July 2024

|

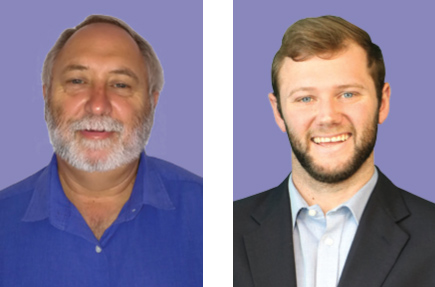

PIETMAN BOTHA, INDEPENDENT AGRICULTURAL CONSULTANT |

|

Making a profit starts with financial planning. Financial planning will help with the decision of what to plant and how to plant it – and most importantly, how to do price management. This article will delve into the details of a production budget for crop price management.

PRODUCTION BUDGET

Table 1 illustrates the production budget for the 2024/2025 season, focussing on North West for BT white maize, sunflower and soybeans. The first column serves as a reference for explaining the budget.

The income or gross production value is firstly explained, followed by the direct allocated cost to calculate the gross margin, including the fixed cost, and lastly the crop net margin. The crop income is the expected yield multiplied by the expected crop price.

Line 1 displays the farmgate price per ton that the farmer will get for his grain and oilseeds, calculated as the Safex market price minus the marketing cost, like the transport differential, silo handling costs and transport from the farm to the nearest silo (line 23).

Line 2 outlines the anticipated yield per hectare, with an estimated example of 4,5 tons for white maize and 1,5 tons for sunflower and soybeans. The yield must be based on the long-term production or the potential of the soil. Line 3 represents the gross production value, obtained by multiplying the value per ton (line 1) with the expected yield (line 2) to determine the projected crop income per hectare.

The direct variable costs are the inputs that are essential to produce the crop. These inputs will be increased or decreased according to the yield expectations. From line 4 to line 16, all the major inputs are itemised and the total direct allocated variable cost (R/ha) (TDAVC) is calculated in line 17 (the sum of line 4 to line 16).

The gross margin (R/ha) is in line 18, and it is calculated by subtracting the total direct allocated variable cost from the gross production value. If the gross margin is negative, it does not make sense to produce this crop at all.

Unfortunately, farmers still have other costs to pay expenses such as salaries, electricity and the household costs. These costs are known as the fixed or overhead costs. Line 19 encompasses the total overhead costs per crop.

If the total overhead cost (R/ha) is deducted from the gross margin (R/ha), the net margin (R/ha) is calculated. This figure tells a farmer if, according to the assumptions, a profit is expected or not. If the figure is negative, try to find the problem and correct it. This can be done by bringing down the costs or increasing the income. Only the farmgate price or the yield can make a difference to increase the income. Most farmers experience a loss due to bad price management.

Grain and oilseed price management starts with knowledge of how much it costs to produce a ton of grain or seed. This production cost per ton is calculated by adding the total direct allocated variable cost (R/ha) to the total overhead cost (R/ha), and then dividing it by the expected yield per hectare. This figure is the first input to calculate the breakeven price per ton needed. By adding the total cost per ton to the marketing cost per ton, the breakeven price is calculated, which can then be compared to the Safex price.

In the table, the total cost per ton, the marketing cost per ton and the breakeven prices are calculated in lines 22 to 24. By comparing the breakeven prices with the current Safex delivery month price, a farmer can decide what to plant.

Line 25 displays the Safex market price on 8 May 2024 for July 2025 white maize, and the May 2025 sunflower and soybeans prices. Farmers must remember that the prices will change every day and therefore this aspect needs constant attention.

PRICE MANAGEMENT STRATEGY

PRICE MANAGEMENT STRATEGY

The aim of price management is to implement a strategy to determine a minimum price, with the opportunity to get a better price if the price moves upwards. Although this sounds like a very difficult action, it is relatively simple if all the price hedging tools are understood and implemented.

In South Africa, Safex determines the daily demand and supply for daily future contract prices. Safex doesn’t only operate the future market, but also the option market. The put and call options are traded on the option market. Today the Safex future market trades a price for a certain product for delivery on a certain future date. This means you can sell your product today at a certain price for delivery in the future.

The option market is a market where the rights to sell and buy at a certain price are traded. If a farmer buys a put option, he obtains the right to sell his product at a certain price. When a farmer buys a call option, he obtains the right to buy a product at a certain price.

The question is what a farmer can do to manage his product price, which is called the price hedging strategy. Several strategies with specific outcomes are available. The first strategy is to do nothing. You produce the crop, take it to the silo and sell it at the price for that delivery day or the spot price.

The second strategy is to sell your grain at a fixed price before it is delivered. The third strategy is to make use of the future market by using the future or option market. Each strategy has its own cost, advantages and disadvantages.

However, before delving into these strategies, it’s essential to grasp a fundamental concept. The breakeven price budget’s line 24 denotes the threshold price where selling grain above it ensures a profit. Regardless of the chosen strategy or method of selling grain, profitability is achieved when the selling price per ton exceeds the breakeven price per ton.

SPOT STRATEGY

The spot strategy involves the farmer refraining from selling any grain throughout the season. Instead, he sells his entire harvest at the current market price on the day of delivery to the silo. To illustrate this, consider soybeans as an example. In column four, line 24, of the budget, it is observed that the breakeven price for soybeans is R8 488,75 per ton.

If the farmer delivers soybeans on 8 May 2025, as indicated by the market price in the same column (line 25), he will sell his grain at R8 835 per ton. Consequently, he would achieve a profit of R346,25 per ton (R8 835 - R8 488,75). However, if the price on the delivery day was R6 890, he would incur a loss of R1 598,75 per ton (R6 890 - R8 488,75).

THE FIXED PRICE STRATEGY

Farmers can also sell their crop on the fixed price contract. This means that the farmer signs a contract that he will deliver a certain grade at a certain price, regardless of what happens to the price. If the price drops or increases, farmers will get the agreed price. Farmers must remember that these contracts should be honoured to avoid paying penalties.

It makes sense to use more than one fixed contract to hedge your average grain price. The three times strategy entails the farmer to sell his grain on three contracts according to the delivery date, but at three different times. This can be illustrated with maize, which has a breakeven price of R4 175,28 (as shown in column two, line 24). The first contract is secured after planting (December), the second during the pollination phase (February), and the third and final one after harvesting (July). Consequently, the farmer sells only a third of the crop at each of these times.

For instance, it can be assumed that the first contract is priced at R4 700 per ton, the second at R4 100 per ton and the third at R3 800 per ton. Although the price of the last contract is lower than the breakeven price, the average price of the three contracts is R4 200, which is still above the breakeven price. Therefore, the farmer realises a profit of R25 per ton. However, if the average of the three prices was lower than the breakeven price, the farmer would incur a loss.

PUT OR OPTION STRATEGY

The put strategy utilises a put option derivative instrument as a way to sell grain. A put option grants the holder (the farmer) the right, but not the obligation, to sell the underlying instrument. Simply put, the farmer can establish a price, known as the strike price, at which he wishes to sell his grain.

If the prevailing market price on the expiration date is lower than the strike price, the farmer sells his grain at the strike price. However, if the market price exceeds the strike price, the farmer has the option to sell at the higher market price instead, although this flexibility requires paying a premium.

For instance, consider sunflower. In column three, line 24 of the budget, it is observed that the breakeven price for sunflower is R6 987,45 per ton. In the put strategy, the farmer purchases a put option covering his entire production after planting, with an expiration date in June 2024.

At the time of purchasing the put option, the Safex price is R8 894 (matching line 25), resulting in a profit of R1 906,55 per ton (R8 894 - R6 987,45). It’s crucial to note that as long as the strike price exceeds the breakeven price, the farmer will profit, regardless of the price movement.

Publication: July 2024

Section: Pula/Imvula