Mei 2016

18

The effects of a possible

downgrade on South Africa

A

lot has recently been said in the

media regarding the possibility of

whether South Africa will be down-

graded to ‘junk status’ by the re-

spective rating agencies, namely Moody’s,

Standard and Poor’s and Fitch.

Emphasis has been placed on the implica-

tions for our stumbling economy, the gov-

ernment, corporates, consumers and what

the government is required to do in order

to avoid a possible downgrade. This article

will focus on understanding what a sover-

eign credit rating is and what ‘junk status’

means for South Africa and its citizens.

What is a sovereign credit

rating?

A sovereign credit rating expresses the risk

that a country will be unable to meet its fi-

nancial commitments, in terms of repaying

interest payments and the debt principal on

a timely basis.

Essentially, a sovereign credit rating is

aimed at providing a relative ranking of a

country’s overall credit worthiness. More-

over, the respective rating agencies men-

tioned above utilise various measures that

allow them to gauge a country’s social,

economic and political position in order to

determine the probability of a country de-

faulting on its repayments.

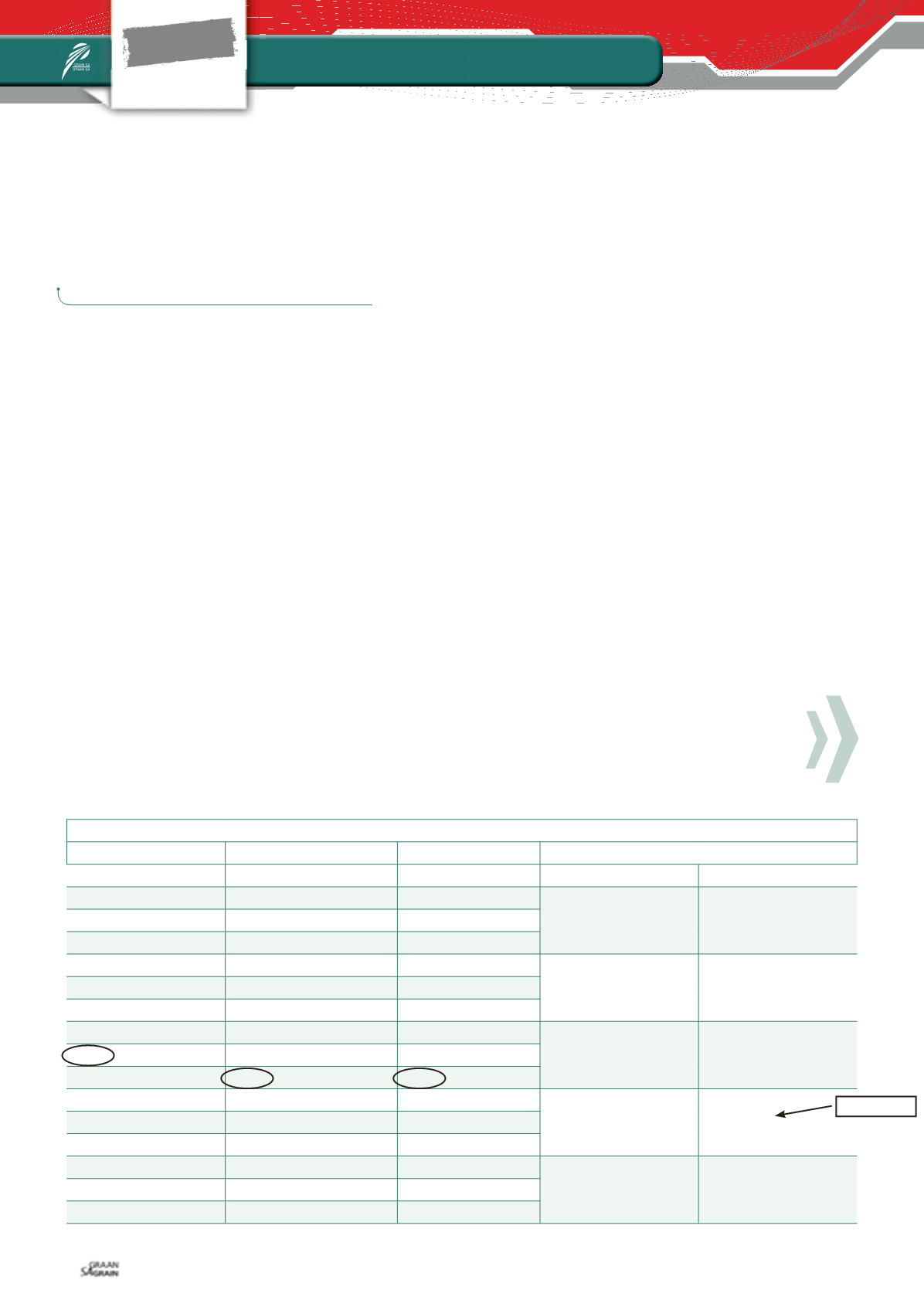

Table 1

below

depicts the sovereign credit ratings by the

respective rating agencies.

As it stands, Moody’s has rated South

Africa as a Baa2 rating which is two notches

above sub-investment grade (‘junk status’),

while Standard and Poor’s and Fitch have

rated South Africa as BBB-, which is one

notch above ‘junk status’.

An important but unappreciated distinc-

tion between the sovereign credit ratings is

the rating between the foreign currency de-

nominated debt and the local currency de-

nominated debt.

Distinguishing between

our local currency debt

rating and foreign

currency debt rating

Foreign currency denominated debt is char-

acterised as debt that is issued in a currency

other than the sovereign’s own currency (i.e.

South African issued government bonds in

US$, yen or euros), while local currency debt

is debt that is issued in local currency (i.e.

ZAR).

Table 2

displays South Africa’s local

currency and foreign currency debt ratings

by the respective rating agencies. Further-

more, it is important to note that it is South

Africa’s foreign currency denominated debt

rating that is in the firing line in terms of a

possible downgrade to ‘junk status’.

As seen in Table 2, Moody’s has one rat-

ing which applies to both the local cur-

rency and foreign currency denominated

debt, while Standard and Poor’s and Fitch

distinguishes between South Africa’s for-

eign currency and local currency debt

ratings.

Moody’s rating for South Africa is two

notches above ‘junk status’, and the Stand-

ard and Poor’s rating for South Africa’s

foreign currency is one notch above ‘junk

status’, while its rating for South Africa’s

local currency is three notches above ‘junk

status’. Fitch’s rating for South Africa’s

foreign currency is two notches above ‘junk

status’, while its rating for South Africa’s

local currency is three notches above

‘junk status’.

FOCUS

Money matters and financial services

Special

SHAWN PHILLIPS,

research analyst: Glacier by Sanlam

SOVEREIGN CREDIT RATING

MOODY’S

STANDARD AND POOR’S FITCH

CREDIT RATING MEANING

Aaa

AAA

AAA

Highest quality

Investment grade

Aa1

AA+

AA+

High quality

Investment grade

Aa2

AA

AA

Aa3

AA-

AA-

A1

A+

A+

Strong payment capacity Investment grade

A2

A

A

A3

A-

A-

Baa1

BBB+

BBB+

Adequate payment

capacity

Investment grade

Baa2

BBB

BBB

Baa3

BBB-

BBB-

Ba1

BB+

BB+

Likely to fulfil obligations,

ongoing uncertainty

Sub-investment grade

Ba2

BB

BB

Ba3

BB-

BB-

B1

B+

B+

High risk obligations

Sub-investment grade

B2

B

B

B3

B-

B-

TABLE 1: SOVEREIGN CREDIT RATING.

Source: Barclays Emerging Market Research

Junk status