January 2021

| Ikageng Maluleke, Agricultural Economist, Grain SA. Send an email to Ikageng@grainsa.co.za |

|

This article is the first of a four-part series that attempts to explore the fundamental factors that have an impact on the market. The first thing we will discuss is the Safex price formation mechanism for maize.

SAFEX

The South African market started to function as a free market in 1996, when the Marketing of Agricultural Products Act was enacted, and the market was deregulated. This means that market participants; namely, producers, traders and processors respond to forces of supply and demand in setting prices. In practice, all of these participants use the Agricultural Markets Division of the South African Futures Exchange (Safex) as the benchmark for the prices they will ask or offer on the ‘spot’ market of daily trading in maize. The spot price refers to the Safex price paid for a commodity at Randfontein, less transportation costs price to determine the spot price at all registered silos.

Upon the formation of Safex, the trading of derivatives (futures and options) was introduced for white, yellow maize and other grains. The price of futures and options are generated on the exchange market through ‘bids’ and ‘offers’, this reflects the views of market participants on the prices of specific commodities at different dates in the future (for example when there is reference to the June price, or the December price).

The same instruments are used to hedge (safeguard) against price risk. The effective use of Safex, allows market participants to manage their price risk, which can improve their financial position. The futures market provides a platform where buyers and sellers can meet and trade freely, in a transparent way. Therefore, effectively discovering the price of the commodity. It is therefore completely up to the farmer how much risk he/she is willing or able to take.

FUTURES PRICE

FUTURES PRICE

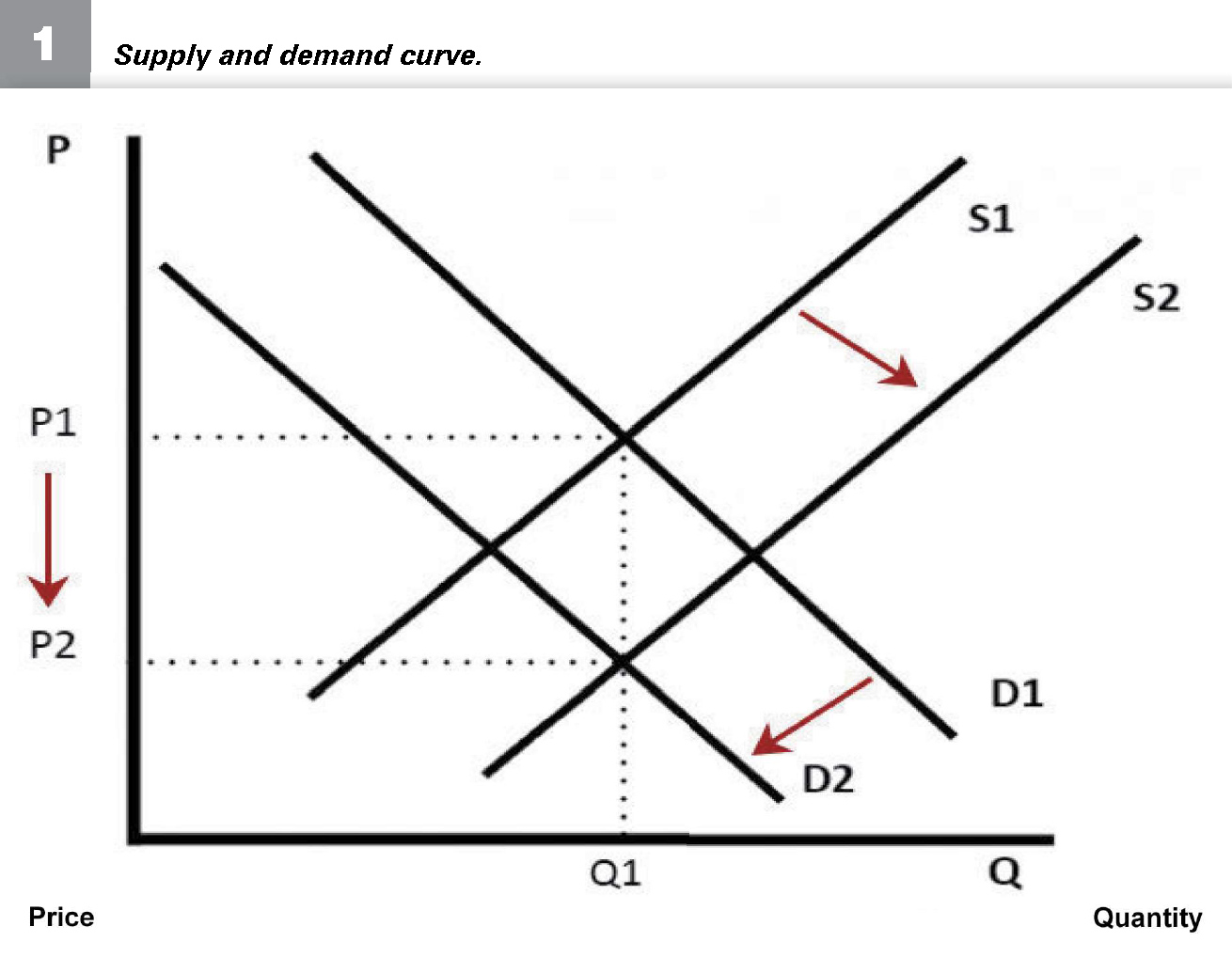

All buyers and sellers of futures contracts on Safex, contribute to the process of price determination. The prices that we see on the futures market represents all supply and demand pressures that determine prices. The large number of volumes traded on the exchange, ensures that there is a good representation and individuals cannot tamper with or influence prices. Therefore, the price is determined by the collective action of thousands of buyers and sellers, including producers, processors, handlers, exporters, importers, and speculators. The market price will rise, fall, or remain steady because of a collective action from participants to either buy or sell.

The futures price reflects the price that buyers and sellers are prepared to pay or accept for a commodity at a future date. The futures price therefore reflects a collective market opinion. For example, the price for maize could be determined by the following:

The futures price is therefore a forecast of what the cash price of the commodity will be for a given future month, based on currently available information. Meaning supply and demand factors (locally, regionally, and internationally), weather conditions, consumer preferences and changes in living standards, government policy, political uncertainty, trade agreements and technology affect the prices of products in the future. In the long-term price trends are normally a reflection of supply and demand factors, while breaking news, the exchange rate and emotions influence the market on a daily basis.

Publication: January 2021

Section: Pula/Imvula