33

May 2015

FOCUS

Money matters and financial services

Special

Financing – a partnership between

the producer and the financier

– especially during hard times

ERNST JANOVSKY,

head: Absa AgriBusiness

W

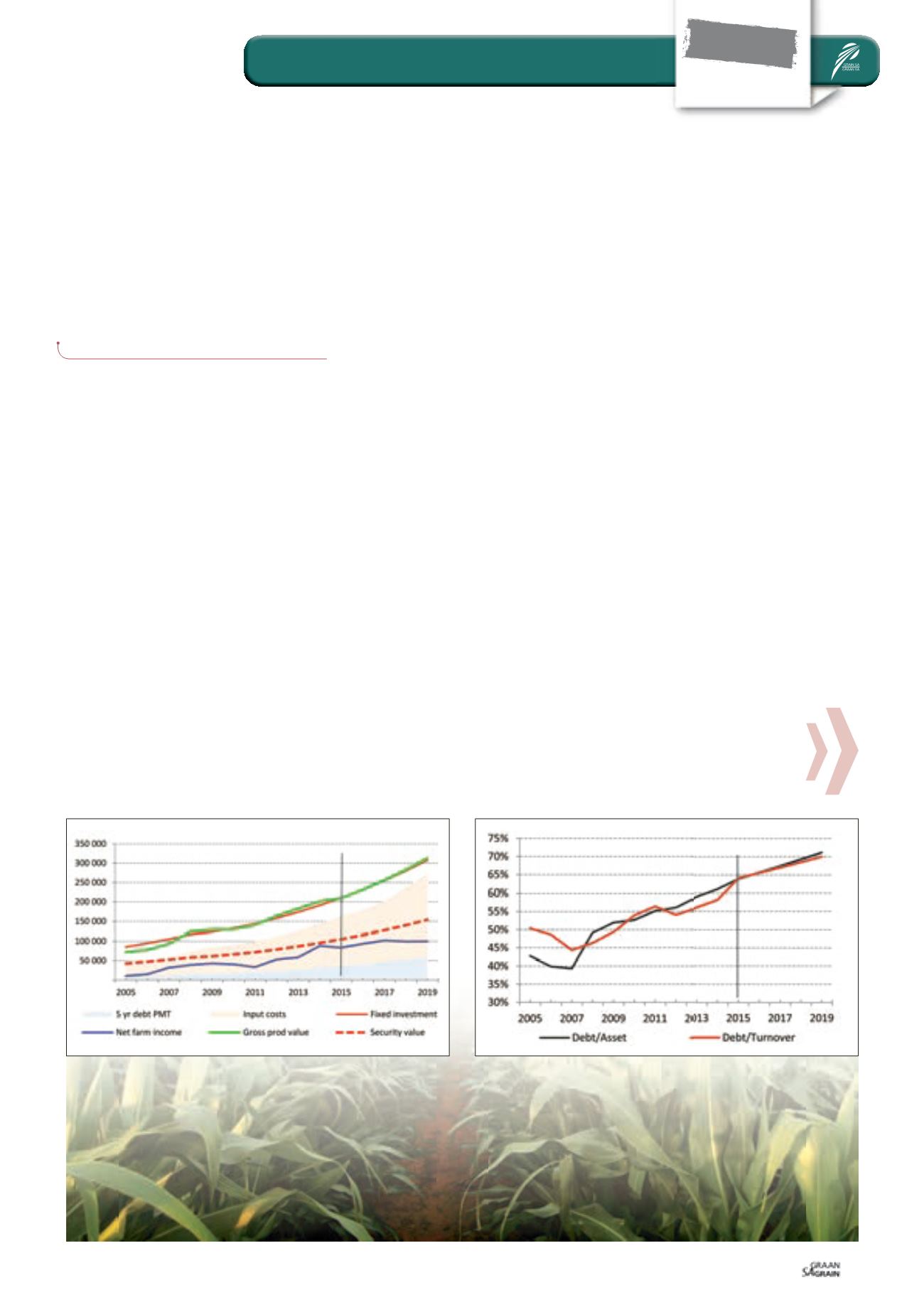

ill the 2014/2015 drought have the negative effect on

agriculture that everybody predicts? Particularly if one

takes into consideration that the financial position of

producers has improved substantially over the past de-

cade with Net Farm Income (NFI) constantly outperforming inflation,

as illustrated in

Graph 1

.

Net Farm Income is expected to decline by 6% year-on-year due to

adverse weather conditions (drought). As livestock producers and

horticultural producers are not directly impacted by the drought, it

will be the grain producers who carry the bulk of the impact. The

following can be used to identify the potential risk of a diversified

farming enterprise:

The debt to asset ratio has continued to weaken as the cost of pro-

duction (need for more debt) has increased faster than the value of

the asset, from 18% in 1980 to just over 59% in 2014. This implies

that one cannot use a constant ratio in evaluating debt.

It is however reaching a critical level in that the recovery value of a

farm normally ranges between 60% and 70%. Producers are there-

fore running out of security, creating the need for new, innovative

finance solutions that does not just rely on fixed assets as collateral.

Although the debt to turnover ratio (

Graph 2

) has deteriorated over

the past few years due to input costs increasing faster than output

revenues, the ratio has improved substantially after peaking at a

high of 109% in 1986. From here it improved to an all-time low of

41% in 2007 and is currently at 58% and expected to continue to

weaken. This is a clear sign that agriculture is in a cost curve and that

producers are using debt to finance their shrinking profits.

Given the current drought and the financial trends mentioned

above, the financial partnership between a producer and his finan-

cier needs to be constantly re-evaluated. Not just in terms of financial

needs, but also on the grounds of good farming practices, because

during a drought, mistakes in farming practices are highlighted

and exposed. Farming entities are therefore differently affected by

a drought – with one producer having no crop, while another still

has a crop to cover costs purely based on the implementation of

different farming practices. This is further complicated by the

huge differences between commodities and the diversification of a

farming enterprise.

Diversification therefore effects the survival of an enterprise during

a drought. All of this speaks to how good the “jockey” is in managing

production, marketing and financial risks – in partnership with his

financier.

All of the above accentuates the need for a more individual approach

rather than a blanket approach when it comes to the restructuring

of carryover debt. It also emphasises the need for an enterprise to

continuously evaluate the risk of doing business, and how it impacts

the repayability of the enterprise.

Graph 1: Capital flows and fixed investment in agriculture (R’m).

Graph 2: Debt to fixed asset and turnover ratio (%).