THE

GRAIN AND OILSEED INDUSTRY

OF SOUTH AFRICA – A JOURNEY THROUGH TIME

ႇႈ

Registered cultivars 2013

Akwa (254)

Harts (254)

Kwarts (254)

Phb 96B01 R (411)

Anel (254)

JL 24 (959)

Rambo (254)

Phb 95Y41 R (411)

Billy (254)

Kangwane Red (254) Sellie

Phb 95Y40 R (411)

Robbie

PAN 9212

Tufa (254)

Phb 95Y20 R (411)

Mwenje (1137)

SA Juweel (254)

Inkanyezi (959)

Phb 95B53 R (411)

Nyanda (1173)

Health. Physical tests are done on samples and samples of all batches before they

may be sold.

Cultivars

South Africa almost exclusively produces the Spanish type of groundnut, and even

though research regarding the development of groundnut cultivars is a priority,

only the following approved cultivars were available in South Africa in 2013:

90,00

80,00

70,00

60,00

50,00

40,00

30,00

20,00

10,00

0,00

Tons (thousand)

1993/1994

1994/1995

1995/1996

1996/1997

1997/1998

1998/1999

1999/2000

2000/2001

2001/2002

2002/2003

2003/2004

2004/2005

2005/2006

2006/2007

2007/2008

2008/2009

2009/2010

2010/2011

2011/2012

2012/2013

2013/2014

2014/2015

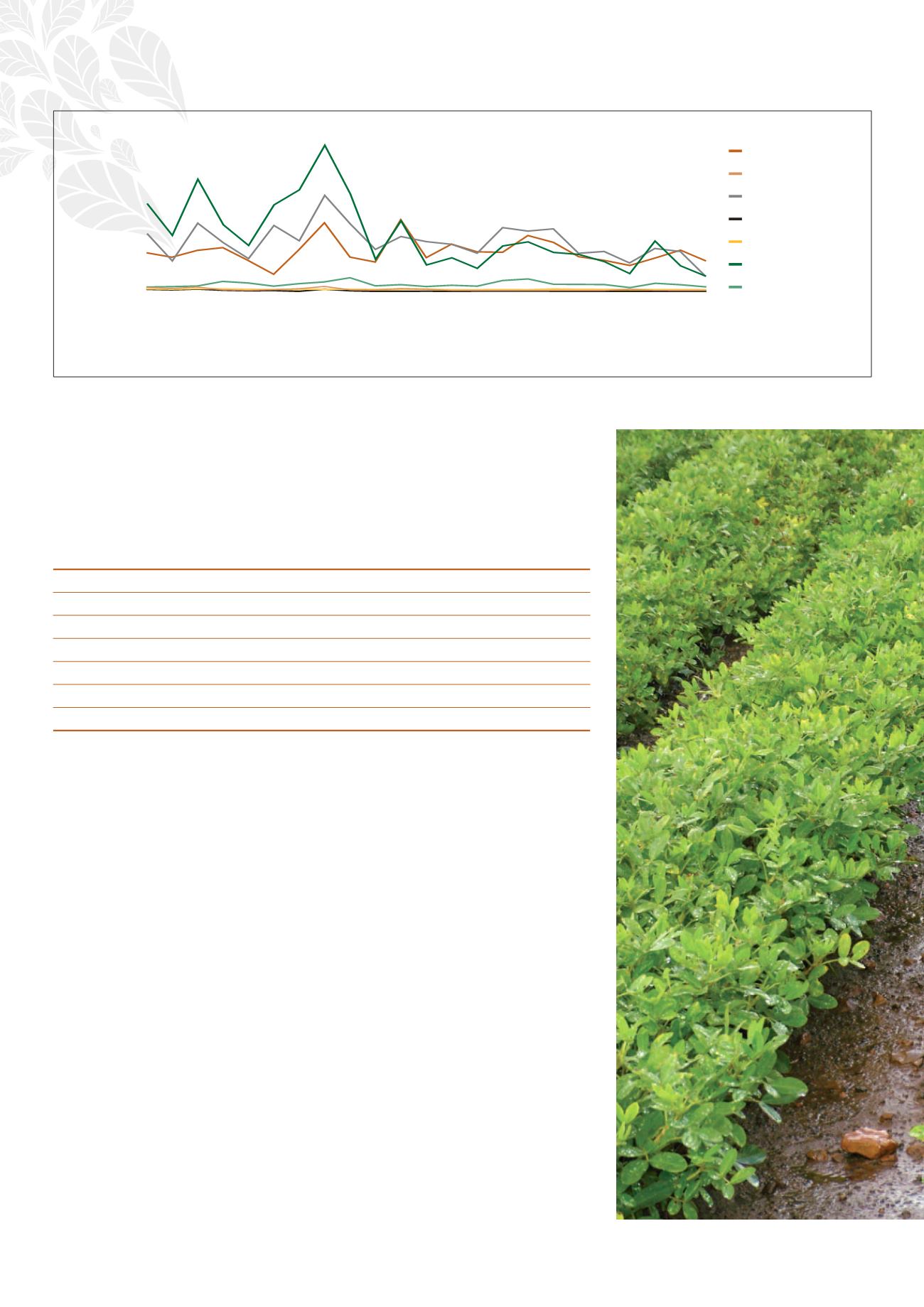

Graph 23: Distribution of groundnut production per province since 1993/1994

Northern Cape

Free State

KwaZulu-Natal

Mpumalanga

Gauteng

North West

Limpopo

In the light of the growing demand for groundnut varieties that deliver higher

yields, the ARC conducted research about this during 2011 and 2012 in various

large groundnut producing countries. The ARC concluded that the best alternative

would probably be for South Africa to import seed for reproduction from Senegal.

In 2012 it was also established that certain larger role-players in the industry had

imported new breeds/varieties independent of the ARC in an attempt to increase

production yields. They were dissatisfied with the ARC’s breeding programme

regarding varieties that could deliver better yields.

Marketing

Under the control of the Oilseeds Board, groundnuts were marketed according to

a single-channel system with prices determined by the Oilseeds Control Scheme.

After control was abolished in 1997, the price of groundnuts was established in the

market place, driven by demand, supply and quality.

Graph 24 (on page 58) shows the annual change in groundnut prices compared to

tons produced from 1990/1991 to 2013/2014. It shows a clear correlation between

the total tons produced and the producer price, but indexed price comparisons

show that the producer price has been structurally higher than the historical price

since 2006/2007.

A study conducted by the Bureau for Food and Agricultural Policy (BFAP) in 2012

concluded that a lack of mutual trust in the groundnut industry’s value chain ham-

pered initiatives for growth and recovering economies of scale to ensure an ongo-

ing supply of high quality groundnuts to the market. The opinion was that a total

turnaround strategy in the industry in South Africa was necessary and it should be