The

grain and oilseed industry

of south africa – A journey through time

14

Grain SA's collection agents

of voluntary levies

Grain SA greatly appreciates the support of its collection agents. By 2015

the agents included the following companies (see opposite page).

Corporate governance

Since its inception Grain SA annually received funding from the Maize Trust and the

Oil and Protein Seed Development Trust (OPDT) for the funding of specific projects. In

terms of the trust deeds, funds from the Maize Trust had to be used only for the maize

industry, and the contributions from the other trusts similarly had to be employed for

the industry from which the funds came. Grain SA then had to submit certain pre-

scribed reports setting out how the funds had been employed. Interim and annual

reports were prepared and submitted to the Maize Trust and OPDT.

The Maize Trust established a practice of visiting the beneficiaries of trust funds

in order to obtain first-hand information on progress with the projects. Grain SA

was one of the beneficiaries visited in the process. During such a visit in 2005 the

Maize Trust insisted on proof of the expenditure that had been included in the re-

ports to the Maize Trust. They were concerned that not all project expenditure had

been employed for maize-specific approved projects, and the trust then insisted

on a forensic audit. The final forensic audit report was issued on 21 June 2005.

Consequently, Grain SA repaid almost R10 million to the Maize Trust with respect

to expenditure that had not been employed for maize specifically.

The records with respect to contributions by the OPDT were also examined and

Deloitte released the report on 30 March 2006.

The audit report made no mention of fraud, but identified specific shortcomings

with respect to reporting on certain financial years. To resolve the dispute, Grain SA

recommended that an allocation method be used for the financial years 2002/2003,

2003/2004 and 2004/2005, with an analysis of projects that were in fact carried out in

practice. These specific projects were supported with corroborative documentation.

The auditors (Deloitte) dealt with the recommendations in relative detail in their re-

port, but did not make a finding on them. They did make the point in their report that

the Grain SA proposal offered a possible solution.

On 12 May 2006 the Oilseed Advisory Committee made an offer of an amount

of R500 000 to Grain SA – ex gratia as full and final settlement for services ren-

dered by Grain SA for the financial years concerned. Further discussions between

Grain SA and the Oilseed Advisory Committee followed, after which the offer was

accepted to finalise the matter.

New projects were then approved by the advisory committee and the OPDT and

subsequent reporting complied with the prescribed requirements of the advisory

committee and the OPDT.

These events focused the attention in Grain SA on the revision of corporate govern-

ance in the organisation. The necessary procedure and policy had to be put in place

for the management of Grain SA. PricewaterhouseCoopers supported Grain SA

with this process. In compliance with the principles of the King reports on corpo-

rate governance, Grain SA appointed an Audit Committee in August 2004. The first

Chairperson of the Audit Committee was Mr Pietman Lourens. In August 2006 he

was succeeded by Mr Fanie van Zyl, who still occupied the position in 2016.

Steps were taken to establish good corporate governance practices and appropriate

policies according to which Grain SA had to be managed. Transparent investment

decisions and proper accounting records were established. The appointment pro-

cess of the auditors was changed at the recommendation of the Audit Committee

and different auditors were requested to make submissions to Grain SA. Arising

from this, PwC was appointed as Grain SA’s auditors from 2007.

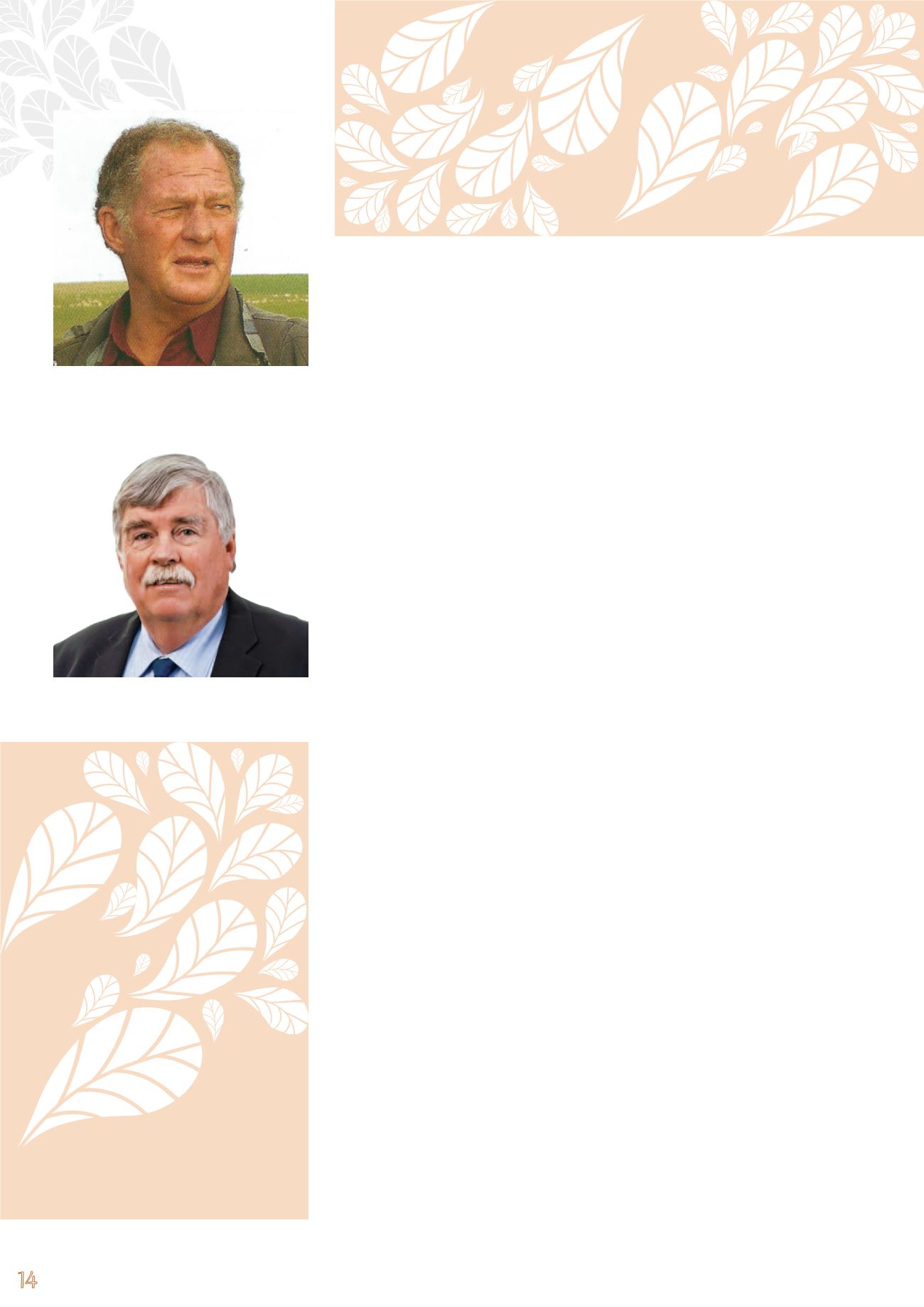

Mr Pietman Lourens, the first Chairperson

of Grain SA’s Audit Committee after its es-

tablishment in 2004.

Mr Fanie van Zyl, Grain SA’s Audit Commit-

tee Chairperson since 2006.

Staff snippets

•

Ms Rita de Swardt

was employed

by SAMPI, NAMPO and Grain SA,

and retired as Accountant in 2002

after 28 years of employment as an

officer in the grain industry.

•

Dr Kit le Clus

(who passed away in

2013) will be remembered for his

diligence and expertise in estab-

lishing an agricultural derivatives

market in South Africa after the

marketing councils were abolished

in 1997. In organised agriculture

circles he is honoured for his vi-

sion that kept South Africa’s grain

industry afloat through drastic

adjustments and helped to make

it internationally competitive. Af-

ter his retirement he continued to

make valuable inputs into the grain

industry and as lecturer at the Uni-

versity of the Free State he shared

his knowledge of and passion for

Economics with students.