FOCUS

Money matters and financial services

Special

Manage your price risk exposure

to volatile diesel prices

S

ince its inception in 2014, the JSE

Diesel Hedge has experienced a

steady increase in market participa-

tion with last month seeing a new

record total number of contracts traded,

with just over 28 million litres. These vol-

umes are a clear indication of the increas-

ing need for a price risk management tool

of this kind.

With so much volatility on energy prices,

the contracts give businesses the oppor-

tunity to lock in their margins, regardless

of movements in the price of diesel. That

is essentially the objective and use of this

contract.

In simple terms, a Diesel Hedge is a type of

derivative in which the underlying traded

product references a foreign underlying

currency, but the instrument itself is settled

in rands per litre. This contract gives you

exposure to an efficient hedge for the local

diesel pump prices by tracking an interna-

tional reference market.

The contracts are traded in rands per litre,

with each contract representing 5 000 litres

of diesel. The agricultural, mining, logistics

and transport sectors in particular will ben-

efit from these contracts.

Any company that uses a lot of diesel in

the course of their work will find these con-

tracts to be very useful and cost effective.

The contracts will help reduce risk by pro-

viding a hedge through following the price

of European gasoil, as traded on the New

York Mercantile Exchange (NYME X).

Gasoil is a refined crude oil product and

is close to diesel in the refinery process.

These contracts provide investors with a

hedge against movements of the price of

diesel refined in Europe, but this price also

plays a big role in what we pay for diesel in

South Africa.

Mining companies and producers could

be using call options to lock in the price. If

the oil price is going through the roof, they

will be able to say: ‘That is the maximum I

will pay’. On the other hand, importers and

refiners in the country who may be con-

cerned that the diesel price is going to fall

could lock in the price at the higher level.

If they think prices are going to go down and

that pump prices will reduce, they can de-

cide to sell the futures contract and lock in

a profit. Investors have the option of buying

as many contracts as they need since the

JSE contract taps into the deep and liquid

international markets. Another example to

further spread out your hedged price is that

you can buy one contract for the next ten

days to secure a more representative aver-

age hedge price.

In terms of how the cash settlement of

these contracts work: The South African

wholesale diesel price is made up of taxes

and levies as well as the basic fuel price

(BFP) of diesel. The BFP (free on board) is

benchmarked of international energy pric-

es, which are quoted in dollars, and so the

dollar/rand exchange rate is also a factor to

consider.

European gasoil is therefore a proxy for the

basket of international energy prices used

to calculate the South African diesel price.

The JSE’s futures and options combine this

price with the current dollar/rand exchange

rate resulting in the JSE futures price

being strongly correlated with the local BFP

diesel price and so providing an excellent

way to manage risk.

The final cash settlement price of the diesel

contracts is calculated on the monthly av-

erage exchange rate and European gasoil

prices in the month before the contract ex-

pires. Our core objective as the derivatives

market at the JSE is to provide our country

with effective and diverse price risk man-

agement tools that can be used in all areas

of business.

For more information or to start hedging,

register as a client with a JSE approved

derivatives member. Alternatively visit the

JSE’s website for contract specifications.

27

May 2016

Product information

CHRIS STURGESS,

director of Commodity Derivatives: JSE

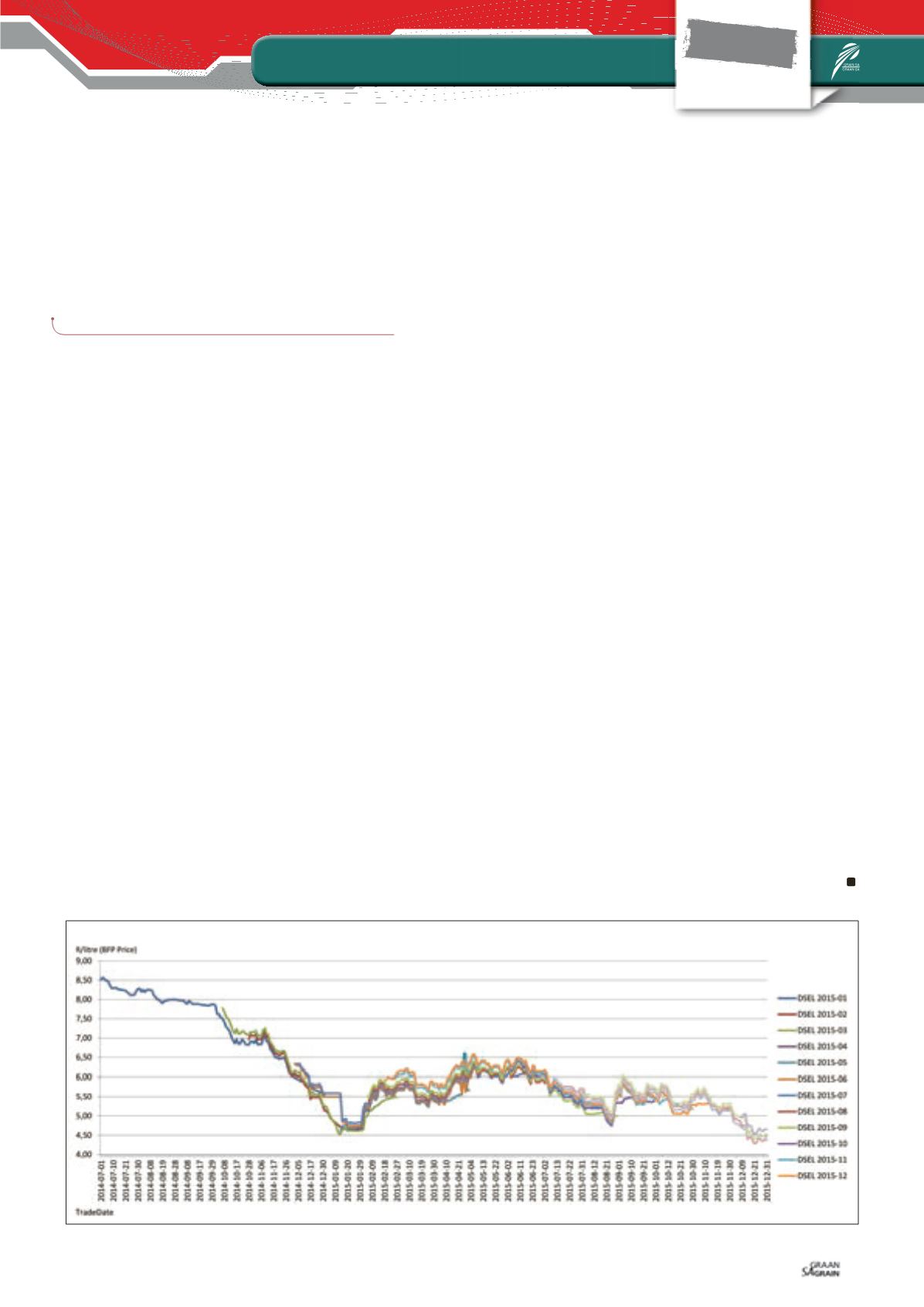

Graph 1: Diesel price movements as at December 2015.