November 2022

| CHRISTIAAN VERCUIEL, JUNIOR AGRICULTURAL ECONOMIST, GRAIN SA |  |

With input costs at record high levels and much uncertainty in the market, producers find themselves in an impossible situation: there is always the possibility that prices may fall back to lower levels, but with the current international supply and demand outlook, it seems that commodity prices will be supported for the near future.

The following factors are supporting commodity prices:

With prices at their current levels and the planting season rapidly approaching, it is the perfect time to start doing calculations with the current input and commodity prices to ensure profitability and sustainability.

Examples

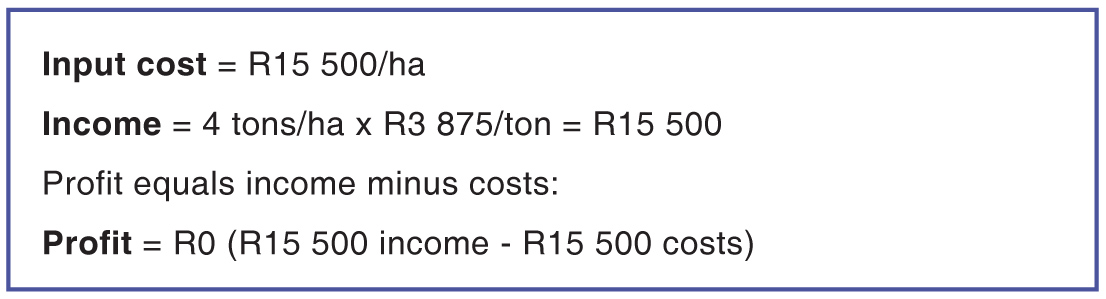

A farmer calculates with the current prices that his input cost to produce maize amounts to approximately R15 500 per hectare. The farmer then needs to ensure that he sells his product in the future at a price that will cover this cost. If the farmer produces 4 tons per hectare, he needs to sell his maize at a minimum of R3 875 per ton to cover his costs.

A profit will be made if there is an increase in tons per hectare produced or an increase in price per ton.

If tons produced increases to 5 tons per hectare:

FACTORS AFFECTING PROFIT

Looking at the examples above, it is clear that the two main factors influencing the profit are production and price. A producer has no control over production but he has control over the price that he is paid for his crop.

Hedging

A simple tool to ensure profit is hedging. Hedging is when a producer sells his product in a forward contract, when he plants at a specific price in the future that is higher than his input costs. The producer then buys a future contract that shifts the risk to another entity. This ensures that a producer gets a specific amount per ton for the product he produces.

The ideal for a producer is to hedge the amount that inputs will cost to ensure that he is able to cover his cost. Depending on market conditions, the producer can choose to hedge a larger portion of the crop or keep the crop for cash sales when harvesting commences.

In essence, hedging helps the producer manage the price risk by ensuring that he is able to pay off the input costs. Everything over and above the input costs are profit. Therefore, hedging is an important strategy in sustainable farming.

CONCLUSION

CONCLUSION

Prices are affected by production. If surpluses are produced, prices will move to export parity and in times of shortages prices will move to import parity. These parities are affected by international prices, and therefore there exists a lot of volatility and factors affecting the market. This is why hedging must be used to manage risks.

Publication: November 2022

Section: Pula/Imvula