURAL ECONOMIST INTERN, GRAIN SA |  |

BY CONDUCTING A THOROUGH MARKET ANALYSIS BEFORE PLANTING, FARMERS CAN MAKE INFORMED DECISIONS THAT MITIGATE RISKS AND ALIGN PRODUCTION WITH THE MARKET NEEDS. THIS ARTICLE AIMS TO GIVE A SMALL OVERVIEW OF WHAT THE FARMER NEEDS TO CONSIDER IN PREPARATION FOR THE UPCOMING SEASON.

In today’s dynamic agricultural landscape, finding a market before planting grains and oilseeds has become a critical factor in ensuring both profitability and sustainability. Farmers face numerous challenges, including a fluctuating demand, price volatility and increasing competition from both local and global markets.

PRODUCTION DATA

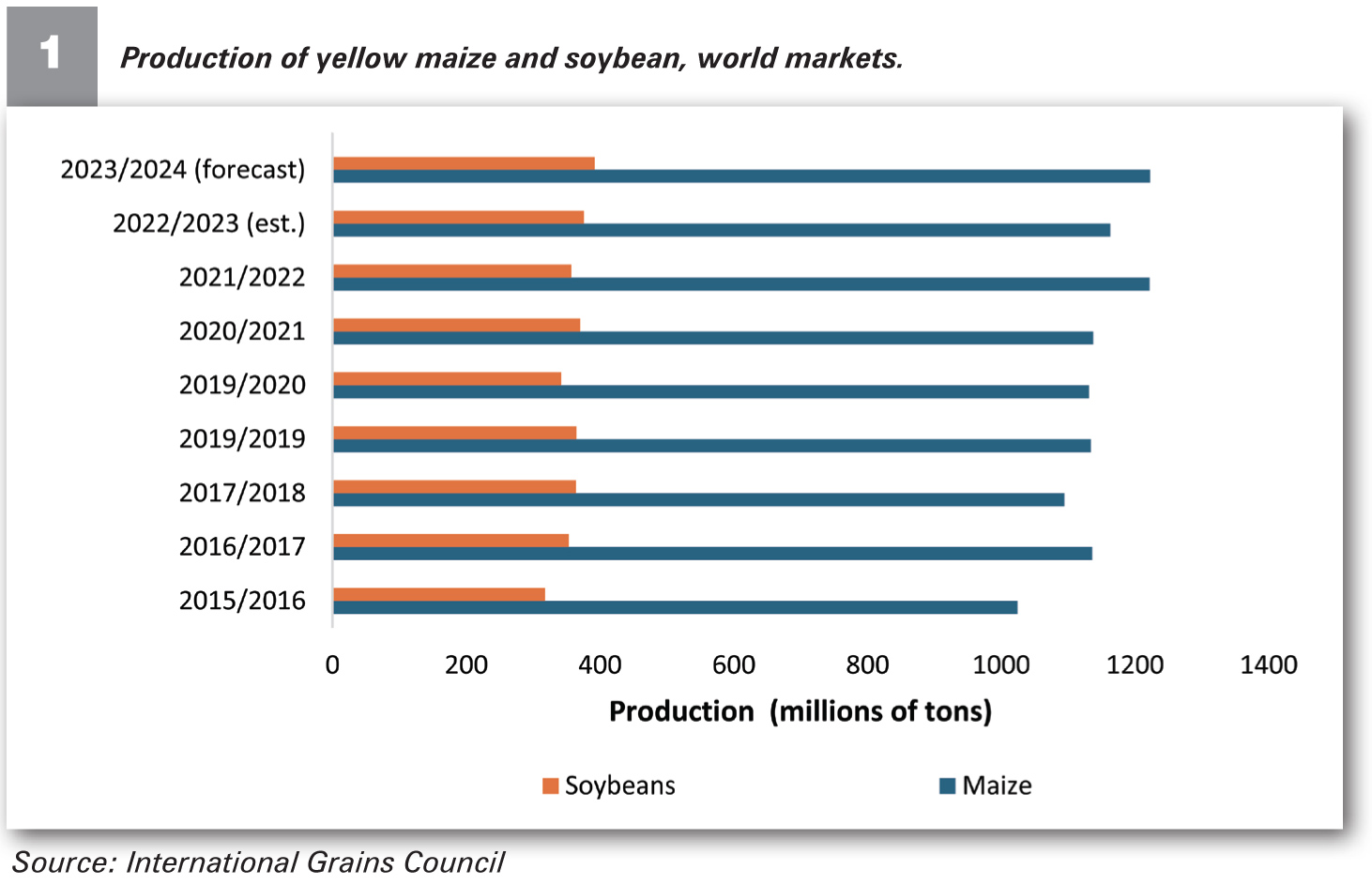

The data for maize and soybean production between 2015/2016 and 2023/2024 reveals interesting trends for both crops. Maize production shows steady growth overall, with a notable increase from 1 024,41 million tons in 2015/2016 to a forecasted 1 222,2 million tons for 2023/2024. This upward trend highlights the increasing demand for maize in world markets, driven by various factors such as its versatility in food, feed and the growing biofuel industries.

Similarly, soybean production has shown consistent growth, with a significant rise from 317,82 million tons in 2015/2016 to an estimated 375,91 million tons in 2022/2023, and a further increase forecasted to 392,24 million tons in 2023/2024. The steady rise in soybean production reflects its growing importance as a protein source and its increasing demand for oil production.

Both the maize and soybean markets are expected to expand, with increasing production to meet the global needs. However, the rate of growth in soybean production appears to be accelerating, with stronger year-on-year increases projected in the near future.

Furthermore, as the production levels grow, particularly with the 2023/2024 forecast (Graph 1), the risk of market saturation becomes more pronounced, which could lead to price drops due to oversupply. When looking at the local markets, one can see this phenomenon taking place.

NAVIGATE THE MARKET ENVIRONMENT

The bearish sentiment reflected in the above price differences signals that farmers may need to hedge their risks or secure contracts early to lock in more favourable prices, especially for white maize and soybeans, where the projected price drops are significant.

Overall, careful timing and risk management will be essential for both sellers and buyers to navigate this market environment. For soybeans, production is expected to increase with 4,34%. This is due to better than expected yields in large producing countries such as the United States of America.

Local future contracts reflect this market supply as average local soybean prices, using the currently available August average information, are also expected to decline. The yellow maize world production is also expected to increase with 5,11%. Similar to soybeans, the yellow maize price is expected to decline.

The price trends for white maize, yellow maize and soybeans indicate a general market expectation of declining prices by May 2025, suggesting potential oversupply or weakened demand. This outlook could create price volatility, with farmers likely to face pressure to sell their crops earlier in the season, particularly around March 2025, to avoid further price drops. This poses a risk as buyers may delay purchases, anticipating lower prices later in the season, which could temporarily slow down market activity.

CONCLUSION

Finding a market before planting grains and oilseeds is essential for reducing uncertainty and enhancing profitability. Farmers must consider the demand, supply, price trends and competition to make informed planting decisions.

With these insights, they can strategically plan their production cycles and capture opportunities in both local and global markets.

Ultimately, a proactive approach to market research can transform traditional farming practices into a more strategic, market-driven operation, positioning farmers for success in an increasingly competitive agricultural sector.

Publication: November 2024

Section: Pula/Imvula