Julie 2014

58

Thesurveyed resultsamong tradersandagri-businessescompletely

matched those obtained from the producers. Without exception, all

rated the services offered by them aswell as cash requirements, as

the twomost important reasons by far for not participating directly

onSafex.

Preferredpricingmethod

The respondents’ preferred pricing method was considered

important. The respondents indicated that they prefer fixed tons

coupled with a fixed price as a sales contract. 76% of respondents

said that they market their entire wheat crop in this manner. Fixed

tons with deferred pricing (13%) was the second most popular

method followed by a minimum price. None of the respondents

indicated that they usedminimum/maximumpricing.

Brokers (traders and agri-businesses)

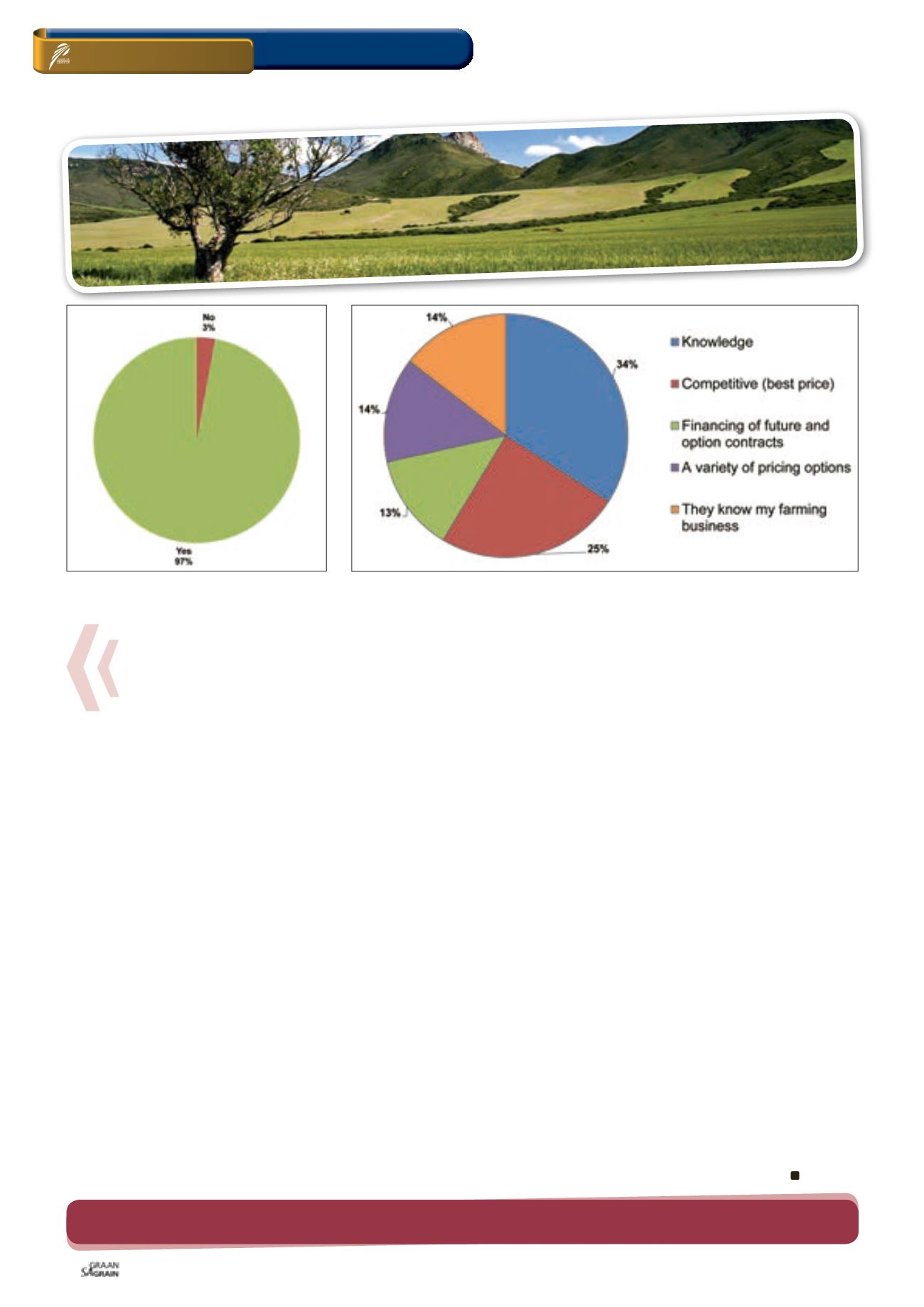

The next three questions dealt with the respondents’ view towards

tradersandagri-businesses.The followingquestionmightbesingled

out as probably the most important question asked in the survey,

namely “Do producers believe brokers offer all of the marketing

options that couldbeachievedby tradingdirectlyonSafex?”Having

the benefit of already having analysed the response to the previous

questions, the answer to this question (as depicted in

Graph 2

),

might havebeen expected.

However, the response was overwhelming, 97% of respondents

said brokers offer all of themarketing options they were interested

in (keep in mind that if a producer’s knowledge about Safex is

limited, therewill be a higher tendency to respondpositively on this

question).

Nonetheless, the overwhelmingly positive response again confirms

that respondents have no need to trade directly onSafex anymore.

Havingestablished that brokersoffer all the services requiredby the

respondents, the survey now attempted to determine what these

services areandhow the respondents ranked them.

Graph3

depicts

the top reasons for using abroker.

The broker or trader’s knowledgewas singled out as the top reason

by theproducer respondents, followedbycompetitivepricesoffered

by the trader or broker.

Producers’ view regarding brokers (traders and agri-businesses)

could be summarised as follows: Wheat marketing is a specialised

function and producers value the services offered by brokers. The

respondents believe that the services offered by the brokers are

sufficient, not warranting them to directly participate in Safex. As

the top reason for using a broker, producer respondents ranked

“broker knowledge”,whilebrokers themselves ranked “financing” as

the top reason.

In conclusion

The survey and analysis of results confirmed that there is a sharp

decline in direct participation by producers on Safex. As for the

reasons, the decline is the direct result of the all-inclusive services

offeredby traders and agri-businesses.

The producer signs a forward contract with his broker while the

broker offsets his risk on Safex. It should be emphasised that the

broker would not have been able to offer the variety of marketing

choices to theproducer if hehadnot been able tooffset it onSafex.

There isanelementofcaution though.Given the importanceofwheat

in the Western Cape and particularly in the Swartland, producers

could not walk away from their responsibility to acquire ormaintain

a minimum knowledge of the functioning of Safex. Irrespective of

whether the producer deals directly on Safex or through his broker,

knowledge now and in the future will hold the key to hismarketing

performance and cannot be replacedby using abroker.

This projectwasmade possible by the funding of theWinter Cereal Trust. The complete report is avail-

able on theirwebsite. The contribution of A. Nordier, C. duPlessis and J. Hartwigsen is recognised.

Has producer hedging entered a new era?

SAGrain/

Sasol Nitrophoto competition

Graph 3: Reasons formarketingwheat through abroker.

Graph 2: Pricing option provided by broker as op-

posed to tradingonSafex.

ON FARM LEVEL

Marketing